How To Apply For Homestead Exemption In Flagler County

How do I apply for Homestead Exemption. Contact your local property appraiser if you have questions about your exemption.

Application should be made to the property appraisers office.

How to apply for homestead exemption in flagler county. Flagler County Property Appraiser Jay Gardner. Home ownership can be a beneficial proposition offering the opportunity to. You will need to bring in proof of age.

Rental for more than 30 days for two consecutive years or for more than six months constitutes abandonment of a homestead exemption. File the signed application for exemption with the county property appraiser. Submit all applications and documentation to the property appraiser in the county where the property is located.

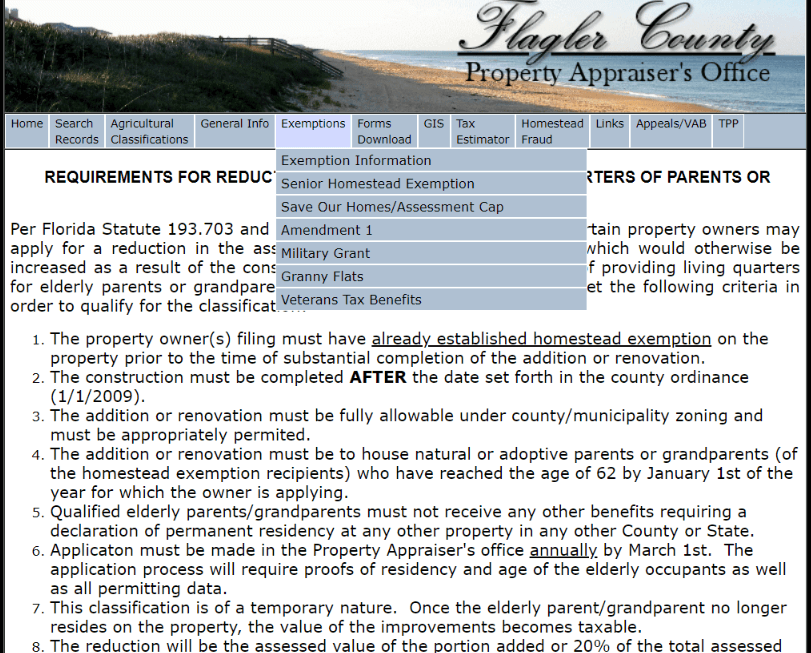

Apply for a Homestead Exemption. Brief summaries of available exemptions are listed here. County residents that are entitled to claim homestead exemption may defer payment of a portion of the combined total of ad valorem taxes and non-ad valorem assessments for which a tax certificate would be sold under Chapter 197 FS levied on his or her homestead by filing an annual application with the tax collector on or before March 31st following the year in which the taxes and non-ad valorem.

For local information contact your county property appraiser. Otherwise the exemption will not take effect until the following year. Homestead exemptions are a form of property tax relief for homeowners.

This is a homestead exemption and only applies to the home you live in and you must be receiving or applying for regular homestead exemption to qualify. First-time Homestead Exemption applicants and persons applying for the Homestead. The application deadline for all exemptions is March 1.

If you qualify you can reduce the assessed value of your homestead up to 50000. FlaglerLive Today is the deadline to file for a Homestead Exemption in Flagler County. To qualify the owner must establish Flagler County as hisher legal domicile.

Once established the exemption is automatically renewed each year. The Property Appraisers Office administers all property tax exemptions. Failure to make application by March 1 of the tax year.

You must furnish proof of age when you apply. Drivers license or Birth Certificate All applicants must already have filed for the original Homestead Exemption before receiving the Senior Exemption. This application is known as the Transfer of Homestead Assessment Difference and the annual deadline to file for this benefit and any other property tax exemption is March 1st.

Property owners with Homestead Exemption and an accumulated SOH Cap can apply to transfer or Port the SOH Cap value up to 500000 to a new homestead property. Signature property appraiser or deputy Date Entered by Date. Homestead and other Exemption Applications are processed by the Property Appraisers office.

This may be achieved though providing a Florida drivers license vehicle registration and voters registration reflecting the domicile of records address. There is a standard 25000 exemption plus an additional exemption up to 25000. Fulton County homeowners can qualify for a variety of homestead exemptions offered through the Fulton County Tax Assessors office.

