How To Determine The Gross Rent Multiplier

Because the gross rent is used GRM doesnt factor in normal operating expenses or debt service. You presume that if buyers.

Formula Gross Rent Multiplier Grm Propertylogy

Formula Gross Rent Multiplier Grm Propertylogy

Heres the grading pattern for GRM.

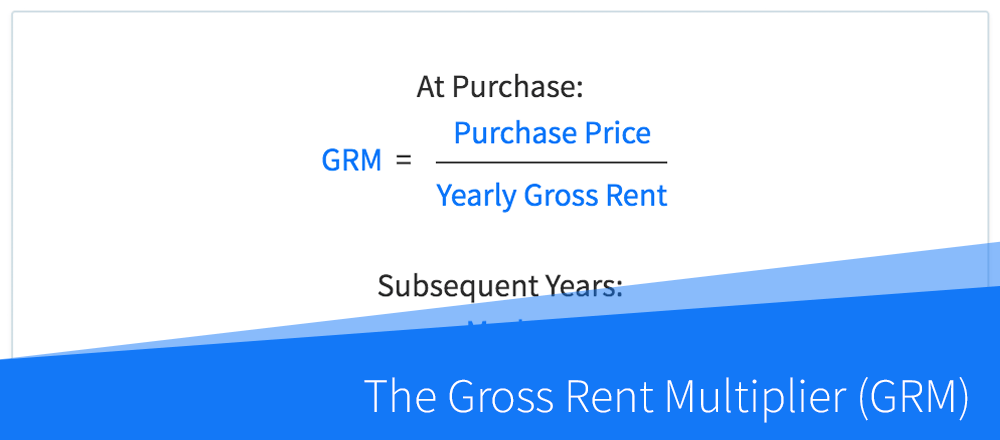

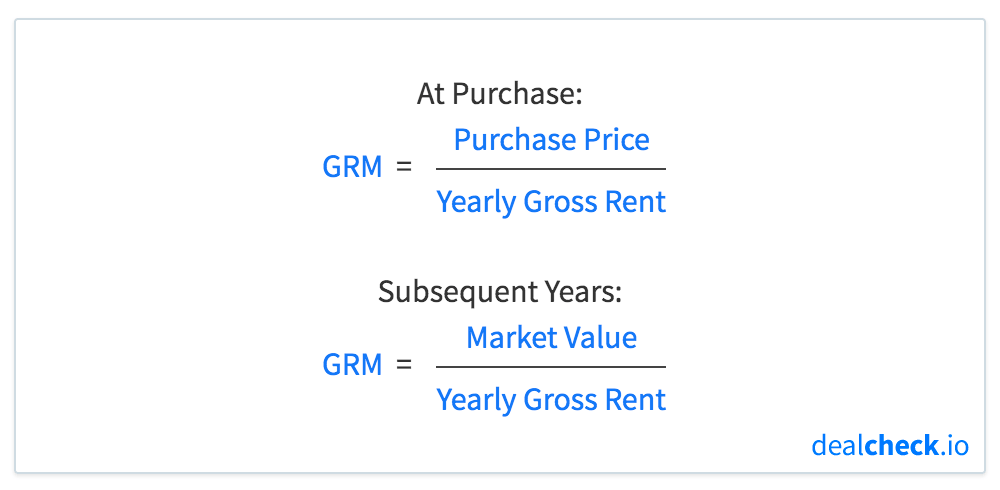

How to determine the gross rent multiplier. Investors would typically use the purchase price in the above formula when evaluating new investment properties and the market value when calculating the GRM of properties they already own. How To Calculate Gross Rent Multiplier How is GRM calculated. You want to know its gross rent multiplier so you can compare it to the average GRM for comparable properties recently sold in your local market area.

