King County Property Tax Late Penalty

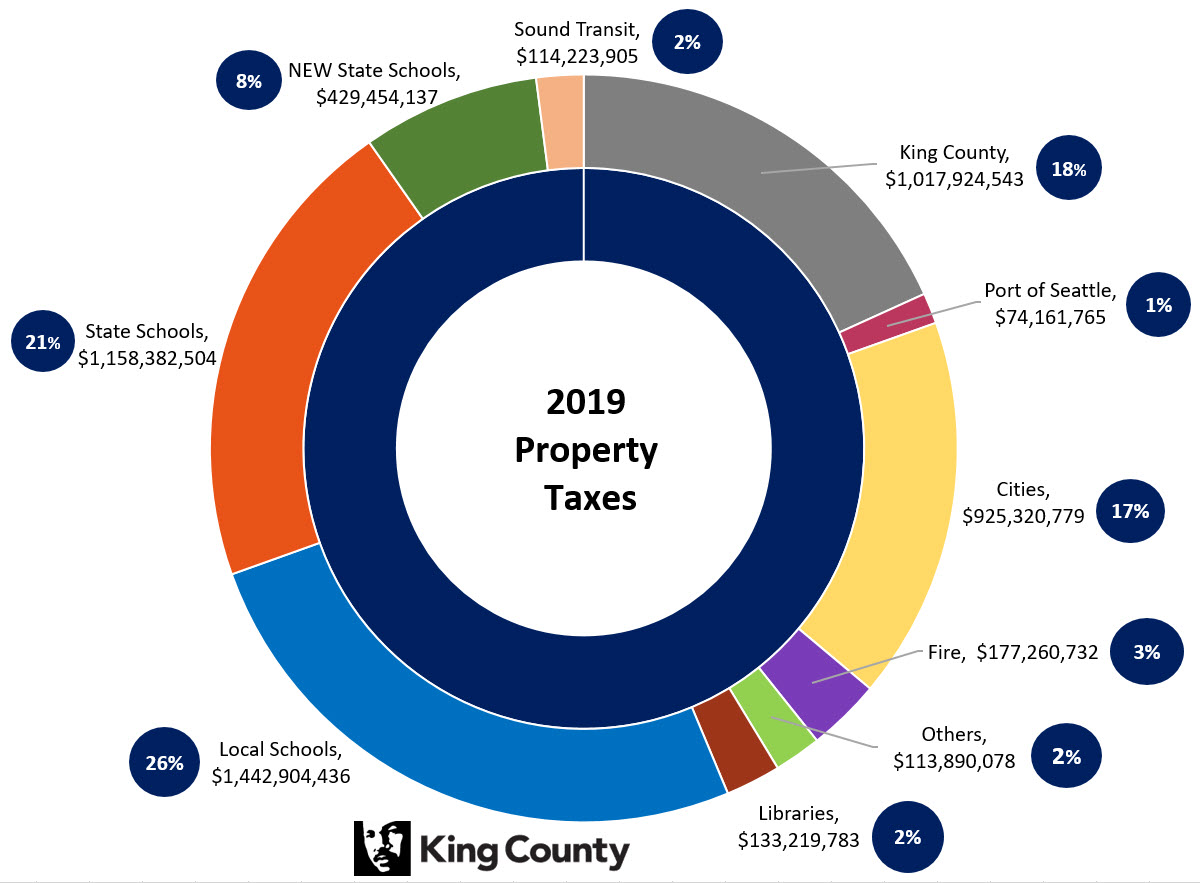

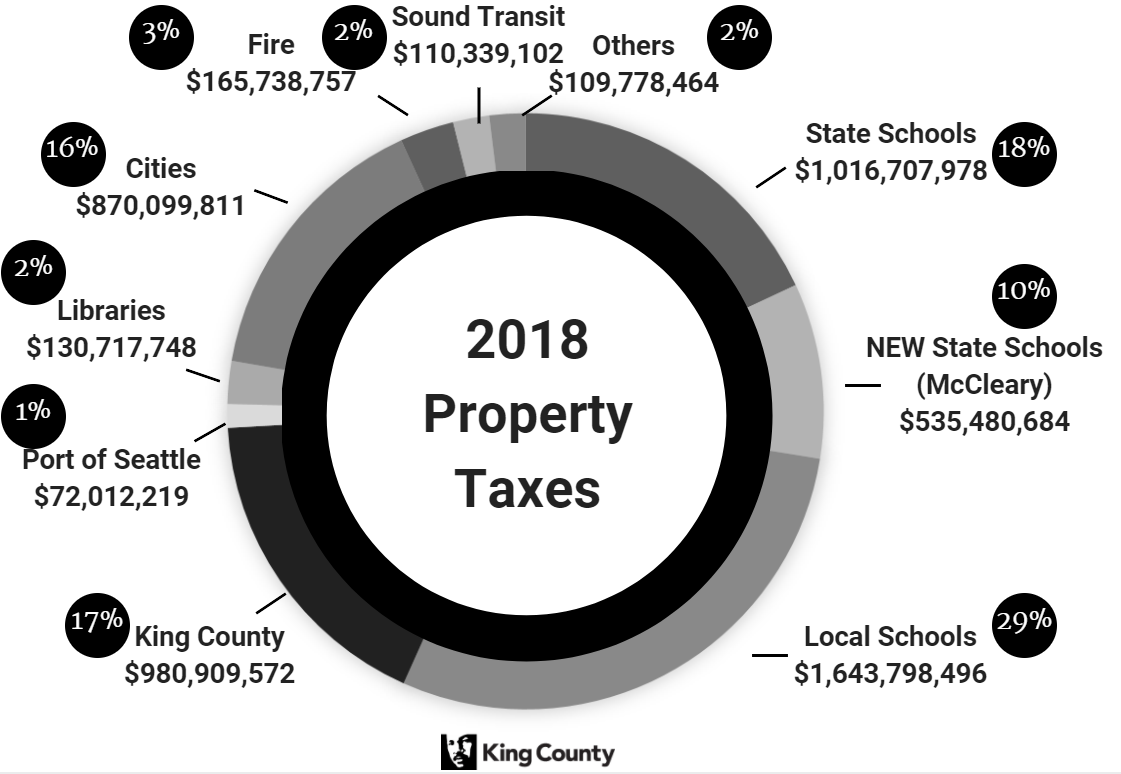

King County receives about 17 percent of your property tax payment for roads police criminal justice public health elections and parks among other services. How the Payment Plan Works.

King County Wa Property Tax Due Dates Property Walls

King County Wa Property Tax Due Dates Property Walls

King County is not at fault for late payments even if this notice fails to send or is never received.

King county property tax late penalty. The Office of the Treasurer Tax Collector will review your waiver request in accordance with the the San Francisco Business and Tax Regulations Code andor the California Revenue Taxation Code where applicable which allow the Office to waive or cancel penalties costs fees or interest in certain limited cases. About 57 percent of 2021 King County property tax revenues pays for schools. In addition to taxes assessments fees interest and penalties costs of foreclosure begin to accrue.

A Certificate of Delinquency is filed with the Superior Court. Fees will be added to late property tax payments. On April 10 th that installment will become delinquent and a 10 penalty on the unpaid tax as well as a 2000 cost is added.

If a payment plan is established before the end of November 2020 the taxpayer will avoid the 8 penalty that would otherwise be assessed on 2020 taxes unpaid as of December 1 st. If the participate abides by the terms of the agreement the December penalty can also be waived. Main Phone 559 852-2479 Fax Number 559 582-1236 Office Location Government Center-Bldg.

025 discount on the last three quarters if you wait until October to pay the entire amount due for the year. The plan was established before June 1 2021 and therefore the homeowner can avoid paying the 3 penalty which is normally imposed in June for unpaid taxes. After your property tax payment is three years overdue the county treasurer will issue a certificate of delinquency which is filed with the court clerk.