Rental of a Homesteaded Property You may rent your homesteaded property for 30 days or less per calendar year and maintain a homestead exemption. First time applicants will need to apply in person at our office. To apply gather required documents and complete an application at your county appraisers office.

The option of the property appraiser original homestead exemption applications may be accepted after March 1 but will apply to the succeeding year. Building 2 Suite 201 in Bunnell. These include basic homestead exemptions as well as homestead exemptions for seniors low income homeowners surviving spouses of public safety and military personnel killed in the line of.

Subsequent yearly renewal of exemption status may be made by mail. You can apply at the Property Appraisers office for the exemption at any time during the year but you must apply by March 1 of the qualifying year. The first 25000 of this exemption applies to all taxing authorities.

Spouses information is required if the home is jointly owned. If you miss the deadline the Flagler County. Flagler County Property Appriaser Jay Gardner offers insight on the March 1 homestead exemption deadline and more.

Homestead Exemption Save Our Homes Assessment Limitation and Portability Transfer. The second 25000 excludes school board taxes and applies to. First-time applicants must apply in person.

For more information or to apply call at 386 313-4150 or visit us at the Government Services Building located at 1769 E. The property appraiser has a duty to put a tax lien on your property if you received a homestead exemption. Homeowners who are 65 years of age on or before January 1 are entitled to a full exemption in the school general and school bond tax categories.

Http Www Flaglercounty Org Document Center Bocc 20agenda 2020 20agenda 20backup 20and 20public 20notices 2020 2003 2016 20bocc 20regular 20agenda 20and 20backup Pdf

Http Www Flaglercounty Org Document Center Bocc 20agenda 2020 20agenda 20backup 20and 20public 20notices 2020 2008 2003 20bocc 20regular 20agenda 20and 20backup Pdf

Dave Sullivan Flagler County Commission Candidate The Live Interview

Dave Sullivan Flagler County Commission Candidate The Live Interview

Welcome To Flagler County Florida

Flagler County Property Appraiser How To Check Your Property S Value

Flagler County Property Appraiser How To Check Your Property S Value

Home Page Flagler Tax Collector

Home Page Flagler Tax Collector

Flagler County Property Appraiser How To Check Your Property S Value

Flagler County Property Appraiser How To Check Your Property S Value

Joe Mullins Flagler County Commission Candidate The Live Interview Flaglerlive

Joe Mullins Flagler County Commission Candidate The Live Interview Flaglerlive

Property Taxes Flagler Tax Collector

Property Taxes Flagler Tax Collector

Flagler County Property Appraiser How To Check Your Property S Value

Flagler County Property Appraiser How To Check Your Property S Value

Http Www Flaglercounty Org Document Center Bocc 20agenda 2019 20agenda 20backup 20and 20public 20notices 2019 2007 2015 20regular 20agenda 20and 20backup 20updated Pdf

Home Page Flagler Tax Collector

Home Page Flagler Tax Collector

Flagler County Commission Agenda

Flagler County Commission Agenda

Flagler County Property Appraiser How To Check Your Property S Value

Flagler County Property Appraiser How To Check Your Property S Value

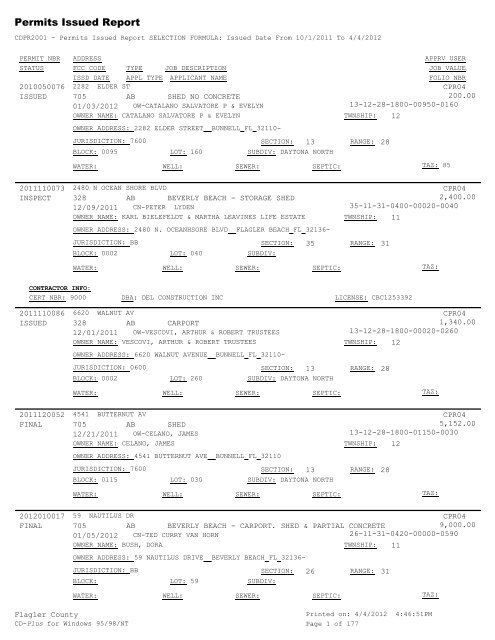

Selection Formula Issued Date From 10 1 Flagler County

Selection Formula Issued Date From 10 1 Flagler County

Https Www Flaglertax Com Documents Tax 20deferral 20info 2012 1 14 Pdf

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home