How To Find My Property Tax Roll Number

The My Properties section of our web site allows you to view details about your property and report any changes to us. The Property Tax Lookup is a convenient way to review your City of Toronto property tax account anytime anywhere from your computer or mobile device.

Details provided include account balance current and previous billing amounts payment details due dates and more.

How to find my property tax roll number. You can find a propertys tax ID number in several ways. The Assessment and Taxation Department does not warrant or make any representations as to the quality content accuracy or completeness of the. If you do not know the account number try searching by owner name address or property location.

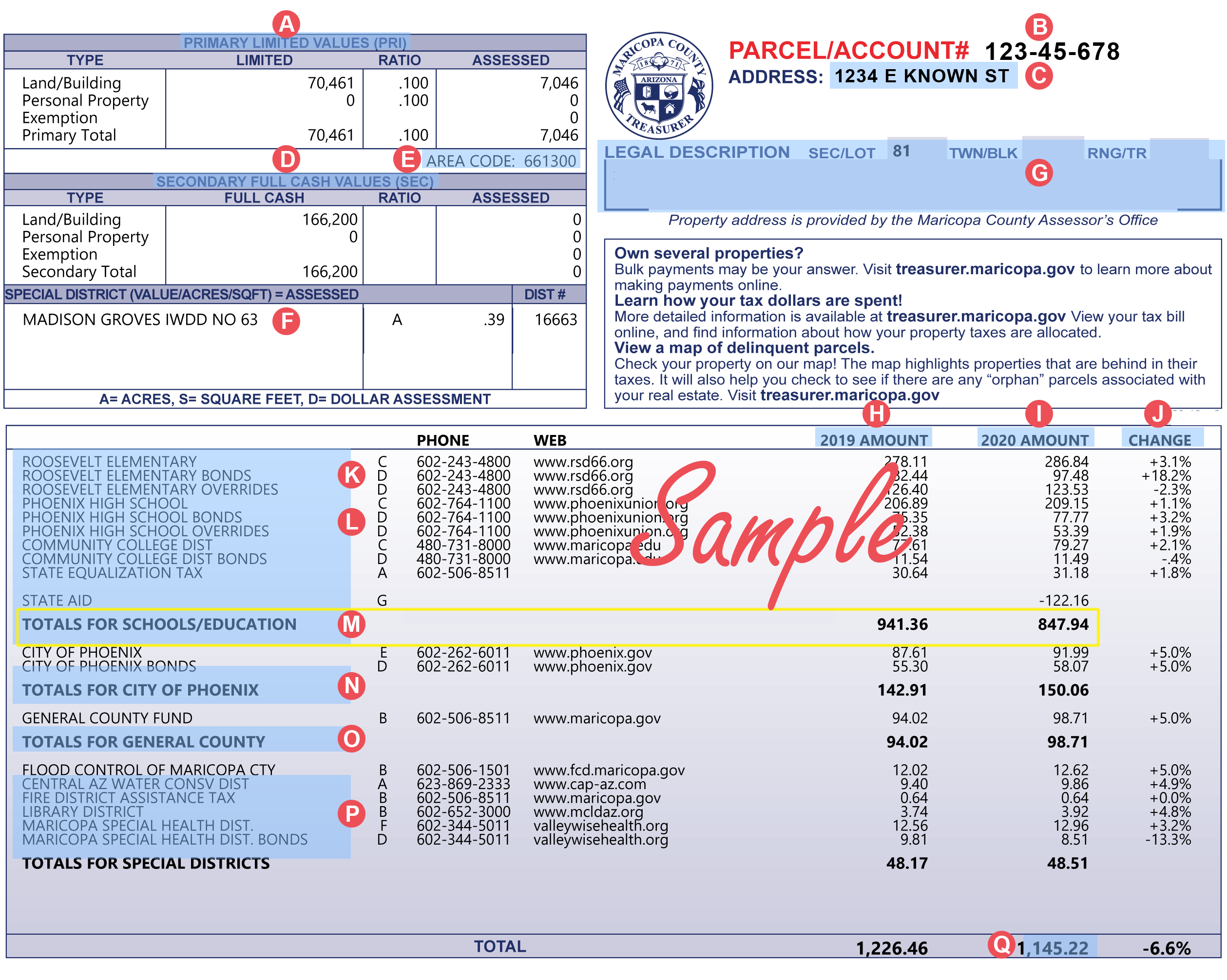

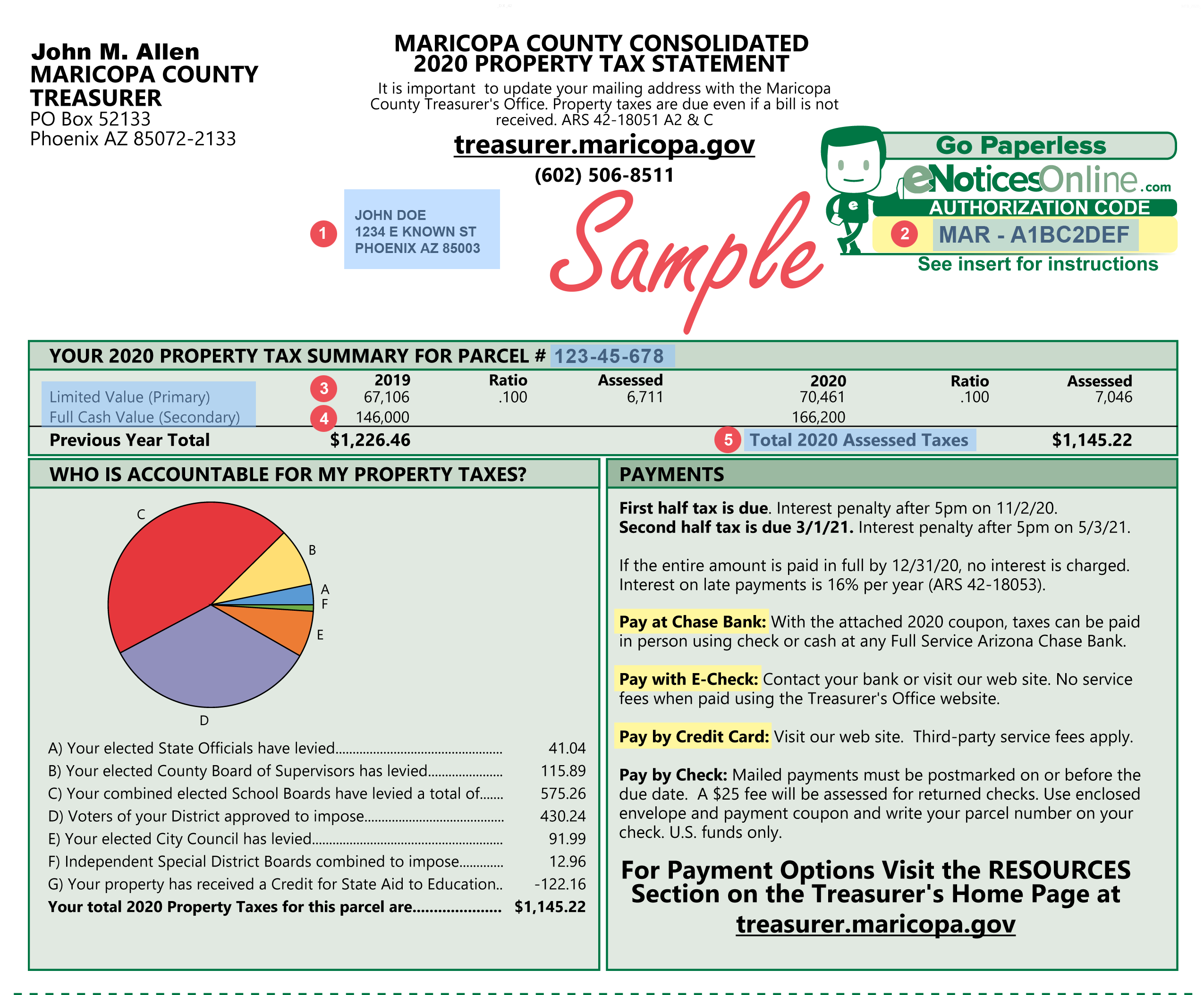

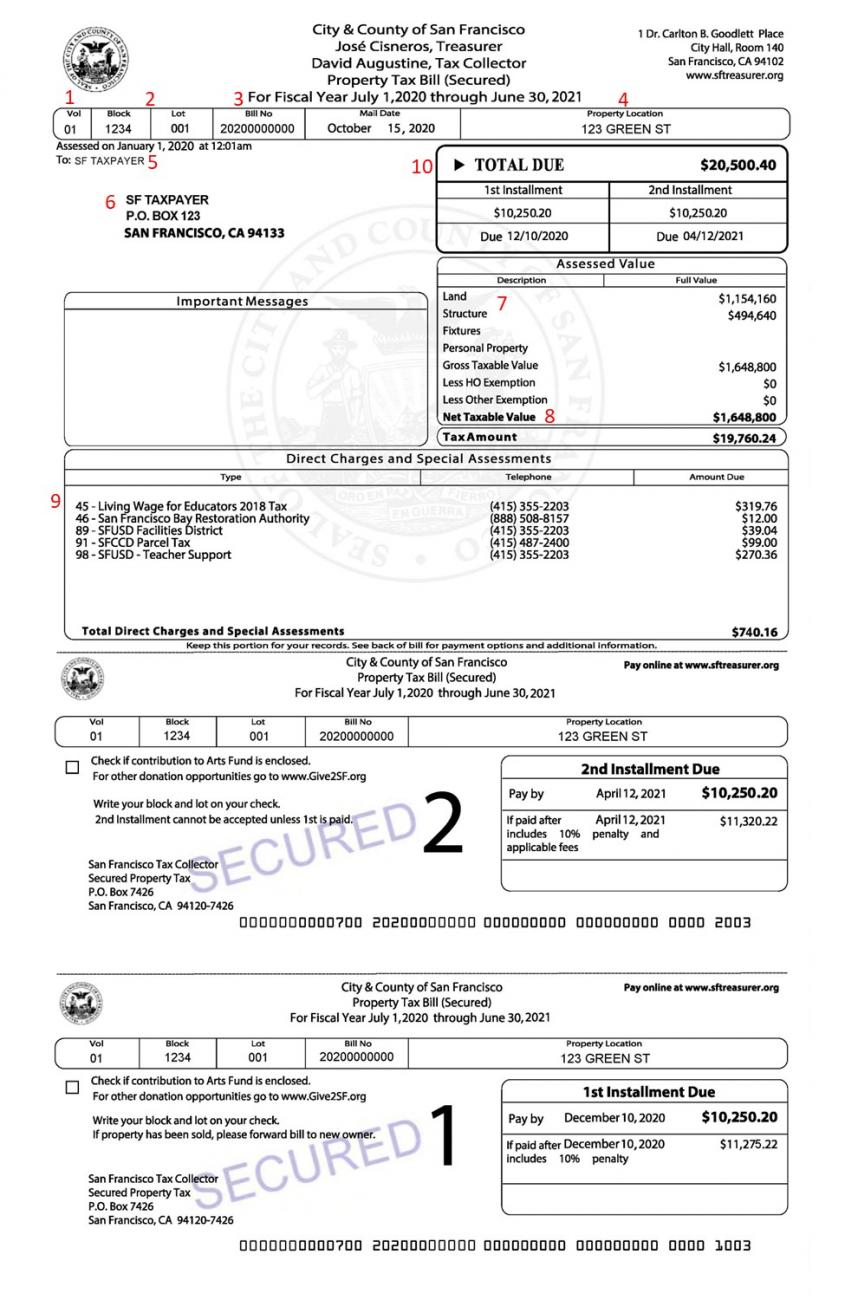

Account numbers can be found on your Tax Statement. Tax statements are then printed and mailed to property owners and mortgage companies. This is the owners mailing address.

Enter the Street Name. You can search by Owner Name Last Name First Name Business Name Account Number Enter the 10-digit account number including the - Ex. Corrected bills are also mailed out using this same form so make sure to check your due dates.

Search by Tax Roll or Parcel Number. 11 digit Roll Number. Enter the 11 digit Roll Number.

Enter a geo number owners name last name first address Prop. Owner Name Search Enter last name first Property Address Search Starts with Geo Number Search Prop. Property Assessment Details.

