Property Tax Definition For Students

The proceeds from property taxes represent one of the principal sources of income for local and state governments in the. If you own a 300000 house and the tax is 3 then each year you have to pay the government 9000 in taxes.

How Property Taxes Are Calculated

How Property Taxes Are Calculated

Or students can complete work online and take part in interactive activities and simulations.

Property tax definition for students. School Taxes Law and Legal Definition. Its also called an ad valorem tax. Every time you buy something at a.

Property tax is usually a percentage of the current value of the house. The Property Tax Has a Significant Effect on the State Budget. Sometimes the tax extends to automobiles jewelry and furniture and even to such intangibles as bonds.

A property tax or millage rate is an ad valorem tax on the value of a property. Technically your tax home is where you have roots a drivers license and are registered to vote. In some countries including the United States the tax is also imposed on business and farm equipment and inventories.

If a real estate taxes paid amount was reported to you usually in Box 10 on your Form 1098 this represents the amount of real estate taxes you paid on your residence during the tax year. Sales Tax Sales tax is placed on all retail sales in many areas. Tax Information for students including education credits paying for college and the Free Application for Federal Student Aid FAFSA.

Property tax levy that is imposed primarily upon land and buildings. Individuals can deduct personal property taxes paid during the year as an itemized deduction on Schedule A of their federal tax returns at least up to a point. This millage is currently fixed at 6 mills and applies to both homestead and non-homestead property.

Teaching taxes can take a traditional approach as students complete downloaded worksheets classroom activities and assessment pages. You are considered to have substantially complied with the visa requirements if you have not engaged in activities that are prohibited by US. How to Explain Taxes to Kids.

A property tax millage levied by the State on all property that is dedicated to help fund K-12 education and is part of Proposal A. The tax is imposed on movable property such as automobiles or boats and its assessed annually. But as a college student the simplest approach is to declare your tax home in the state where you earned the income in you earned it where you go to school.

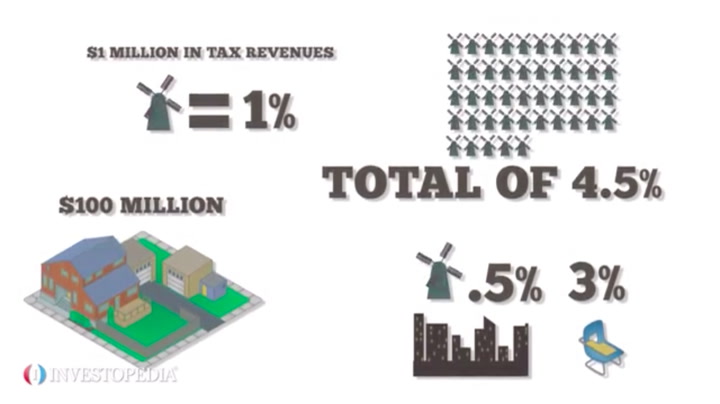

Critics argue that such school property tax systems unfairly advantage those schools in wealthy areas because of higher home values which lead to more taxes being collected for. In the OECD classification scheme this includes households recurrent taxes on immovable property and net-wealth taxes on estate inheritance and gifts and taxes on financial and capital transactions. Although the property tax is a local revenue source it affects the state budget due to the states education finance systemadditional property tax revenue from the 1 percent rate for K14 districts generally decreases the states spending obligation for education.

A tax levied on real or personal property Examples of property tax in a Sentence Recent Examples on the Web In a letter to Pritzker in February Chicagoland Chamber of. A student is any individual who is temporarily in the United States on an F J M or Q visa for the primary purpose of studying at an academic institution or vocational school and who substantially complies with the requirements of that visa. Real estate taxes property taxes paid on your primary residence are deductible as an itemized deduction on Schedule A of your federal return.

Sometimes items like food or clothing are exempt from sales tax. When filing a tax return you may need to include scholarships and grants as taxable income. Some school property taxes are tied to a homes value.

The Internal Revenue Service provides a. Property tax is a tax on property -- usually real estate -- as determined by an assessor. Property tax is any tax on real estate or certain other forms of property.

Noun a tax levied on real or personal property. School districts typically collect taxes through payment of local residents property taxes. Talking to kids about the ins and outs of taxes is a way to explain civic responsibility and fiscal obligation and provide an inside look at how the government acts as a steward of taxpayer money.

Property tax is a tax paid on property owned by an individual or other legal entity such as a corporation. Definition of property tax. The tax is levied by the governing authority of the jurisdiction in which the property is located.

School tax laws very by state and local area. Most commonly property tax is a real estate ad-valorem tax which can be considered a. A personal property tax is imposed by state or local tax authorities based on the value of an item of qualifying property.

Read more »Labels: definition, property, students

/GettyImages-1042505068-d5c7b095f4704a5286a5cabcc25f4495.jpg)