How To Get Carbon Tax Rebate In Alberta

Reporting paying rebates and refunds. In a statement the provincial Environment Ministers spokesperson Jess.

Can We Fix Toronto S Transit By 2030 With An Expected Population Of 8 Million Experts Say It S Already Too Late In 2020 Rapid Transit 10 Year Plan Downtown Toronto

Can We Fix Toronto S Transit By 2030 With An Expected Population Of 8 Million Experts Say It S Already Too Late In 2020 Rapid Transit 10 Year Plan Downtown Toronto

Conservatives including federal party leader Andrew Scheer have.

How to get carbon tax rebate in alberta. Simply choose between the different form options to get the total amount of credit you could get for 2021 based on your 2020 income. I called OTooles tax. All you have to do is make sure youve filed your tax return and filled in a quick form you also need to meet the income criteria.

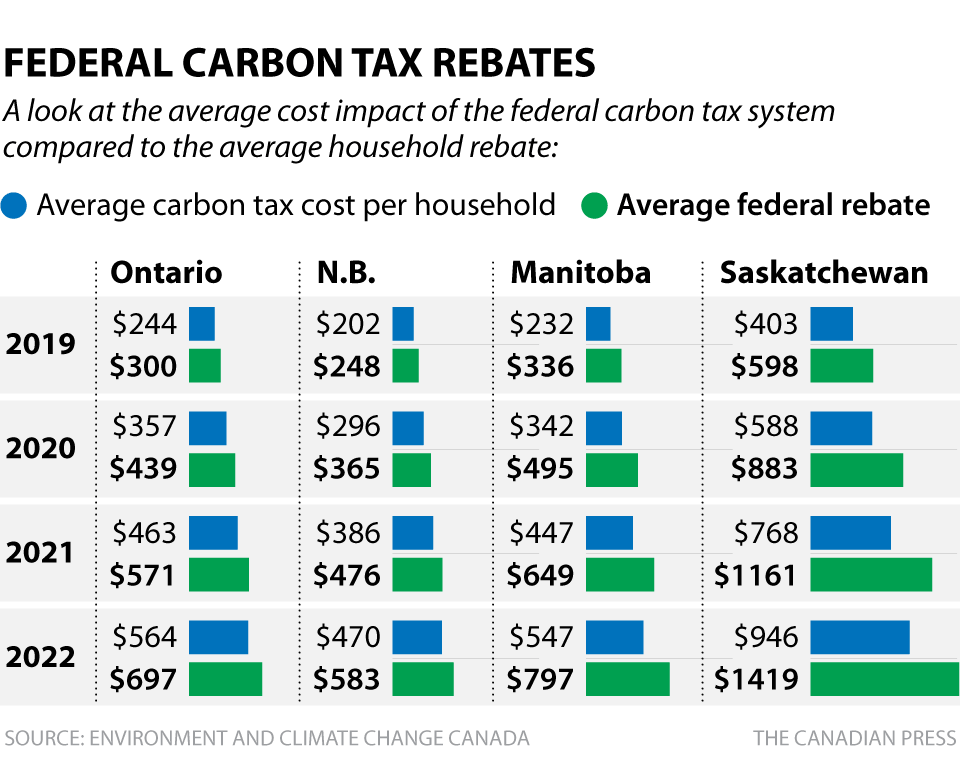

If you are a resident of Saskatchewan Manitoba Ontario or Alberta you can claim it when you file your 2019 income tax and benefit return. This is the incentive to burn less pay less tax thus keep more of the rebate. A family of four in Alberta will see a rebate of 888 in 2020.

The province is awaiting a decision in regards to its court challenge. If you happen to notice a bit of a boost in your bank account today it could be because you. A claim for a refund or rebate of carbon levy to eligible fuel sellers and consumers must be made no later than 2 years after the end of the calendar year in which the fuel purchased included the carbon levy.

Calculate the carbon tax credit for Alberta residents in 2021. But OTooles carbon tax will be just as high as the tax Trudeau promised in the 2019 election before he got green greedy and decided to jump it to 170. How to claim the carbon tax rebate.

Carbon tax rebates start flowing into Alberta bank accounts. The schedule 14 form. No application is necessary for you to get your rebate.

Non-residents of Canada or Canadians who were incarcerated at any point in the year are not entitled to the credit. Single adult or first adult in a couple 1. Each child under 18 starting with the second child for single parents 3.

Economists say its a cumbersome idea - and it might not work. The current federal governments carbon pricing plan at least makes some sense. The rebates are meant to offset the added consumer costs resulting from Ottawas carbon tax of 20 per tonne of carbon.

Alberta Environment Minister Jason Nixon says the province is encouraged the federal Conservatives would scrap the current carbon tax if elected even if replacing it still means consumers. The carbon levy is no longer in effect as of May 30 2019. Thats why the Government of Canada has put a price on carbon pollution.

The Conservatives have released a new climate plan that would create a new low-carbon savings account for Canadians. Tax and levy payments and administration. If you are getting money back it will be added to your refund.

490 Second adult in a couple or first child of a single parent 2. According to the Climate Action Incentive official website Canadians will be able to claim their carbon tax rebate on their tax return. The Government of Canada has introduced the new climate action incentive CAI payment.

If you owe money it will be subtracted from your tax bill. Information on carbon levy. The rebates were unveiled the same week the Alberta government was in court fighting the federal carbon tax.

Alberta scrapped its carbon tax in June but starting Jan. The process will include filling out a quick form detailing the number of people in the family unit both adults and children as well as whether the family lives in a small or rural community. 1 2020 the federal carbon levy will be imposed on the province.

