How Do You Find The Gross Rent Multiplier

You can use the sale price list price or the appraisal value of a property. To calculate GRM multiply the monthly income by 12.

How To Calculate Grm Formula Excel Example Zilculator Real Estate Analysis Marketing

How To Calculate Grm Formula Excel Example Zilculator Real Estate Analysis Marketing

12 New quality property 1 -10 years of age routine maintenance.

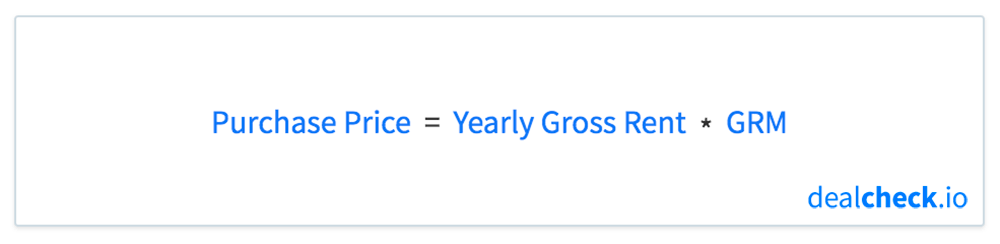

How do you find the gross rent multiplier. Here is the Gross Rent Multiplier Formula. How to calculate the Gross Rent Multiplier To calculate the Gross Rent Multiplier divide the selling price or value of a property by the subjects propertys gross rents. GRM PROPERTY PRICE GROSS ANNUAL RENTAL INCOME So if the property price is 600000 and the gross annual rental income is 50000 then the GRM is 60000050000 12.

Use GRM to Estimate Property Value. 300000 Property Value 36000 Annual Rental Income 833 GRM. GRM PriceGross Annual Rent As you can see from the formula above the Gross Rent Multiplier is calculated by dividing the fair market value of a property or the propertys asking price if on the market for.

Gross Rent Multiplier Formula. The gross rent multiplier in this case is simply 1000000100000 which results in a GRM of 10x. The property rents for 3000month for a gross annual rent of 36000.

The Formula for the Gross Rent Multiplier This is the formula to calculate the gross rent multiplier. The formula to calculate GRM is. Gross rental income signifies gross scheduled income on our form For best results use annual amounts for all entries.

For example a property with a 200000 sale price and a. GRM Sale PriceGross Annual Rental Income As you can see calculating gross rent multiplier requires only two simple numbers and no speculations or predictions which makes it one of the easiest aspects of rental property analysis. How is GRM calculated.

What is the Gross Rent Multiplier Formula. GRM Price of PropertyGross Annual Rental Income. Gross Rent Multiplier Property Price Gross Rental Income.

You can even choose between monthly or annual income. A gross income multiplier is a rough measure of the value of an investment property. You take the market value of a property and divide it by the propertys gross rental income.

How Do You Calculate Gross Rent Multiplier. The gross rent multiplier formula can be used for more than simply calculating the GRM factor. You can use GRM to come up with the fair market value for similar properties in a market or use it to calculate gross rent.

You want to know its gross rent multiplier so you can compare it to the average GRM for comparable properties recently sold in your local market area. How To Calculate Gross Rent Multiplier. 10 to 12 10 and 20 years modernizing maintenance.

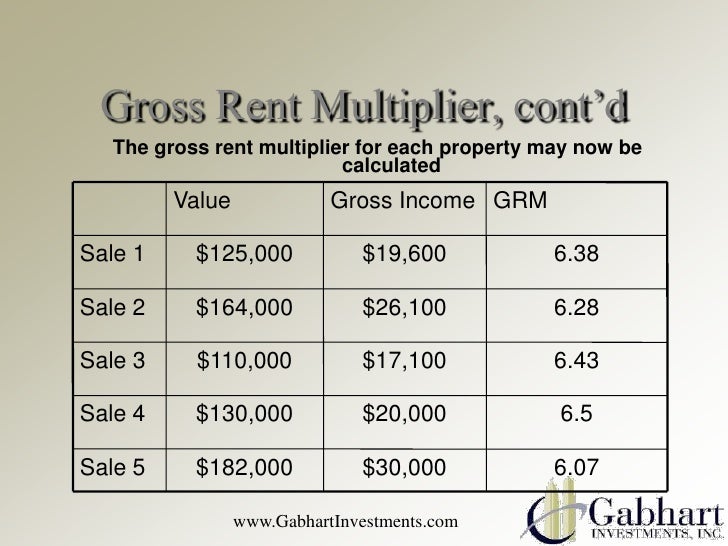

The gross rent multiplier calculation is. Consider a commercial office building with a year 1 gross potential income of 100000 and a price of 1000000. 2000000320000 625.

Market Value Annual Gross Income Gross Rent Multiplier If a property sold for 750000 with 110000 annual income the GRM is 682. Lets take a quick example to illustrate how the gross rent multiplier works. Only 3 numbers are involved.

8 to 10 25 years or older possible overdue maintenance. You can get the GRM for recently sold real estate with this equation. Property price gross rental income and the GRM itself.

The basic gross rent multiplier formula is very simple. A rental property is selling for 500000 and you calculate that it will generate a monthly income of 5500. Gross Rent Multiplier Property CostGross Annual Rent You can manipulate the equation a bit too.

To get an indication of the GRM for a specific property type and location its a good idea to contact a local commercial appraiser a local commercial real estate agent or calculate a GRM on your own using recent comparable sales - more. GIM is calculated by dividing the propertys sale price by its gross annual rental income. Property Price Gross rental income x GRM.

So for example if a property is selling for 2000000 and it produces a Gross Rental Income of 320000 the GRM would be. How you do this is up to you. Gross Rent Multiplier Property Price Gross Rental Income.

Now weve got our two metrics for the GRM formula. If you want to calculate the fair market value of a property plug in the gross rental income and the GRM into the equation. For example if you have the fair market rent for an area and the average GRM you can determine the property price.

Heres the grading pattern for GRM. From 2 of those. Say Sam has his eyes on a property that costs 300000.

What Does Gross Rent Multiplier Mean In Practice. This gives us a gross annual rent of 66000. Gross rent multiplier is a mathematical formula used to calculate an investment propertys potential rent income based on the ratio of the propertys fair value market or purchase price to the expected gross annual rent income.

Calculating the gross rent multiplier is simple. 14 High rent properties under ten. Divide the market value by the annual gross income expected from the property.

How to Calculate Gross Rent Multiplier.

Read more »Labels: find, multiplier, property