How Do I Find My Property Id Number Mn

246 Center City MN 55012 Phone 651213-8558 Fax 651213-8551. You may apply for a Minnesota Tax ID number with the Minnesota Department of Revenue online at Business Registration by phone at 651-282-5225 or 800-657-3605 or by filing a paper form Application for Business Registration ABR.

License Minnesota Tax Identification Id Number Minnesota Tech Company Logos Company Logo

License Minnesota Tax Identification Id Number Minnesota Tech Company Logos Company Logo

McCarrons Center 1900 Rice Street Saint Paul MN 55113 651-266-6350.

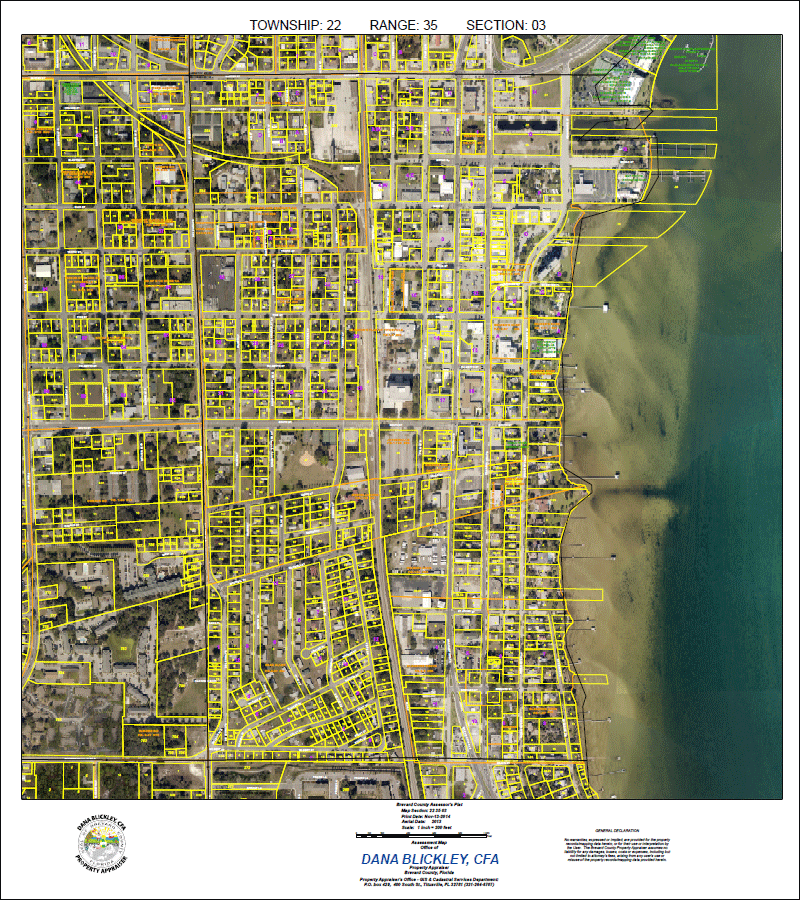

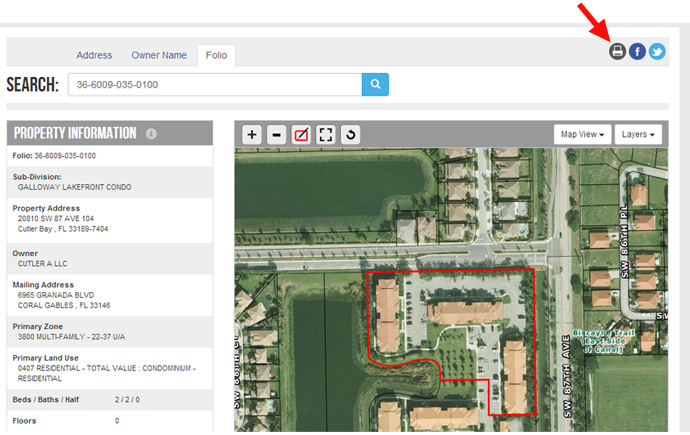

How do i find my property id number mn. Pay your property taxes online. Property interactive map click the map to find your property. We have provided a brief summary of which offices could be involved with Real Property transactions on this page.

The information requested on the contact form is personal information that is classified as private data under Minnesota law. A Minnesota Tax ID Number is a seven-digit number used to report and pay Minnesota business taxes. Choose the correct parcel under Property Search Results.

Tax Identification ID Number Alternate Title. For manufactured homes go to the Manufactured Home Tax Stubs and enter the 11-digit property identification number. - Search for Property Information - Future year value information is certified in July.

How do I calculate State Deed Tax and Mortgage Registration Tax. How do I obtain a copy of recorded documents or my Certificate of Title. If you need one you can apply through Business Tax Registration.

When searching for Property Information by address use your house number and the first few characters of the street name for the best results. Property boundary basemaps and ownership records are maintained at the county level usually by the recorders assessors or land surveyors offices. Many Minnesota counties keep records in digital computer-readable format while others keep them as paper records.

You can also call the Property Information Center at 651-438-4576. Where do I find my property information. Assessor Chisago County Assessor 313 N.

Property address type the address into the search form. 9112008 21751 PM Modification Date. Search for your property.

Property Tax Statements are also available on our online property information website. You can also call the Property Information Center at 651-438-4576. Real Property Land Transactions can involve multiple departments within Wright County depending on the complexity of the transaction.

Paying your property taxes is still provided through US Bank. Look on your last tax bill the deed to your property a title report which may be in. Click Pay Property Tax button.

Sales and Use Tax Taxes Creation Date. Visit property tax and value lookup. You will need to have your property identification number or your address available to access this information.

Look on your property tax statement for something like. What needs to be on a document for recording purposes. 375 Jackson Street Suite 220 Saint Paul MN 55101 651-266-8989 SPRWS.

A Minnesota Tax ID Number is a seven-digit number used to report and pay Minnesota business taxes. What is a standard document. 58-0218-0920 or 31-0-018900 these are just examples If you dont have this call your countycitylocal.

To access the payment portal. Then select Property Tax Statement. The results always default to the current year that taxes are payable.

Search Chisago County property tax and assessment records by property ID property house number and property address. If the ID number you need to find is for a property you own you may already have the number in your files. Stearns Co MN shall not be liable for any direct indirect special incidental compensatory or consequential damages or third party claims resulting from the use of this data even if Stearns Co MN has been advised of the possibility of such potential loss or damage.

Minnesota Department of Revenue Subject. Property Tax Calculations Property taxes do not have a set rate like income or sales taxes. The Minnesota Department of Revenue asks you to supply this information on the contact form to verify your identity.

Property ID number PID found on your tax or assessment statement. Where are real estate property forms available. Go to the Property Information Search and enter your house number.

Addition name from the legal description. How do i find my property id number on Minnesota form m1pr property tax refund. Description of Line Items on 2021 Property Tax Statement.

Read more »