Wake County Property Tax History

A tax lien attaches to real estate on January 1 and remains in place until all taxes. Property Taxes Mortgage 521277100.

Mom And Dad S Weekly Planner Weekly Family Planner Planner Weekly Planner

Mom And Dad S Weekly Planner Weekly Family Planner Planner Weekly Planner

Wake County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Wake County North Carolina.

Wake county property tax history. Search Wake County property tax records by owner name address or parcel id. Wake County Property Records are real estate documents that contain information related to real property in Wake County North Carolina. Wake Revenue Department Assessor 919 856 - 5400.

The full Wake County real estate file is available in the following formats. Tax Assessor and Delinquent Taxes Wake County Revenue Department One Bank of America Plaza 421 Fayetteville St Suite 200 Raleigh NC 27601 Phone 919856-5400. Active duty non-resident military personnel may be exempt from North Carolina motor vehicle property tax.

The Tax Assessors Office is responsible for listing appraising and assessing all property subject to ad valorem taxation. Tax information for specific property is available online. Wake County makes no warranties express or implied concerning the accuracy completeness reliability or suitability of.

Wake County makes no warranties express or implied concerning the accuracy completeness reliability or suitability of. Wake County collects on average 081 of a propertys assessed fair market value as property tax. This property is described in Wake County records as Parcel ID 0443803 Total value of all three parcels is 2095000 Totaling approx 108 acres.

The data files are refreshed daily and reflect property values as of the most recent countywide reappraisal. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. The statement should be for the month and year in which you register the vehicle and must include your Estimated Time of Separation ETS date and a home of record other.

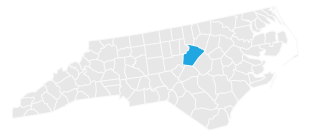

Real estate in Wake County is permanently listed and does not require an annual listing. Wake County is located in central North Carolina and is the ninth fastest growing county in the United States. In-depth Wake County NC Property Tax Information.

These records can include Wake County property tax assessments and assessment challenges appraisals and. To qualify for an exemption you must present a copy of your Leave Earnings Statement LES to the county tax office. Statements for Real Estate Business and Personal Property Taxes Statements for these property types can be obtained by using our Online Tax Bill Search or by emailing your request to email protectedRequests should include the tax account number if available the name on the bill and a description of the property.

5 rows Name Phone Online Report. Property Taxes No Mortgage 149860000. Wake County North Carolina Property Taxes - 2021 3 days ago The median property tax in Wake County North Carolina is 1793 per year for a home worth the median value of 222300.

This data is subject to change daily. This data is subject to change daily. The property records and tax bill data provided herein represent information as it currently exists in the Wake County collection system.

There are approximately 25000 parcels of land 700 businesses and 40000 motor vehicles in Hoke County. Ownership sale information and property detail for all Wake County real estate parcels is available for download. Houses 9 days ago The property records and tax bill data provided herein represent information as it currently exists in the Wake County collection system.

Wake County Property Tax Information. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Go to Data Online.

Wake County is also home to the city of Raleigh which is also the capital of the state. Wake County Property Tax Collections Total Wake County North Carolina. With a lower than average unemployment rate and a rapidly growing population Wake County is a great place to live and visit.

Read more »