Property Records Mecklenburg County Nc

As an example try typing 700 n. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

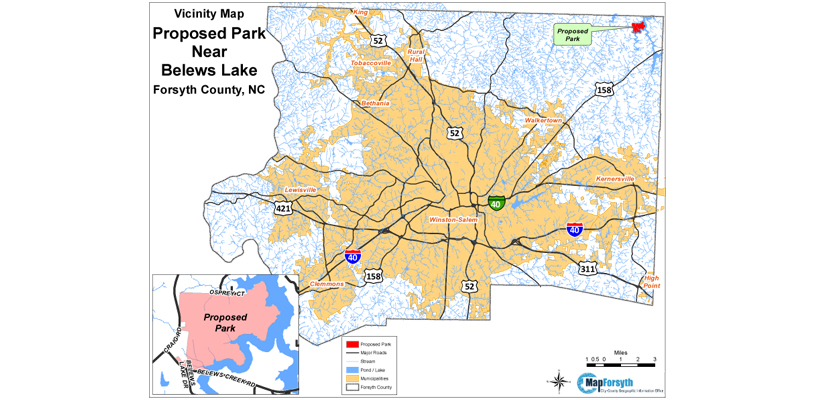

Forsyth County Http Www Co Forsyth Nc Us Rod Online Lookup Aspx To Look At Deeds Prior To 1965 Click Begin Your Online Real Estate Business Forsyth County

Forsyth County Http Www Co Forsyth Nc Us Rod Online Lookup Aspx To Look At Deeds Prior To 1965 Click Begin Your Online Real Estate Business Forsyth County

This office also issues marriage licenses and handles Notary commissions and military discharge recordings.

Property records mecklenburg county nc. To discover list and appraise all real and personal property in Mecklenburg County in accordance with North Carolina General Statutes. Fourth St Charlotte NC 28231 Number. Search by owner property address or p arcel ID.

These records can include Mecklenburg County property tax assessments and assessment challenges appraisals and income taxes. One of the better recorded document services available. The AcreValue Mecklenburg County NC plat map sourced from the Mecklenburg County NC tax assessor indicates the property boundaries for each parcel of land with information.

Enter your email address and password to login. 980 314-4226 available from 800 am. Land Records are maintained by various government offices at the local Mecklenburg County North Carolina State and Federal level and.

Even perform Market Analysis. Land Records Polaris 3G The Countys Premiere Real Estate Mapping Tool featuring property info assessed values sales and a lot more. For questions regarding the Streamside Subdivision assessment Matthews jurisdiction only please call.

Map of Mecklenburg County Assessors Office. Go to Data Online. Mecklenburg County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Mecklenburg County North Carolina.

Mecklenburg Register of Deeds 980 314 - 4900. GeoPortal is your online gateway to a. North Carolina Mecklenburg County 800 E.

The Assessors Office provides accurate and timely information to internal and external customers while fostering good relations with those customers and the community. If you still cant find the property youre looking for OR if you notice the listed information is incorrect please contact the County Assessors Office. Open Property Tax Bill Search in new window If you have questions on your tax bill please call 311 or dial 704-336-7600 if outside Mecklenburg County limits.

The Register of Deeds is elected by the people and serves a four-year term. Mecklenburg County Land Records are real estate documents that contain information related to property in Mecklenburg County North Carolina. Mecklenburg Assessor 980 314 - 4226.

Developed for Mecklenburg County Property Record Card Property Search by. Monday Friday except holidays Email. They are maintained by various government offices in Mecklenburg County North Carolina.

This office records indexes and stores all real estate and business related documents that are presented for registration. Polaris 3G Mecklenburg County Property Ownership and Land Records System. Street Num Tax Year.

Mecklenburg Tax Collector 704 336 - 7600. Mecklenburg Mapping GIS. Historic Aerials 480 967 - 6752.

Mecklenburg County Government serving the communities of Charlotte Cornelius Davidson Huntersville Matthews Mint Hill and Pineville. Mecklenburg County Property Record Card Property Search. These records can include land deeds mortgages land grants and other important property-related documents.

Go to Data Online. Provided by the Mecklenburg County Register of Deeds you may search birth and death records notaries marriages UCCs and most importantly mortgages deeds liens judgments amendments and other. Go to Data Online.

Find Mecklenburg County residential property tax assessment records tax assessment history land improvement values district details property maps tax rates exemptions market valuations ownership past sales deeds more. Use the Search box to find your location. Mecklenburg County Property Records are real estate documents that contain information related to real property in Mecklenburg County North Carolina.

Please select criteria. Mecklenburg County NC PublicRecords Public Records Print. Just type the first part of what youre looking for and let the search control do the work for you.

Remember Me Sign In Forgot. Go to Data Online. Plat map and land ownership.

AcreValue helps you locate parcels property lines and ownership information for land online eliminating the need for plat books.

Read more »Labels: mecklenburg, property, records