Real Estate Purchase Agreement By Owner

The document informs the seller of the amount the buyer is willing to pay and specifies various terms the seller must satisfy if the buyer is to agree to the sale. AGREEMENT TO SELL REAL ESTATE.

Application For Sale By Owner Seller Financing Purchase Agreement Printable Blank Form Print Home Own Contract Template Real Estate Forms Room Rental Agreement

Application For Sale By Owner Seller Financing Purchase Agreement Printable Blank Form Print Home Own Contract Template Real Estate Forms Room Rental Agreement

FOR SALE BY OWNER - PURCHASE AGREEMENT.

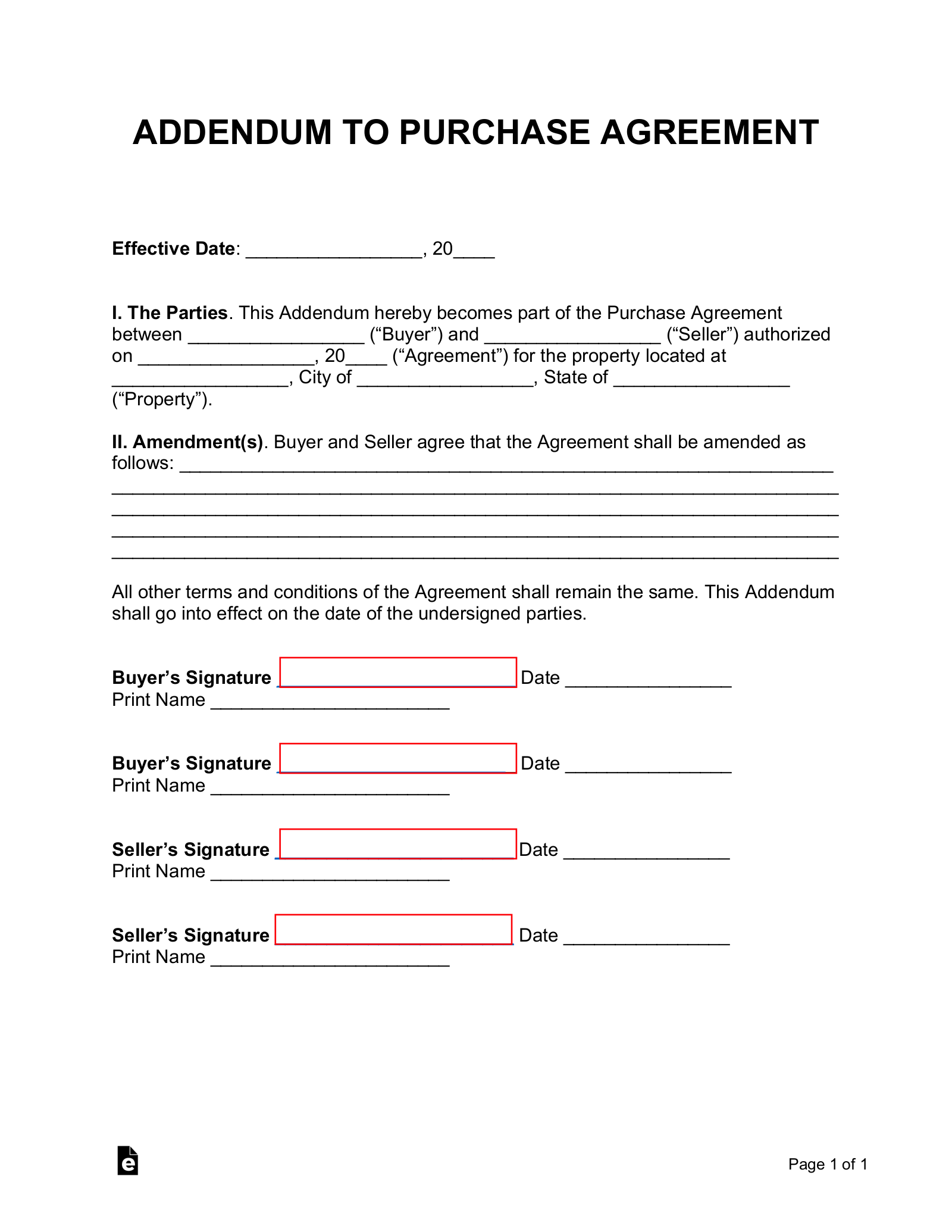

Real estate purchase agreement by owner. A Real Estate Purchase Agreement is one of the key legal documents to completing a For Sale by Owner home sale. This agreement shall be binding upon the heirs personal representatives successors and assigns of both Purchaser and Seller. It is expressly agreed that this agreement to purchase real estate includes the entire agreement of Purchaser and Seller.

This contract establishes that Owner shall sell and Buyer shall buy the property and that Owner shall finance the balance of the purchase price for the property for Buyer after Buyer delivers a down payment. This includes the specifics of the property the purchase price the downpayment the payment terms and other terms and contingencies that the parties agree on. The main terms of the agreement will consist of a purchase price downpayment and the financing terms if any.

Free Texas Residential Purchase And Sale Agreement. THIS FORM IS INTENDED FOR USE ONLY IN SIMPLE RESIDENTIAL REAL ESTATE TRANSACTIONS. REAL ESTATE BROKER AND COOPERATING BROKER COMPENSATION A.

PARTIES TO CONTRACT - PROPERTY. A Texas residential purchase and sale agreement is used to outline a home buyers conditions when offering to purchase real estate. IF YOU DO NOT UNDERSTAND IT SEEK LEGAL ADVICE.

A real estate purchase agreement is a binding agreement where the seller and the buyer agree and commit to the terms of the sale of a piece of real property. Available in A4 US Letter Sizes. Make sure you give full attention to finding the document option that works for you.

Easily Editable Printable. TIME IS OF THE ESSENCETime is of the essence of this Sale and Purchase Agreement. 2 days ago.

Purchaser and Seller acknowledge that Broker is_____ is not_____ the limited agent of both parties to this transaction as outlined in Section III of the Agency. FOR SALE BY OWNER CONTRACT. An Arizona residential real estate purchase and sale agreement is a legal document wherein terms and conditions are set forth in regard to a buyers interest in purchasing a piece of property from an individual wishing to sell said property.

