How Do I Get My Carbon Tax Rebate In Ontario

If youre a resident of Ontario Manitoba Alberta or Saskatchewan you can apply for the CAI rebate on your 2020 tax return. The Government of Canada has introduced the new climate action incentive CAI payment.

Confused About Carbon Taxes And Rebates Here S What You Need To Know Globalnews Ca

Confused About Carbon Taxes And Rebates Here S What You Need To Know Globalnews Ca

Claim your Carbon Tax Rebate when you file your Income Tax return.

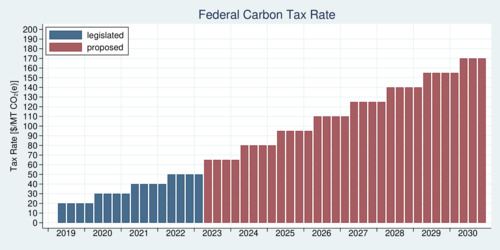

How do i get my carbon tax rebate in ontario. Approximatly 90 of the Carbon Tax will be retured to residents throught the CAI payments. The amount varies from province to province calculated based on the. With the federal carbon tax set to increase by 10 to 40 per ton on April 1 many Canadians will have to pay more at the pump or for heating their houses.

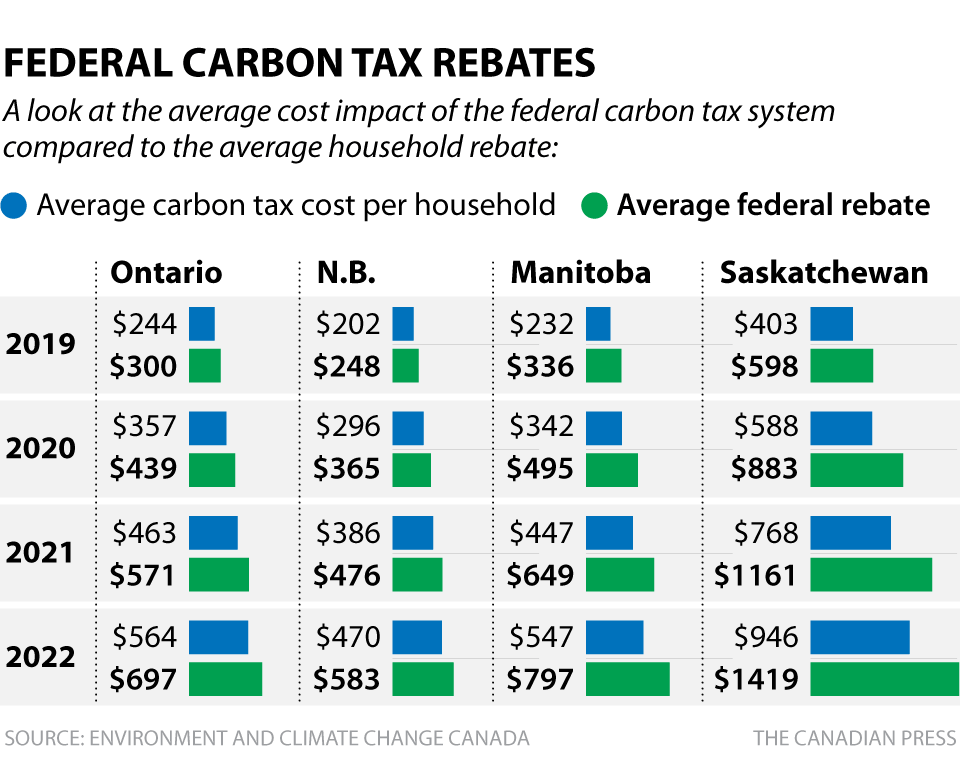

Trudeau unveils the details of carbon tax rebates for Canadians Oct 23 2018 READ MORE. The rebates are meant to offset the added consumer costs resulting from Ottawas carbon tax of 20 per tonne of carbon emitted into the atmosphere for 2019. The change comes after certain provinces did not abide by Ottawas existing carbon pricing model which calls for added tax on carbon products to encourage Canadians to live greener.

If you are getting money back it will be added to your refund. If you are a resident of Saskatchewan Manitoba Ontario or Alberta you can claim it when you file your 2019 income tax and benefit return. The average Ontario household is expected to get.

The plan officially starts on April 1 and you can apply for the rebate with your 2018 tax return. If you live in one of the provinces subject to federal carbon pricing youll claim your payment amounts through your income tax return. The CAI payment will be automatically applied to your balance owing for the year if applicable or may increase the amount of any refund you may be entitled to.

The carbon tax rebate amounts in Canada for 2020 have been modified by the federal government decreasing the incentive rebate available for residents in some provinces. In Ontario the carbon tax rebate for an average family of four in Ontario will be 307 in 2019 increasing each year. A supplement of 10 is also reserved for residents of small and rural communities.

Only one person per family can make a claim. It does not automatically renew after one year. The amount youll receive depends on where you live.

Based on province a family of four could receive up to 600 in 2019. But they will also get a bigger tax. You need to file a tax return to get your climate action tax credit.

Claim the climate action incentive payment. Canadas budget watchdog agrees with the federal governments claim that Canadians are going to get more from the climate change tax rebate than they are paying in carbon tax. In Ontario Manitoba New Brunswick and Saskatchewan where conservative-minded governments have steadfastly opposed any sort of carbon pricing scheme Ottawa will apply its carbon tax.