Real Property Tax Real Estate 206-263-2890. For example if the address is 123 Main St try inputting 123 Main You can also try using part of your last name instead of your full first and last name. Pay or view your account online do a property search or sign up for e-Reminder Notices via text or email.

No or fiduciary number then select a Type of Search option. The roll number is more or less for the internal use of the jurisdiction and can be utilized as a quick means of pulling up all relevant data on a given piece of property. Please include your payment stub with any payment and write the roll year and bill number on your check Unsecured Property Tax Bill - Unsecured bills are mailed out every year no later than July 31st and are due no later than August 31st.

If you have trouble searching by Name please use your Property Tax Account Number or your Property Address. If you are searching on a property with units you must search on the property address then pick the unit. Enter 15 digit Tax Roll like.

Street Number and Community can be entered to narrow the search. Learn how your propertys assessed value relates to your property taxes. View various City of Antioch GIS maps including Assessors parcel book subdivisions general plan census tracts trails business listings and city base maps.

If you disagree with your assessment you can file a Request for Reconsideration. King or King St E. The Tax Office accepts property tax payments online by mail or.

If your property tax is paid through your mortgage you can contact your lender for a copy of your bill. Try a partial search by using just the street name without direction or type. Mobile Homes and Personal Property Commercial Property Tax 206-263-2844.

123456-7890 or Location Address Address should be entered as it appears on the Real Estate Tax Notice for the closest match. City of Antioch GIS Map Gallery. This of course is only easy if you happen to have your current bill or deed handy.

Enter owners last name followed by a space and the first name or initial. Tax Roll Item Number. Include your property address account number the property owners email address and phone number.

This number is located on your county tax bill or assessment notice for property tax paid on your principal residence during the tax year for which you are filing your return. Managed Forest and Conservation Land. You may also get this number from your county assessors office.

To begin your search enter one set of criteria and click the Search button below. Most tax payments are mailed to a lockbox at the County depository. Learn about how we assess managed forest and conservation land.

Clicking on the roll number will take you to a secure site where you can view more details about your. You may search for assessed values and other property assessment information for all properties in Winnipeg from this screen using either of the search facilities below. Roll numbers tend to remain the same from one tax period to the next and may be configured with numbers only or be an alphanumeric combination if this approach works best.

However if youre the owner of the house the easiest way is by looking on your deed or most recent property tax bill. Welcome to the online Property Tax Lookup. If you own multiple properties you will see a list.

This is a summary of your. The certified appraisal roll and the tax rates are used to levy the current property taxes in OctoberNovember of each year. Enter your search criteria in the Property Search box below.

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home