How To Avoid Paying Taxes On Mutual Funds

Fund companies publish the so-called. By avoiding tax events.

Tax On Mutual Funds Taxation Rules How Are Mutual Funds Taxed

Tax On Mutual Funds Taxation Rules How Are Mutual Funds Taxed

Buy mutual fund shares.

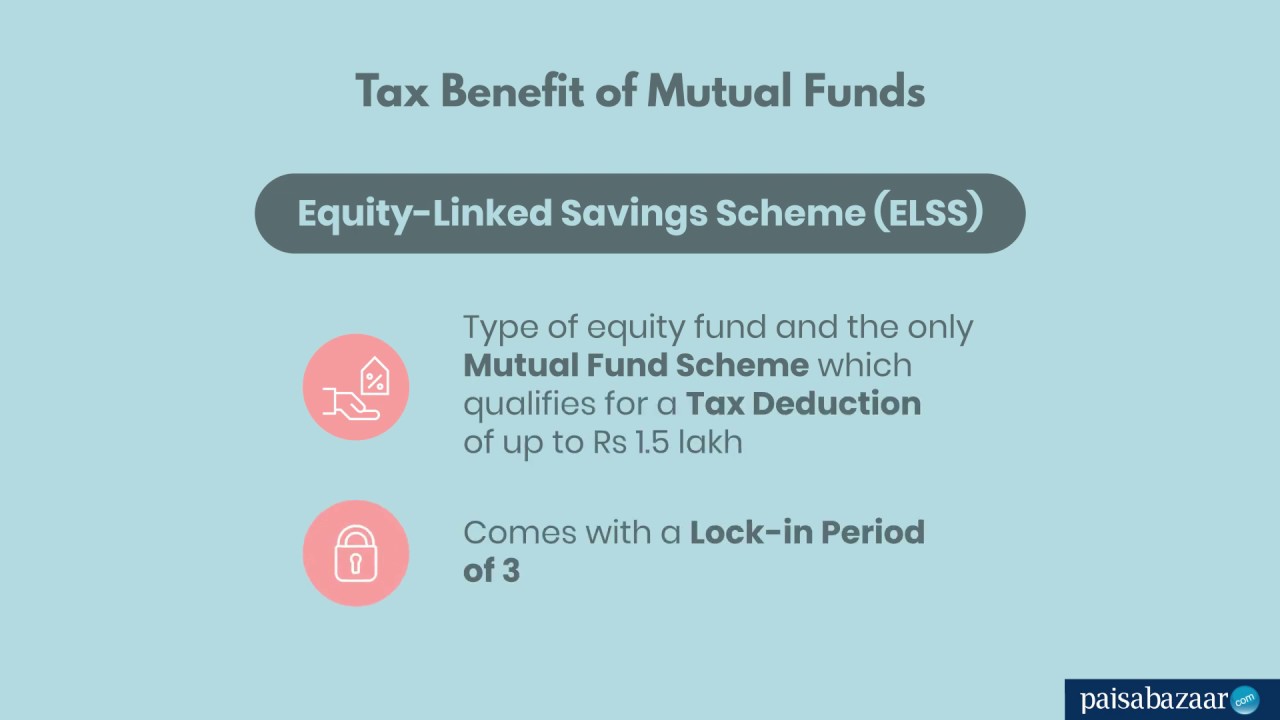

How to avoid paying taxes on mutual funds. Taxation of regular mutual fund sales Most of the time if you want to make a withdrawal from a mutual fund you have to sell some of the shares that you own. If you are selling it before a year you would pay short-term capital gains STCG tax of 15 percent. The other way to minimize your income tax bill is to invest in so-called tax-free mutual funds.

Even better keep your statements and pass them along to your tax professional while you go about your life. If you want to avoid paying taxes on a funds year-end distribution its not enough to exchange out of the fund before the payment date of that distribution. Together that may enable you to donate up to 238 more than if you had to pay capital gains taxes.

By donating long-term appreciated stocks or mutual funds to a public charity you are generally entitled to a fair market value FMV deduction and you may even be able to eliminate capital gains taxes. Some mutual funds such as municipal bonds are exempt from federal taxes and will not require you to file a 1099-DIV form with the IRS. The main benefit of avoiding taxable gains in a mutual fund is tax deferral.

Even if you have a. 6 quick tips to minimize the tax on mutual funds Wait as long as you can to sell. Every time you are going to sell your mutual fund holdings you are going to incur tax.

In that case you might owe money from. These funds invest in government and municipal bonds also called munis that pay tax-free. Contribute appreciated stock instead of cash.

There are a few ways to approach and navigate capital gains distributions but its difficult to completely avoid the tax bill from a funds distribution of gains. At the same time you can owe capital gains taxes every year on mutual funds even if you dont sell them. You can avoid making the same mistake by simply keeping all of your mutual-fund statements and paying attention to all amounts invested and more importantly the amounts reinvested You may also refer to IRS Publication 550.

In order to avoid taxing people twice the Internal Revenue Service IRS allows credits for foreign taxes paid. Determine which clients hold material positions in the high-distributing fund within taxable accounts. You can carry over excess capital losses of more than 3000 to offset capital gains in future tax years and potentially ordinary income of up to 3000 per year.

Or you can take your distributions in smaller quantities that are spread out over more than one calendar year. If you are selling it after a year you will have to pay a tax of 10 percent without indexation if the long-term capital gains LTCG are above 1 lakh in a financial year. You cant control whether your fund will make a capital gains distribution.

You can avoid a big tax bill by doing a rollover instead if your mutual funds are held in a tax-deferred account such as an IRA 401k or tax-sheltered annuity. If you sell prior to the. The lower the turnover rate the better.

3 Invest in tax-managed or tax-efficient mutual funds to minimize your taxation amount. However you can avoid triggering your own capital gains by hanging on to your mutual fund shares. Sometimes international funds arent taxed because of the foreign tax credit.

Selling in less than a year can trigger higher capital gains taxes if you make a profit. Its probably not worth the trading costs to save just a few bucks. The way to avoid the trap or at least greatly lessen the potential damage is to steer clear of mutual funds that trade or turn over more than the equivalent of 10 percent of the portfolio annually.

Funds distribute their taxable gains to investors who pay income taxes on them in the same year. Sell and replace. Invest in tax-exempt mutual funds to avoid paying any taxes on mutual funds.

There are no inheritance taxes at the federal level but some states still impose an inheritance tax on bequests.

Read more »