Instead King County is offering payment plans to all delinquent taxpayers for the full 2020 tax year. This filing starts the foreclosure process. Delinquent second installment property tax payments are also charged a.

This service is only a reminder of King County property tax payment deadlines. King County Washington one of the counties that has postponed its April 30 property tax deadline says the extension until June 1 is. Penalty is three percent current year tax only on amount unpaid on June 1 and eight percent current year tax only on amount unpaid on December 1.

If you owe 2500 in property taxes a 10 percent late payment penalty would be 250. PENALTY of three percent is assessed on the amount of tax delinquent on June 1st of the year in which the tax is due. Look out for Legal Changes.

US Postmark on or before April 10 th is considered timely payment. If you fail to pay the second installment at the Tax Collectors office by 500 pm. An additional 8 shall be assessed on the total amount of tax delinquent on December 1 of the year in which the tax is due.

Property taxes also fund voter-approved measures for veterans and seniors fire protection and parks. When real property taxes become a full three years delinquent the county treasurer begins foreclosure action. Hanford CA 93230 Mailing Address.

Kings County Tax Collector. Beginning on April 11 2020 my office will begin accepting requests for penalty cancellation related to COVID-19 on our website. Even so not every property owner will get equal relief.

A penalty of 3 shall be assessed on the amount of tax delinquent on June 1 of the year in which the tax is due. King County will not be extending the due date for residents to pay the second half of their 2020 property taxes as the coronavirus pandemic continues to. Late filers are subject to a penalty of 5 percent per month up to 25.

Title searches are conducted on each of the parcels subject to. In addition all delinquent taxes are subject to penalties as follows. If the message doesnt reach you for any reason you are still required to pay your property taxes on time.

An additional penalty of eight percent is assessed on the total amount of tax delinquent on December 1st of the year in which the tax is due. In Washington o nce a tax year is three years late the county can start a foreclosure. This executive order only applies to individual residential and commercial taxpayers who pay property taxes themselves rather than through their mortgage lender.

This penalty will be added to your personal property tax bill. Interest is one percent per month on the full amount due from month of delinquency to month of payment. Due to the financial hardships caused by the COVID-19 pandemic King County Executive Dow Constantine has extended the first-half 2020 property tax deadline to June 1.

Property owners affected by COVID-19 may have late penalties cancelled if they are unable to pay their property taxes by April 10 2020. 05 on the full amount of your yearly property tax if you pay the full years worth of tax shown on your bill by the July due date or grace period due date.

King County Wa Property Tax Calculator Smartasset

King County Wa Property Tax Calculator Smartasset

King County Wa Property Tax Due Dates Property Walls

King County Wa Property Tax Due Dates Property Walls

Deadline For Second Half Of King County Property Taxes To Remain November 2 Auburn Examiner

Deadline For Second Half Of King County Property Taxes To Remain November 2 Auburn Examiner

Penalty Cancellation Requests Related To Covid 19 Treasurer And Tax Collector

Penalty Cancellation Requests Related To Covid 19 Treasurer And Tax Collector

King County Looks For Property Tax Relief During Coronavirus Crisis

King County Looks For Property Tax Relief During Coronavirus Crisis

King County Wa Property Tax Due Dates Property Walls

King County Wa Property Tax Due Dates Property Walls

King County Wa Property Tax Due Dates Property Walls

King County Wa Property Tax Due Dates Property Walls

King County Wa Property Tax Due Dates Property Walls

Https Kingcounty Gov Media Operations Finance Treasury Propertytax Covidfaq83kb Ashx La En

King County Wa Property Tax Due Dates Property Walls

King County Wa Property Tax Due Dates Property Walls

King County Wa Property Tax Due Dates Property Walls

King County Wa Property Tax Due Dates Property Walls

Penalty Cancellation Due To A Lost Payment Affidavit Treasurer And Tax Collector

Penalty Cancellation Due To A Lost Payment Affidavit Treasurer And Tax Collector

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home