How To Find Property Taxes On 1098

Some lenders report Real Estate Taxes paid on the back side of the statement. Peek at IRS Form 1098 Every homeowner with an active mortgage should.

Making Sense Of Irs Form 1098 What You Need To Know Tms Tms Grow Happiness

Making Sense Of Irs Form 1098 What You Need To Know Tms Tms Grow Happiness

The lender of record or a qualified person must file Form 1098 to report all points paid by the payer of record in connection with the purchase of the principal.

How to find property taxes on 1098. If you prepaid property taxes here is additional information. Box 2 on IRS Form 1098 Box 2 on IRS Form 1098 displays the principal balance of your loan as of January 1 2020 or when Chase acquired or originated the loan in 2020. Consult your tax advisor for more information If you have an escrow account your Year End Statement may also show the property taxes and homeowners insurance you paid.

Form 1098 Tax Document Obtain Form 1098 from your mortgage lender. Your mortgage lender might pay your real estate taxes from an escrow account. This tax document lists the mortgage interest you pay during the year and also lists any real estate taxes your lender paid on your behalf through an escrow account.

But even if your lender handles your property tax payments that information may not appear on your 1098. 1098 Tracks Your Mortgage Interest The primary purpose of your 1098. Who must report points.

Each countys website varies but common link titles to. If you pay your property taxes yourself the quickest way to find out how much you paid is simply to go back through your check registers bank account statements or credit card statements. You can also find more information to help you prepare and file your tax return.

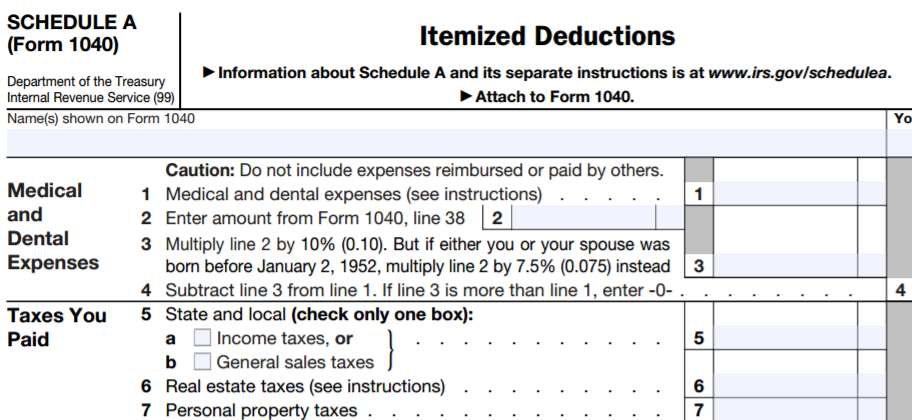

If you pay either type of property tax claiming the tax deduction is a simple matter of itemizing your. Use Form 1098 Info Copy Only to report mortgage interest of 600 or more received by you during the year in the course of your trade or business from an individual including a sole proprietor. If a mortgage does not meet the 600 interest threshold the form does not have to be.

Locate the property search link. This form will report any real estate taxes you paid. Often if there is not a specific box showing Real Estate Taxes paid if may be toward the bottom of the statement under the Escrow Reconciliation area as Taxes Paid.

Go to your city or county tax assessors website and look for a link to Property search or Property Tax records. You can deduct up to 10000 or 5000 if married filing separately of state and local taxes including property taxes. Deducting Property Taxes for Real Estate Where to Look.

Examine Box 4 on Form. If you cannot locate the amount of the real estate taxes paid anywhere on your Form 1098. Lenders must file a separate Form 1098 for each mortgage you hold.

Each year property taxpayers receive three notices that provide information on the valuation of the property proposed tax amounts meetings about proposed levies and budgets and the amount of taxes due. About Form 1098 Mortgage Interest Statement. The Maryland Department of Assessments and Taxation administers and enforces the property assessment and property tax laws of Maryland.

The tax levies are based on property assessments determined by the Maryland Department of Assessments and. If you meet the guidelines for receiving a 1098 form you can sign in to Online Banking select your mortgage account and then select the Statements Documents tab. If you pay taxes on your personal property and owned real estate they may be deductible from your federal income tax bill.

Here are some ways to figure it out. If so theyll send you Form 1098. Youll find a link to your 1098 form in the Year-end Statements section.

Your Year End Statement Form 1098 shows the mortgage interest you paid in 2020. This form is important if you plan to deduct your mortgage interest payments from your taxes. Marylands 23 counties Baltimore City and 155 incorporated cities issue property tax bills during July and August each year.

Visit the website of the county assessor to which you pay property taxes. Form 1098 Mortgage Interest Statement is used by lenders to report the amounts paid by a borrower if it is 600 or more in interest mortgage insurance premiums or points during the tax year. IRS Form 1098 Mortgage Interest Statement is completed by mortgage providers for loans for individuals or sole proprietorships that they earn over 600 of interest on throughout the yearIf youre a mortgage holder as an individual or sole proprietorship and have paid 600 or more in interest or points on your mortgage within the last year you will likely receive a 1098 tax form from.

Form 1098 from different lenders may read slightly different. Checking property taxes is easy as looking at your tax bill form 1098 or visiting the county assessors office or website. The first notice a valuation notice is.

Most state and local tax authorities calculate property taxes based on the value of the homes located within their areas and some agencies also tax personal property. Review your bank or credit card records if you paid the propertyreal estate tax yourself. Report the total points on Form 1098 for the calendar year of closing regardless of the accounting method used to report points for federal income tax purposes.

If you have not received them by February 15 please contact us. Checkbox 10 Other on Form 1098 from your mortgage company. For other 1099 tax forms.

Read more »

/GettyImages-1042505068-d5c7b095f4704a5286a5cabcc25f4495.jpg)