Calculate Vehicle Property Tax North Carolina

If youve bought a new or used vehicle in North Carolina youre liable to pay the mandatory North Carolina car tax also known as the How to Calculate North Carolina Car Tax - CarsDirect 1-888-227-7347. For instance if your vehicles value is assessed at 10000 and the property tax rate is 5 simply multiply 10000 by 5 to get 500 which is what you owe.

Property Taxes 101 Understanding Your Property Tax Propel Tax

Property Taxes 101 Understanding Your Property Tax Propel Tax

This calculator can help you estimate the taxes required when purchasing a new or used vehicle.

Calculate vehicle property tax north carolina. These fees must be added to the estimated tax for the year to derive the total amount due. In 2013 the North Carolina Tax Simplification and Reduction Act radically changed the states tax structure. Please note that special sales tax laws max exist for the sale of cars and vehicles services or.

Richland County - Personal Vehicle Tax Estimator. DMV Registration fees are charged every 2 years. 077 average effective rate.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Pursuant to North Carolina law property is appraised at 100 of fair market value. Under Boats and Planes Personal Property Tax where we have listed it in years past or under Vehicle Registration Fee where TT has a note that NC.

Vehicles are also subject to property taxes which the NC. Check out our North Carolina mortgage rates guide for information about purchasing or refinancing properties in the state. Select the correct assessment ratio from the Assessment Ratio drop down.

Our North Carolina Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in North Carolina and across the entire United States. Please note that DMV and other vehicle fees are not included in the estimated tax amount. Multiply the tax rate percentage by the assessed value of your vehicle.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to North Carolina local counties cities and special taxation districts. North Carolina has a 475 statewide sales tax rate but also has 325 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2188 on top of the state tax. Enter the proper Storm Water Fee.

North Carolina policy states that all vehicles will be taxed at 100 percent of their appraised value. 3610 cents per gallon both of regular gasoline and diesel. Property taxvehicle registration deduction in North Carolina Definitely just list Property Tax not registration fees for vehicles in NC.

6000 on all improved parcels in Mt Pleasant. How To Calculate A Tax Bill. 7200 on all improved parcels in unincorporated areas.

The average effective property tax rate in North Carolina is 077 which compares rather favorably to the 107 national average. Other taxes and fees applicable to North Carolina car purchases. In FY2020 property tax represented 5773 of Henderson County revenues.

How to Calculate a Tax Bill. How much this tax will cost you depends on where you live since vehicle property tax rates vary. North Carolina taxes vehicle purchases before rebates or incentives are applied to the price which means that the buyer in this scenario will pay taxes on the vehicle as if it cost the full 10000.

Anytime you are shopping around for a new vehicle and are beginning to make a budget its important to. Not ALL STATES offer a tax and tags calculator. Enter the first 3 fields to calculate your estimated vehicle tax.

Previously North Carolina had a progressive income tax with rates ranging from 6 to 775. Multiply the applicable county and municipaldistrict combined tax rate to the county tax appraisal of the property. 4 for a primary residence 6 for a non-primary residence or other real property or a motor vehicle 105 for personal property.

Division of Motor Vehicles collects as defined by law on behalf of counties Revenue from the highway-use tax goes to the North Carolina Highway Trust Fund and the North Carolinas General Fund and is. Confusion comes this year on TT as to where to list it. See below for states that do and dont offer these services In addition CarMax offers a free tax and tag calculator for some states only.

In North Carolina property tax is the primary source of revenue for local governments.

