How To Collect Carbon Tax Rebate

The principle behind a carbon tax is to make people use less fossil fuel energy by making it more expensive to buy it. If you owe money it will be subtracted from your tax bill.

The schedule 14 form can.

How to collect carbon tax rebate. The Government of Canada has introduced the new climate action incentive CAI payment. Higher carbon tax rates cause larger changes in. Conservatives including federal party leader Andrew Scheer have.

Approach to Carbon Pricing. The average passenger car produces a tonne of greenhouse gases about every. To help provide relief during the COVID-19 pandemic a previously scheduled increase was postponed in 2020.

The plan officially starts on April 1 and you can apply for the rebate with your 2018 tax return. Non-residents of Canada or Canadians who were incarcerated at any point in the year are not entitled to the credit. However even though its been under way for a while now figuring out how your households carbon tax rebate and costs are calculated may still seem a bit confusing.

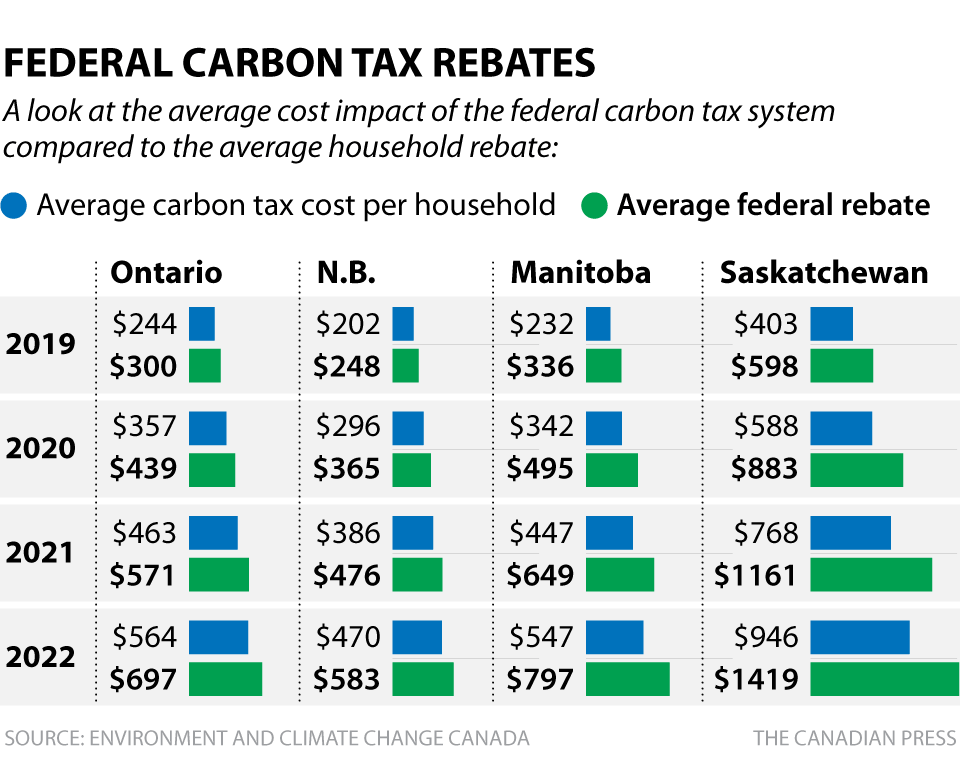

Who qualifies for carbon tax rebate. This applies whether its. The rebates are adjusted each year as the carbon tax goes up 10 per tonne until 2022 and then by 15 a year until 2030.

You have to file your taxes. The average passenger car produces a tonne of greenhouse gases about every. On account of the different carbon-intensity of fuels price impacts are most significant for energy produced with coal then petroleum then natural gas.

If you are getting money back it will be added to your refund. The Liberals say average households will come out ahead in its plan to levy a carbon tax and provide direct rebates to consumers in the provinces and territories that dont have a carbon. How to claim the carbon tax rebate.

On April 1 2021 BCs carbon tax rate rose from 40 to 45 per tCO 2 e. OTTAWA A new analysis by Parliaments budget watchdog has found that most households in provinces where the federal carbon tax applies will receive more money back in rebates. The rebates are adjusted each year as the carbon tax goes up 10 per tonne until 2022 and then by 15 a year until 2030.

In 2019 each single adult or first adult in a couple will receive 128. In order to receive the Climate Action Incentive tax credit you have to file your personal income tax return. According to the Climate Action Incentive official website Canadians will be able to claim their carbon tax rebate on their tax return.

The CAI payment will be automatically applied to your balance owing for the year if applicable or may increase the amount of any refund you may be entitled to. A carbon tax increases energy costs in proportion to the carbon content of the source of energy. The carbon tax rebate for a family of four in New Brunswick will be 256 in 2019 growing to 607 in 2022.

New revenues generated from increasing the carbon tax will be used. The process will include filling out a quick form detailing the number of people in the family unit both adults and children as well as whether the family lives in a small or rural community. Complete Schedule 14 included with your return available in your certified tax software and tax package send file your return to the Canada Revenue Agency.

If you are getting money back it will be added to your refund. The second adult. Thats why the Government of Canada has put a price on carbon pollution.

Potentially adding to the confusion explained Gittens is that the tax refund is being offered pre-emptively before the federal carbon tax takes effect in April 2019. The rate is scheduled to increase to 50 per tonne on April 1 2022. The schedule 14 form can be found here.

The carbon levy is already in full swingand quickly on its way to next years increases. You wont see a fee subtracted from your wages or have to account for when filing your taxes. If you owe money it will be subtracted from your tax bill.

Instead carbon pricing is applied to goods and services from industries that. If you are a resident of Saskatchewan Manitoba Ontario or Alberta you can claim it when you file your 2019 income tax and benefit return. Carbon pricing does not collect revenue directly from Canadians.

Read more »