Delivered Through 2020 Personal Income Tax Returns Amount Ontario Manitoba Saskatchewan Alberta. The plan officially starts on April 1 and you can apply for the rebate with your 2018 tax return. Burn less gas pay less carbon tax but still get same rebate as someone who burned more gas paid more tax.

How to claim the Alberta carbon tax rebates. The carbon tax rebate is also called Climate action incentive or CAI. Overview for fuel sellers and consumers on carbon levy administration in Alberta.

In order to receive the Climate Action Incentive tax credit you have to file your personal income tax return. You may be eligible for a carbon levy rebate if you used the fuel for an eligible exempt purpose and you paid the carbon levy. You have to file your taxes.

The carbon levy is no longer in effect as of May 30 2019. Information for fuel sellers.

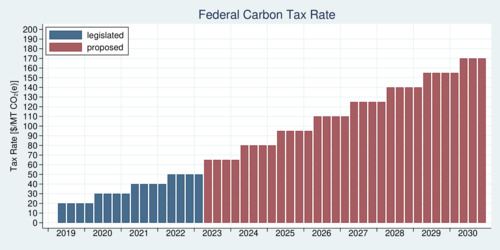

Canada S Carbon Pricing Is Continuing On The Right Track

Canada S Carbon Pricing Is Continuing On The Right Track

Confused About Carbon Taxes And Rebates Here S What You Need To Know Globalnews Ca

Confused About Carbon Taxes And Rebates Here S What You Need To Know Globalnews Ca

Renewable Energy Will Be Consistently Cheaper Than Fossil Fuels By 2020 Report Claims Renewable Energy Wind Power Fossil Fuels

Renewable Energy Will Be Consistently Cheaper Than Fossil Fuels By 2020 Report Claims Renewable Energy Wind Power Fossil Fuels

Pin By Keep Our Planet Healthy On Help The Planet With Renewable Energy How To Increase Energy Renewable Energy Green Energy

Pin By Keep Our Planet Healthy On Help The Planet With Renewable Energy How To Increase Energy Renewable Energy Green Energy

Will Household Rebates Really Make Canadians Warm To A Carbon Price Carbon Tax Carbon Taxes Recycling University Of Ottawa Carbon Climate Change

Will Household Rebates Really Make Canadians Warm To A Carbon Price Carbon Tax Carbon Taxes Recycling University Of Ottawa Carbon Climate Change

All You Need To Know About Bc S Carbon Tax Shift In Five Charts Sightline Institute

All You Need To Know About Bc S Carbon Tax Shift In Five Charts Sightline Institute

How Alberta Can Benefit From A Provincial Carbon Tax Cbc News

How Alberta Can Benefit From A Provincial Carbon Tax Cbc News

All You Need To Know About Bc S Carbon Tax Shift In Five Charts Sightline Institute

All You Need To Know About Bc S Carbon Tax Shift In Five Charts Sightline Institute

Carbon Taxes Rebates Explained Province By Province

Carbon Taxes Rebates Explained Province By Province

Key Facts About The Link Between Climate Change Drought Climate Change Climate Reality Climate Change Solutions

Key Facts About The Link Between Climate Change Drought Climate Change Climate Reality Climate Change Solutions

![]() How The New Carbon Tax Will Affect Canadians Heating Cooling Costs

How The New Carbon Tax Will Affect Canadians Heating Cooling Costs

Pin On Climate Change And Global Warming

Pin On Climate Change And Global Warming

Where The Money Goes How Revenue From Carbon Taxes Drives Change Without Hurting Albertans Publications Pembina Institute

Where The Money Goes How Revenue From Carbon Taxes Drives Change Without Hurting Albertans Publications Pembina Institute

Instagram Photo By Mc Professional Accountant Cga Jun 18 2016 At 12 21am Utc Accounting Pet Clinic Dog Houses

Instagram Photo By Mc Professional Accountant Cga Jun 18 2016 At 12 21am Utc Accounting Pet Clinic Dog Houses

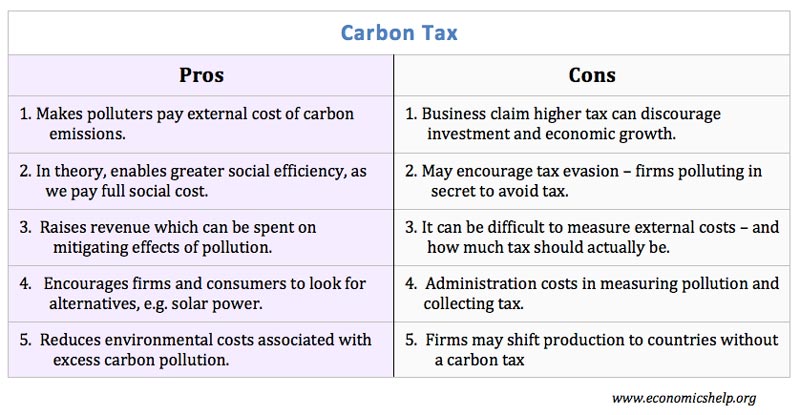

Carbon Tax Pros And Cons Economics Help

Carbon Tax Pros And Cons Economics Help

All You Need To Know About Bc S Carbon Tax Shift In Five Charts Sightline Institute

All You Need To Know About Bc S Carbon Tax Shift In Five Charts Sightline Institute

Canadian Carbon Tax To Climb 33 In April Following Favorable Court Ruling Natural Gas Intelligence

Canadian Carbon Tax To Climb 33 In April Following Favorable Court Ruling Natural Gas Intelligence

How To Travel Green Greenseat Co2 Compensatie Reis

How To Travel Green Greenseat Co2 Compensatie Reis

Wexit Big Concern Must See Big Caribou Concern

Wexit Big Concern Must See Big Caribou Concern

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home