Oklahoma Property Tax Calculator Smartasset

Oklahoma Property Tax Calculator Smartasset

Guide To Central Pennsylvania Property Taxes Century 21 Core Partners

Guide To Central Pennsylvania Property Taxes Century 21 Core Partners

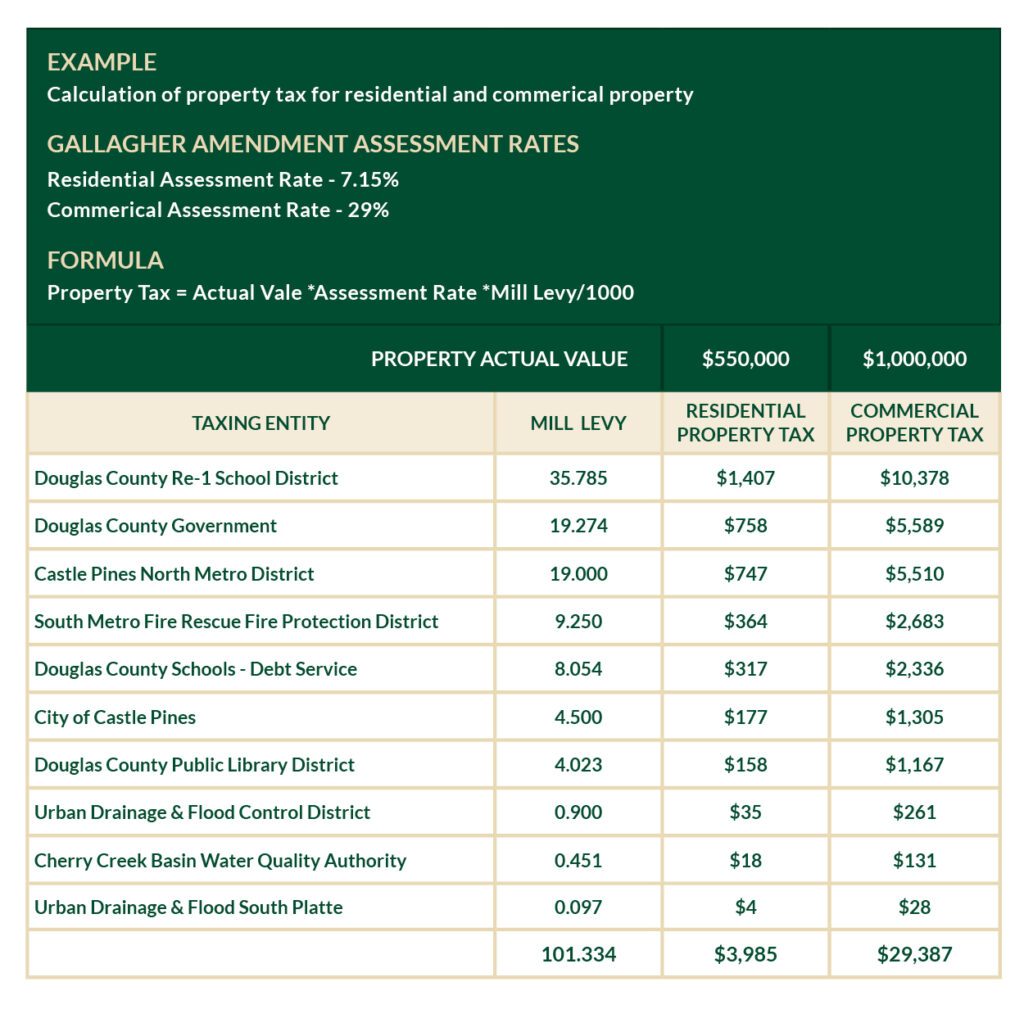

Taxation In Castle Pines City Of Castle Pines

Taxation In Castle Pines City Of Castle Pines

Property Taxes By State Why We Should All Embrace Higher Property Taxes

Property Taxes By State Why We Should All Embrace Higher Property Taxes

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

5 States With No Property Tax In 2018 Mashvisor

5 States With No Property Tax In 2018 Mashvisor

Easyknock South Carolina Property Tax Rate A Complete Guide

Easyknock South Carolina Property Tax Rate A Complete Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

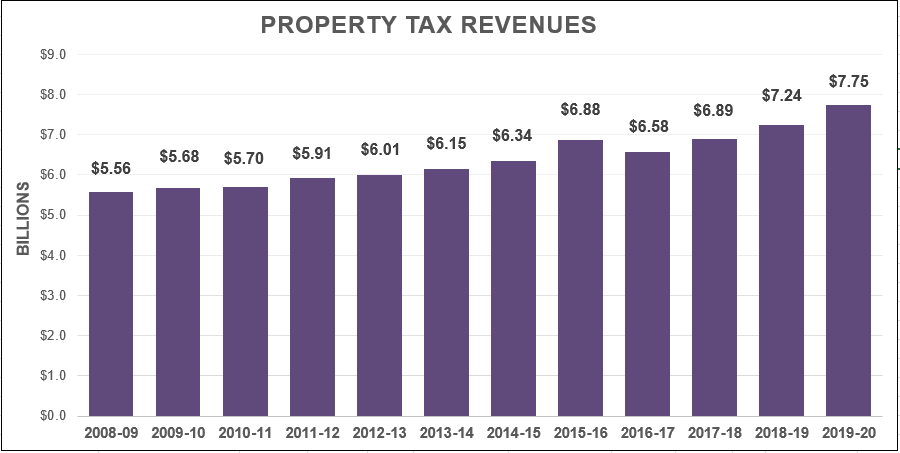

County Budget And Tax Survey North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

County Budget And Tax Survey North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

Property Tax Comparison By State For Cross State Businesses

Property Tax Comparison By State For Cross State Businesses

Do You Have To Pay A Vehicle Tax Here S Some Good News The Motley Fool

Do You Have To Pay A Vehicle Tax Here S Some Good News The Motley Fool

Property Taxes By State Why We Should All Embrace Higher Property Taxes

Property Taxes By State Why We Should All Embrace Higher Property Taxes

Commercial Vehicle Lease Agreement Template 11 Simple Commercial Lease Agreement Template For Landowner And Lease Agreement Rental Agreement Templates Lease

Commercial Vehicle Lease Agreement Template 11 Simple Commercial Lease Agreement Template For Landowner And Lease Agreement Rental Agreement Templates Lease

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home