Fulton County Property Tax Bill Lookup

Our office encourages visitors to take the time to check out what the new application has to offer. The Vigo County Treasurers Office has a new website.

Harrison County Courthouse 200 West Houston Suite 108 PO Box 967 Marshall Texas 75671 903-935-8411 903-935-5564 fax.

Fulton county property tax bill lookup. Fulton County GA Property Tax Search by Address. To search for a tax bill select your property type personal property or real estate then select the information you want to enter. Tax Summary request for multiple parcels - If you know the complete parcel IDs of the properties you are looking for this feature provides an efficient way of looking up your Tax Bills and Detailed Tax Summaries.

See what the tax bill is for any Fulton County GA property by simply typing its address into a search bar. The tax is levied on the assessed value of the property which is established at 40 of the fair market value unless otherwise specified by law. From the Tax Commissioners website property owners can find out the property taxes for their property or properties in two ways.

The amount of tax is determined by the tax millage rate. House Number Low House Number High Street Name. Search for a tax bill - This feature allows you to search for a tax bill or bills using a complete or partial parcel ID account number or physical address.

We have received the rates from the state and the property taxes have been calculated 2020P2021. From the Tax Commissioners website property owners can find out the property taxes for their property or properties in two ways. Alpharetta Service Center 11575 Maxwell Road.

It consists of the Map Section The individual Block located in the map and the individual Lot number. Fulton County Assessors Office Website httpwwwcofultoninusdepartmentindexphp View Fulton County Assessors Office information including office address phone number hours and duties. 48-5-311 e3B to review the appeal of assessments of property value or exemption denials.

Monday-Friday 8am-430pm Fulton County Government Center 141 Pryor Street Suite 1018 Atlanta GA 30303-3487. The property SBL is also known as the Tax Map Number or Property ID Number. After entering your information click Search.

Sale Price Min Sale Price Max Sale Date Min MMDDYYYY. Search For a Tax Bill - This feature allows you to search for a tax bill or bills using a complete or partial parcel ID account number or physical address. Tax Summary request for multiple parcels - If you know the complete parcel IDs of the properties you are looking for this feature provides an efficient way of looking up.

Search For a Tax Bill - This feature allows you to search for a tax bill or bills using a complete or partial parcel ID account number or physical address. Fulton County Assessors Website Report Link httpswwwfultoncountynygovnode33 Visit the Fulton County Assessors website for contact information office hours tax payments and bills parcel and GIS maps assessments and other property records. Fulton County Property Tax Inquiry.

The Tax Commissioner takes the appraised value and the exemption status provided by the Board of Tax Assessors along with the millage rates set by the Board of Commissioners and other Governing Authorities to calculate taxes for each property and mails bills to owners at the addresses provided by the Board of Tax Assessors. Statements are mailed August 15th and are due by October 15th of each year. The basis for ad valorem taxation is the fair market value as determined by the Fulton County Board of Assessors.

14910-5-1 These numbers appear on various documents including Assessment Rolls Tax Rolls Tax Bills Etc. Approved and adopted September 2 2020. VIGO COUNTY Ind.

The Fulton County Auditors Office has switched to a new property search website. The Department of Local Government Finance has compiled this information in an easy-to-use format to assist Hoosiers in obtaining information about property taxes. The 2020 Millage Rate is 12899 0012899.

Officials say the due date has not been extended this year. WTHI - Vigo County property tax bills are in the mail and they are due Monday May 10. See Fulton County GA tax rates tax exemptions for any property the tax assessment history for the past years and more.

Fulton County Initiatives Fulton County Initiatives. Tax Summary request for multiple parcels - If you know the complete parcel IDs of the properties you are looking for this feature provides an efficient way of looking up. The Fulton County Board of Assessors reserves the right when circumstances warrant to take an additional 180 days pursuant to OCGA.

3 days ago. Fulton County GA Property Tax information. Property taxes Read More Boards of equalization Read More Homestead Exemptions Read More plats and land records.

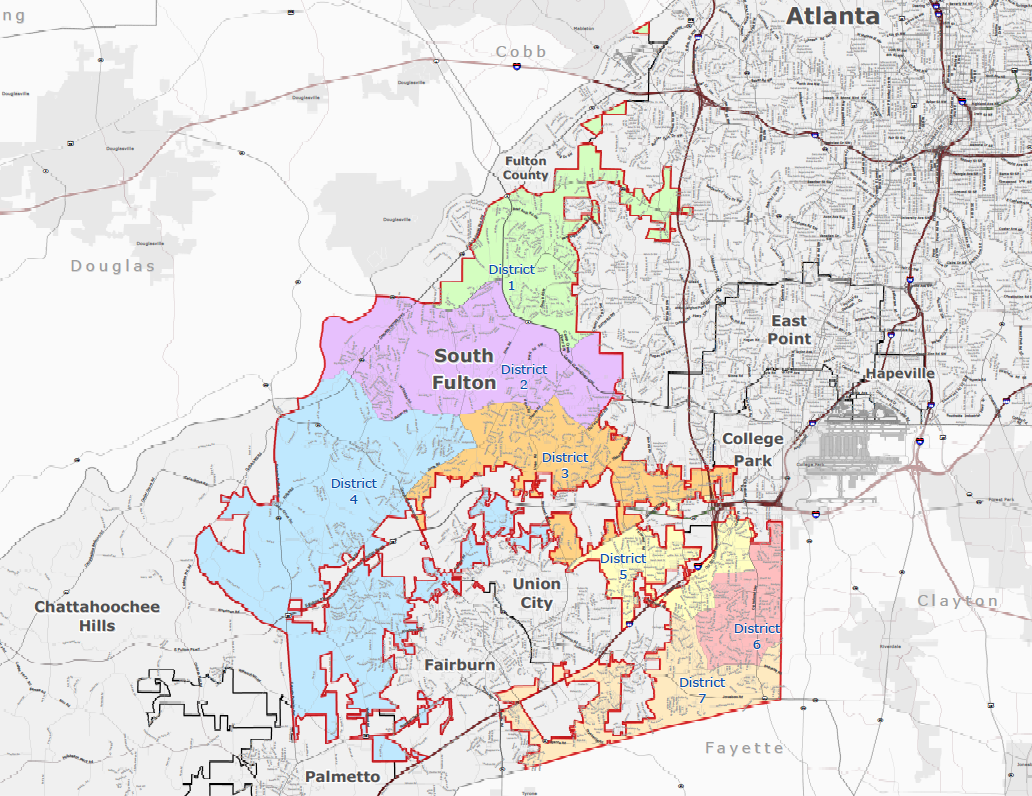

In-depth Property Tax Information. If you are having trouble with your search try reading our Search. PROPERTY TAXES The City of South Fulton property taxes also known as ad valorem taxes are billed and collected through Fulton County Tax Commissioners office.

We hope you find this new website easier and more efficient. Fulton County Assessment Rolls httpswwwfultoncountynygovnode245 Search Fulton County property assessments by tax roll parcel number property owner address and taxable value. Tax Bill Search The information provided in these databases is public record and available through public information requests.

Once you go to this link click on Vigo County. Fulton County Tax Commissioner. Map Search BOARD OF ASSESSORS Peachtree Center North Tower Main Office 235 Peachtree Street NE Suite 1400 Atlanta GA 30303 Hours of Operation.

You may select from parcel ID account number or street address.

Read more »