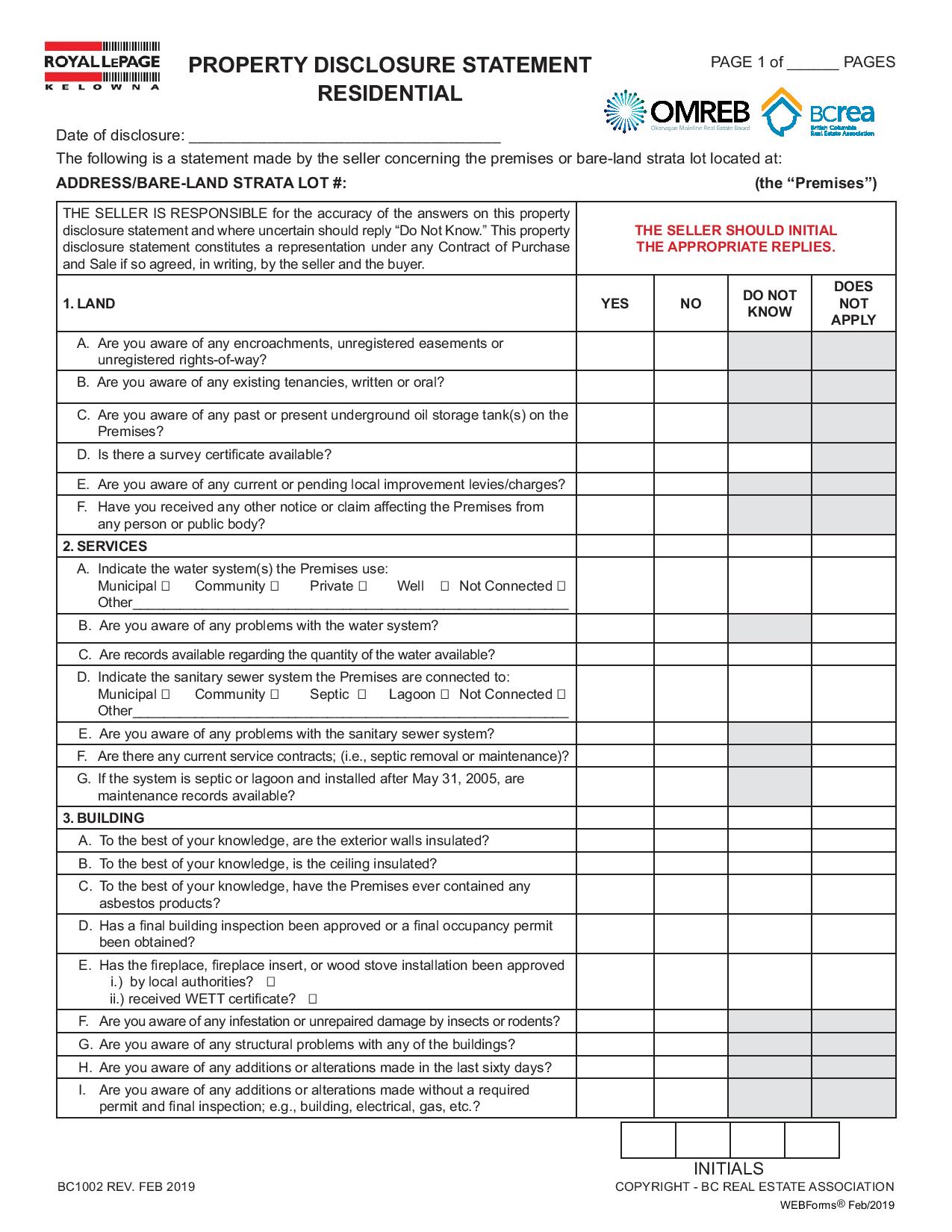

The seller and buyer or their attorneys will negotiate terms of the agreement including purchase price closing date property condition and so on. Houses 2 days ago A real estate purchase agreement is a binding agreement where the seller and the buyer agree and commit to the terms of the sale of a piece of real property. Residential real estate is required to provide the buyer with any information on lead-based paint hazards.

Sellers attorney shall pr epare deed note mortgage Sellers af fidavit any cor-. Contract of purchase are true and that any other agreement entered into by any of the parties to this transaction is. _____ address subject to and together with any reasonable easements zoning restrictions restrictive covenants.

A Real Estate Contract for FSBO. Mortgages may not exceed the Real Estate contract balance and the interest rate and. The Purchaser and Seller agree that and brought about the sale and Seller agrees to pay the brokerage commission as set forth in the listing agreement and Purchaser agrees to pay brokers commission as set forth in the buyers broker agreement.

PURCHASE AGREEMENT THIS IS A LEGALLY BINDING CONTRACT BETWEEN PURCHASER AND SELLER. Real Estate Purchase Agreement Form 2021 OFFICIAL PDF. Most real estate purchase contracts include details such as the purchase price closing date and any contingencies the sale hinges onsuch as the real estate passing inspection or appraising at a.

IF YOU DO NOT UNDERSTAND THE TERMS CONSULT AN ATTORNEY BEFORE SIGNING. This agreement shall be interpreted and enforced in accordance with the laws of the State. The parties may also allow the agreement to be conditional for example upon the buyer being able to sell their home the buyer to receive financing.

On the document the buyer will list the terms of their offer including how the payment will be financed when payments and. Buyer names hereby offer to purchase the real property locally known as. A New York residential real estate purchase and sale agreement is a written agreement that takes place between the seller of a piece of property and a potential buyerThe purchaser will use the agreement form to present their financial offer to the real estate seller.

An Alabama residential purchase and sale agreement allows a buyer and seller to enter into a legally binding contract for real property. This includes the specifics of the property the purchase price the downpayment the payment terms and. Oct 3 2020 - Instantly Download Sale by Owner Purchase Agreement Template Sample Example in Microsoft Word DOC Google Docs Apple Pages Format.

Read more »