How To Calculate Gross Rental Multiplier

Only the net operating income NOI can. GRM Property PriceGross Annual Rent For example if the price of a rental property is 200000 and the monthly rent is 1500 the GRM will be 20000018000 111 This means that the payback period will be 111 years.

Follow This Real Estate Investing Strategy To Buy Rental Properties And Bui Rental Property Investment Real Estate Investing Rental Property Investing Strategy

Follow This Real Estate Investing Strategy To Buy Rental Properties And Bui Rental Property Investment Real Estate Investing Rental Property Investing Strategy

Calculating the gross rent multiplier is simple.

How to calculate gross rental multiplier. Gross Rent Multiplier Property Price Gross Annual Rent 5 million552000 906 So we have found that the Gross Rent Multiplier for this property is 906. If you already have this figure on-hand this is kind of self-explanatory. GRM P AR Where GRM is the gross rent multiplier P is the purchase price of the property.

In other words to calculate the gross rent multiplier of any property you have to have a value assigned to the property and know the amount of rent you can expect to collect each year from it. Gross Rent Multiplier Property CostGross Annual Rent. Heres the gross rent multiplier formula.

As the GRM uses the gross rents as the denominator in the equation it cannot be used to calculate any kind of payoff period for the property. Use GRM to Estimate Property Value Lets say that you did an analysis of recent comparable sold properties and found that their GRMs averaged around 675 like the example above. Examples of Gross.

Gross Rent Multiplier Property Price Gross Annual Rental Income. You can even choose between monthly or annual income. To calculate the gross rent multiplier for a particular property simply take the price of the property and divide it by the expected gross rent.

A gross income multiplier is a rough measure of the value of an investment property. Lets say youre looking at a property listed for 400000 and the gross annual rent monthly rent times 12 would be 35000. But if you are trying to.

How you do this is up to you. You can manipulate the equation a bit too. You can get the GRM for an investment property using the following equation.

How to Calculate Gross Rent Multiplier Property Price. You can use the sale price list price or the appraisal value of a property. Shows the ratio between a propertys value to its gross scheduled income.

Market Value Annual Gross Income Gross Rent Multiplier If a property sold for 750000 with 110000 annual income the GRM is 682. 12 New quality property 1 -10 years of age routine maintenance. GRM Sale PriceGross Annual Rental Income As you can see calculating gross rent multiplier requires only two simple numbers and no speculations or predictions which makes it one of the easiest aspects of rental property analysis.

Heres the grading pattern for GRM. Gross Rent Multiplier Calculator Free Online Calculation. 10 to 12 10 and 20 years modernizing maintenance.

To calculate the Gross Rent Multiplier divide the selling price or value of a property by the subjects propertys gross rents. How Do You Calculate Gross Rent Multiplier. You take the market value of a property and divide it by the propertys gross rental income.

Gross Rent Multiplier Property Price Gross Rental Income So for example if a property is selling for 2000000 and it produces a Gross Rental Income of 320000 the GRM would be. Gross rental income looks only at the potential. Gross property income can be examined two ways.

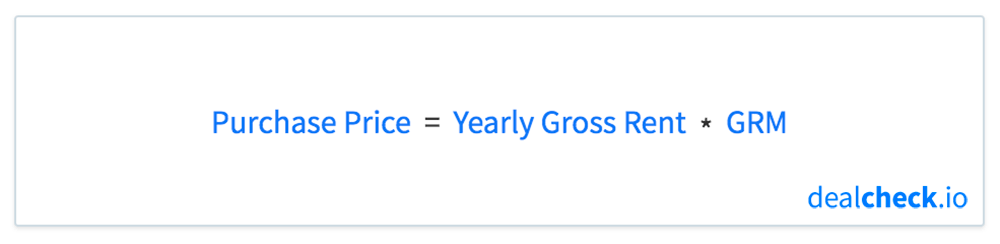

In the formula the property price is the selling price of the property in question and the gross annual rental income is how much money you would make in a year from rent on the property. The following formula is used to calculate a gross rent multiplier. Property Price Gross rental income x GRM.

8 to 10 25 years or older possible overdue maintenance. 14 High rent properties under ten years of age efficiency maintenance. For example if a property is selling for 200000.

Gross scheduled income reflects all income derived from rents as if all units were 100 occupied with vacant units if any typically included at the market rent. For example if you have the fair market rent for an area and the average GRM you can determine the property price. Gross Rent Multiplier Formula.

GIM is calculated by dividing the propertys sale price by its gross annual rental income.

Read more »Labels: calculate, gross, multiplier, rental