Residents in rural areas will receive 10 more than residents who live in cities. Conservatives including federal party leader Andrew Scheer have. Come 2022 the rebate for the average Ontario.

The tax rises to 30 per tonne in 2020. The Climate action incentive CAI commonly called Carbon tax rebatescredit consist of an amount gives to the Canadians of specific Provinces by the government of Canada. In case youre wondering if there are carbon tax rebates in Ontario know that they will be available once the carbon tax goes into effect in April 2019.

The payment will be made through the Canada Revenue Agency CRA. You will need to file a tax return every year to keep receiving the credit even if you earn no income in that tax year. April 26 2019 1123 AM.

You have to file your taxes. Heres how to claim your carbon tax refund from the Canadian government. Canadas Climate Action Revenue Incentive Program is a new initiative to combat climate change.

The schedule 14 form can be found here. Youre only allowed one credit per household so youll have to decide which member of your family will apply for the credit youll receive the same rebate no matter who applies. After all the hot-button chatter about carbon taxes in recent years that the tax is unconstitutional doesnt have an impact on climate change and that it gouges regular Canadians in the pocketbook some will be getting a carbon tax rebate this year whether they wanted the.

Thats why the Government of Canada has put a price on carbon pollution. Liberals say 90 of carbon tax will be given to Canadians in rebate. Complete Schedule 14 included with your return available in your certified tax software and tax package send file your return to the Canada Revenue Agency.

Wednesday Dec 04 2019 The Year 2019 Concludes A Decade Of Exceptional Global Heat Retreating Ice And Record Sea Levels Driven By Greenhouse Gases F Historia

Wednesday Dec 04 2019 The Year 2019 Concludes A Decade Of Exceptional Global Heat Retreating Ice And Record Sea Levels Driven By Greenhouse Gases F Historia

Get Started With Bim 10 Phases To A Successful Bim Implementation Strategy Infographic Building The Digital Strategy Infographic Building Information Modeling Bim

Get Started With Bim 10 Phases To A Successful Bim Implementation Strategy Infographic Building The Digital Strategy Infographic Building Information Modeling Bim

What Is Carbon Tax How To Get A Carbon Tax Rebate

What Is Carbon Tax How To Get A Carbon Tax Rebate

What S Holding You Back From Getting A Geothermal System Greenon Rebates Up To 20 000 Cover A Huge Portion Of The Costs Geothermal Commercial Hvac Cool Roof

What S Holding You Back From Getting A Geothermal System Greenon Rebates Up To 20 000 Cover A Huge Portion Of The Costs Geothermal Commercial Hvac Cool Roof

In Order To Avoid Your Pipes Freezing Make Sure You Have Proper Installation In Your Home Contact Econcompany Today F Frozen Pipes Connected Home Save Energy

In Order To Avoid Your Pipes Freezing Make Sure You Have Proper Installation In Your Home Contact Econcompany Today F Frozen Pipes Connected Home Save Energy

Fuel Economy Standards Won T Be Met Without 16 Electric Car Market Share By 2020 World Energy Council Fuel Economy Energy Electricity

Fuel Economy Standards Won T Be Met Without 16 Electric Car Market Share By 2020 World Energy Council Fuel Economy Energy Electricity

Oregon Ends Up Refunding More Tax Revenue Than It Gains For Its Pay Per Mile Program Local News Stories Argusobserver Com Revenue Gain Refund

Oregon Ends Up Refunding More Tax Revenue Than It Gains For Its Pay Per Mile Program Local News Stories Argusobserver Com Revenue Gain Refund

Dear Cas With Flurry Of Letters Russia May Delay Olympic Ban Russia Olympics Sport Event European Games

Dear Cas With Flurry Of Letters Russia May Delay Olympic Ban Russia Olympics Sport Event European Games

Can We Fix Toronto S Transit By 2030 With An Expected Population Of 8 Million Experts Say It S Already Too Late In 2020 Rapid Transit 10 Year Plan Downtown Toronto

Can We Fix Toronto S Transit By 2030 With An Expected Population Of 8 Million Experts Say It S Already Too Late In 2020 Rapid Transit 10 Year Plan Downtown Toronto

Canada S Carbon Pricing Is Continuing On The Right Track

Canada S Carbon Pricing Is Continuing On The Right Track

A Bookkeeper And An Accountant Have Two Different Roles In Your Business Operations Learn How They Intera In 2020 Small Business Success Success Business Accounting

A Bookkeeper And An Accountant Have Two Different Roles In Your Business Operations Learn How They Intera In 2020 Small Business Success Success Business Accounting

Don T Miss The Carbon Tax Credit On Your 2018 Taxes Cbc News Income Tax Return Tax Deadline Income Tax

Don T Miss The Carbon Tax Credit On Your 2018 Taxes Cbc News Income Tax Return Tax Deadline Income Tax

Wire Mesh Cable Trays Digital Science Future Energy Online Marketing Strategy Social Media

Wire Mesh Cable Trays Digital Science Future Energy Online Marketing Strategy Social Media

Canadian Carbon Tax To Climb 33 In April Following Favorable Court Ruling Natural Gas Intelligence

Canadian Carbon Tax To Climb 33 In April Following Favorable Court Ruling Natural Gas Intelligence

Carbon Taxes Rebates Explained Province By Province

Carbon Taxes Rebates Explained Province By Province

![]() How The New Carbon Tax Will Affect Canadians Heating Cooling Costs

How The New Carbon Tax Will Affect Canadians Heating Cooling Costs

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home