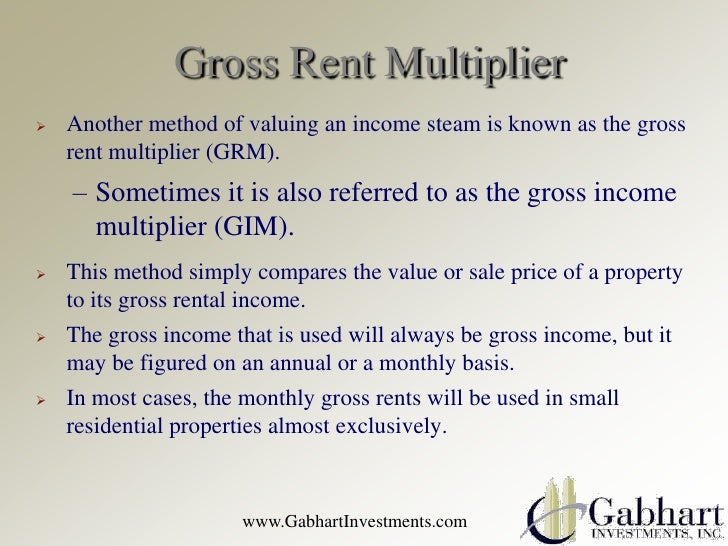

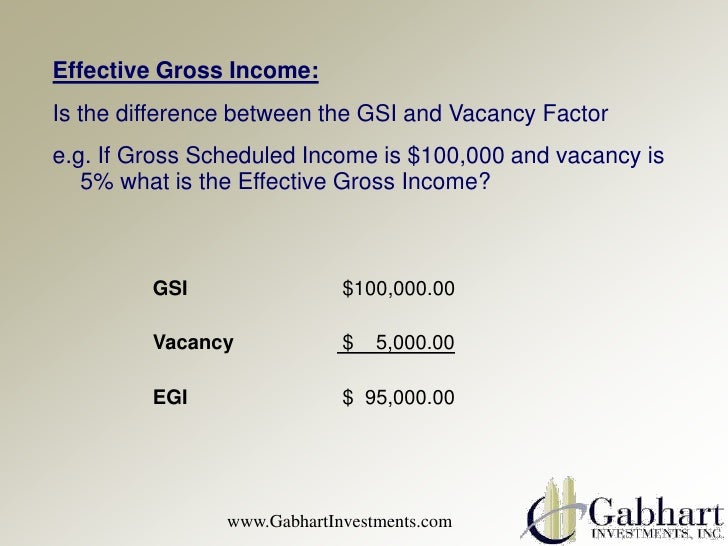

A gross income multiplier is a rough measure of the value of an investment property. Gross property income can be examined two ways. Divide the market value by the annual gross income expected from the property.

In this case your GRM is 625 500000. Gross rental income signifies gross scheduled income on our form For best results use annual amounts for all entries. For example a property with a 200000 sale price and a 9600 annual income would have a GRM of 2083.

Gross rental income looks only at. How to Calculate Gross Rent Multiplier Property Price. You can manipulate the equation a bit too.

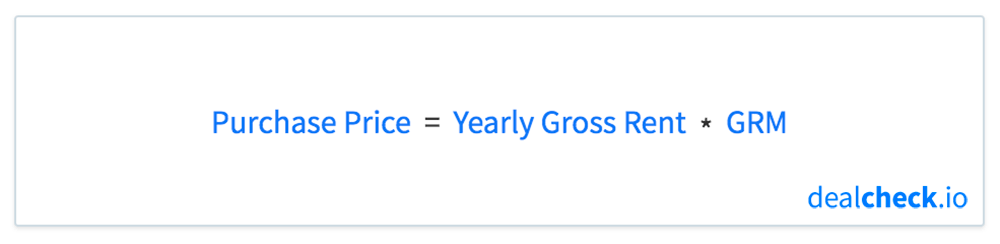

Property Price Gross rental income x GRM. Here is the Gross Rent Multiplier Formula. 8 to 10 25 years or older possible overdue maintenance.

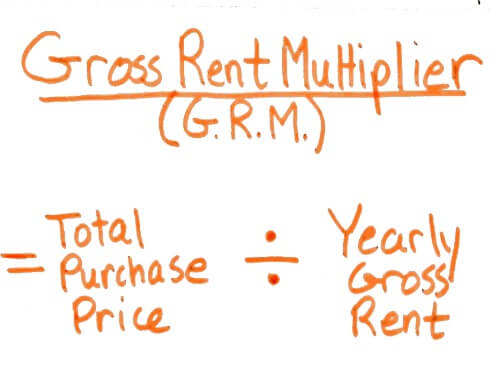

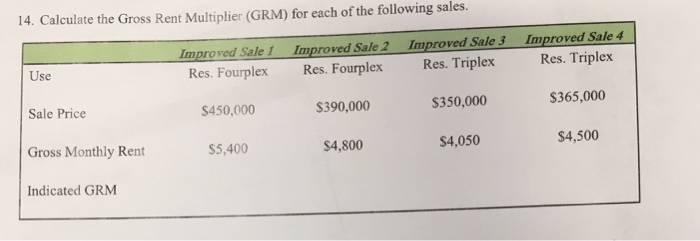

But if you are trying to. GIM is calculated by dividing the propertys sale price by its gross annual rental income. To calculate the gross rent multiplier for a particular property simply take the price of the property and divide it by the expected gross rent.

14 High rent properties under ten years of age efficiency maintenance. Lets say you found a rental property with a list price of 500000 and based on your estimate the gross annual income is 80000. The gross rent multiplier GRM is a simple method by which you can estimate the market value of an income property.

The gross rent multiplier is calculated by dividing the propertys purchase price or its market value by its potential or actual yearly gross rent. Gross Rent Multiplier Property Price Gross Annual Rental Income. For example if a property is selling for 200000.

The GRM is a market-driven measurement. 12 New quality property 1 -10 years of age routine maintenance. Lets say youre looking at a property listed for 400000 and the gross annual rent monthly rent times 12 would be 35000.

