Does Georgia Have High Property Taxes

Fulton County collects the highest property tax in Georgia levying an average of 273300 108 of median home value yearly in property taxes while Warren County has the lowest property tax in the state collecting an average tax of 31400 051 of median home value per year. How high are property taxes in Georgia.

Nj Counties With The Highest Lowest Property Taxes Property Tax Tax County

Nj Counties With The Highest Lowest Property Taxes Property Tax Tax County

Just over 4000 of that bill is Georgia state tax including whats effectively a flat tax on income an average sales tax rate of 715 percent and an.

Does georgia have high property taxes. Additionally there are a number of exemptions that can help seniors in need of property tax relief. The Gwinnett County Tax Commissioner bills Suwanee property owners separately for county and school taxes. The list is sorted by median property tax in dollars by default.

The first step towards understanding Georgias tax code is knowing the basics. However imagine that they believe based on evidence that their assessment is too high and appeal the 200000 taxable value. New Jersey has the highest effective rate on owner-occupied property at 221 percent followed closely by Illinois 205 percent and New Hampshire 203 percent.

Neither Florida nor Georgia taxes personal or household goods so there are no property taxes on tangible property. Hawaii sits on the other end of the spectrum with the lowest. For information related to unemployment income please read FAQ 3.

Capital Gains Taxes Georgia. In general property taxes in the Peach State are relatively low. How does Georgia rank.

This is because your total tax liability depends on more than federal and state income tax. You are hit with capital gains taxes when you sell an asset and make a profit. This is the sixth-highest property tax rate of any state.

It also includes property tax sales tax and other local taxes. Individuals 65 years or older may claim an exemption from all state ad valorem taxes on their primary legal residence and up to 10 acres of land surrounding the residence. Median property tax is 134600 This interactive table ranks Georgias counties by median property tax in dollars percentage of home value and percentage of median income.

Below we have highlighted a number of tax rates ranks and measures detailing Georgias income tax business tax sales tax and property tax systems. State of Florida resident vehicles must be titled and are subject to. If you are selling an investment property or house you have lived in less than two years you will likely be paying capital gains tax.

The typical Georgian ends up paying over 9500 a year in taxes over half of which is going to federal income taxes. Property owners within the city limits of Suwanee pay a property tax millage rate of 493 mills. The state of Georgia is automatically extending the 2020 individual income tax filing and payment deadline from April 15 2021 to May 17 2021 without penalties or interest.

Others like New Jersey and Illinois impose high property taxes alongside high rates in the other major tax categories. State property taxes. Homeowners in Georgia pay about 870 annually in property taxes per 100000 in home value a below-average figure.

The average American household spends 2375 annually on real estate property taxes and according to the National Tax Lien Association more than 14 billion in property taxes. Overall the effective property tax rate for homeowners is 12 in the US. On a median home of 178600 thats an annual tax bill of 2149.

The median real estate tax payment in Georgia is 1771 per year which is around 800 less than the 2578 national mark. For example Texas levies no state income tax but the statewide average property tax rate is 186 percent. The City of Suwanee issues property tax notices for city taxes in October with payment due by December 20.

Its important to keep in mind though that property taxes in Georgia vary greatly between locations. These taxes are due by October 15 each year. The exact property tax levied depends on the county in Georgia the property is located in.

Each states tax code is a multifaceted system with many moving parts and Georgia is no exception. The average effective property tax rate is 087. If the tax rate is 1 David and Patricia will owe 2000 in property tax.

This does not apply to or affect county municipal or school district taxes. The appeals board reduces that value to 150000. 160 rows The state of Georgia is automatically extending the 2020 individual income tax filing and.

160 rows Georgia. Click on the banner for more info. How much you are taxed is dependant on how much profits you make and how much money you earn annually at your job or business.

Now Patricia and David owe only 1500 in property tax on their Georgia home.

State By State Guide To Taxes On Retirees Kiplinger Retirement Income Retirement Best Places To Retire

State By State Guide To Taxes On Retirees Kiplinger Retirement Income Retirement Best Places To Retire

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

The Hidden Costs Of Owning A Home

The Hidden Costs Of Owning A Home

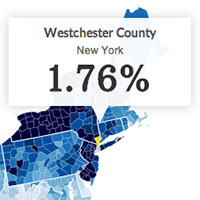

Property Taxes How Does Your County Compare Cnnmoney Com

Property Taxes How Does Your County Compare Cnnmoney Com

Which States Have The Lowest Property Taxes Property Tax History Lessons Historical Maps

Which States Have The Lowest Property Taxes Property Tax History Lessons Historical Maps

New Hampshire Property Tax Calculator Smartasset

New Hampshire Property Tax Calculator Smartasset

Your Guide On Property Taxes In Atlanta Georgia Atlanta Dream Living

Your Guide On Property Taxes In Atlanta Georgia Atlanta Dream Living

Where Do People Pay The Most In Property Taxes In The Us Property Tax This Is Us Map

Where Do People Pay The Most In Property Taxes In The Us Property Tax This Is Us Map

Property Tax Map Tax Foundation

Property Tax Map Tax Foundation

Your Guide On Property Taxes In Atlanta Georgia Atlanta Dream Living

Your Guide On Property Taxes In Atlanta Georgia Atlanta Dream Living

Property Taxes How Much Are They In Different States Across The Us

Property Taxes How Much Are They In Different States Across The Us

How Do Tax Rates On The Poor Compare To Taxes On The Rich In Your State Itep

How Do Tax Rates On The Poor Compare To Taxes On The Rich In Your State Itep

Soon After Taking The Oath Dehradun S New Mayor Sunil Uniyal Gama Hinted To Revise House Tax In The City Property Tax Tax Consulting Tax Payment

Soon After Taking The Oath Dehradun S New Mayor Sunil Uniyal Gama Hinted To Revise House Tax In The City Property Tax Tax Consulting Tax Payment

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Median Property Taxes By County Tax Foundation

Median Property Taxes By County Tax Foundation

Property Tax Appeal Get The Guide For This Process Property Tax Property Valuation Tax Reduction

Property Tax Appeal Get The Guide For This Process Property Tax Property Valuation Tax Reduction

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home