In the formula the property price is the selling price of the property in question and the gross annual rental income is how much money you would make in a year from rent on the property. If you already have this figure on-hand this is kind of self-explanatory. GRM is a simplified way to analyze the value of rental property using the income approach.

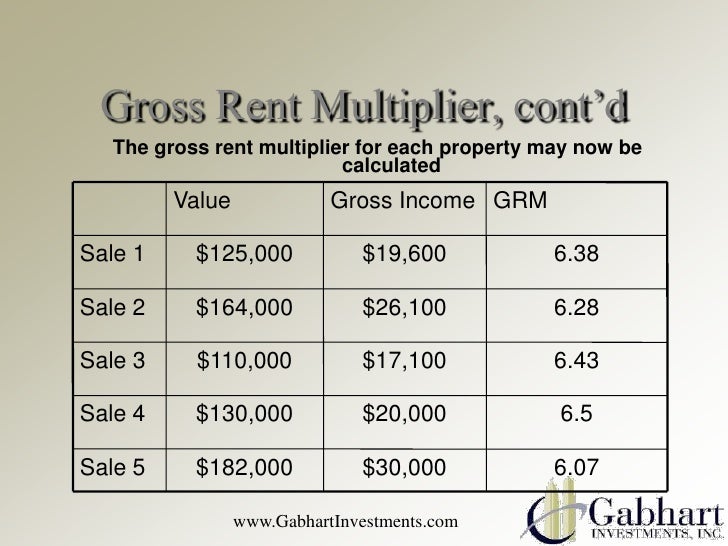

Gross Rent Multiplier Property Price Gross Rental Income So for example if a property is selling for 2000000 and it produces a Gross Rental Income of 320000 the GRM would be. Market Value Annual Gross Income Gross Rent Multiplier If a property sold for 750000 with 110000 annual income the GRM is 682. Heres the gross rent multiplier formula.

To calculate the Gross Rent Multiplier divide the selling price or value of a property by the subjects propertys gross rents. Gross Rent Multiplier Rental Property Value Gross Property Income It can be helpful to practice with an example. GRM Property PriceGross Annual Rent For example if the price of a rental property is 200000 and the monthly rent is 1500 the GRM will be 20000018000 111 This means that the payback period will be 111 years.

GRM PriceGross Annual Rent As you can see from the formula above the Gross Rent Multiplier is calculated by dividing the fair market value of a property or the propertys asking price if on the market for. The basic gross rent multiplier formula is very simple. Use GRM to Estimate Property Value Lets say that you did an analysis of recent comparable sold properties and found that their GRMs averaged around 675 like the example above.

Gross Rent Multiplier Property CostGross Annual Rent. The gross rent multiplier GRM compares the gross annual rental income to the fair market value of a property. 10 to 12 10 and 20 years modernizing maintenance.

For example if you have the fair market rent for an area and the average GRM you can determine the property price.

Gross Income Multiplier How To Calculate Gross Income Multiplier

Gross Income Multiplier How To Calculate Gross Income Multiplier

How To Calculate The Gross Rent Multiplier Grm In Real Estate Dealcheck Blog

How To Calculate The Gross Rent Multiplier Grm In Real Estate Dealcheck Blog

Understanding The Gross Rent Multiplier In Commercial Real Estate

Understanding The Gross Rent Multiplier In Commercial Real Estate

How To Calculate The Gross Rent Multiplier Grm In Real Estate Dealcheck Blog

How To Calculate The Gross Rent Multiplier Grm In Real Estate Dealcheck Blog

Effective Gross Income Multiples Signvalue

Effective Gross Income Multiples Signvalue

Gross Rent Multiplier Grm How To Calculate Formula Dubai Khalifa

Gross Rent Multiplier Grm How To Calculate Formula Dubai Khalifa

Understanding The Gross Rent Multiplier In Commercial Real Estate

Understanding The Gross Rent Multiplier In Commercial Real Estate

How To Run The Numbers For Rental Properties Back Of The Envelope Analysis

How To Run The Numbers For Rental Properties Back Of The Envelope Analysis

Gross Rent Multiplier Vs Cap Rate Rating Walls

Gross Rent Multiplier Vs Cap Rate Rating Walls

How To Value Commercial Real Estate 101

How To Value Commercial Real Estate 101

How To Value Commercial Real Estate 101

How To Value Commercial Real Estate 101

How To Value Commercial Real Estate 101

How To Value Commercial Real Estate 101

How To Compute Gross Rent Multiplier Video Dailymotion

How To Calculate The Gross Rent Multiplier Grm In Real Estate Dealcheck Blog

How To Calculate The Gross Rent Multiplier Grm In Real Estate Dealcheck Blog

Understanding The Gross Rent Multiplier In Commercial Real Estate

Understanding The Gross Rent Multiplier In Commercial Real Estate

Gross Rent Multiplier Explained Http Realbench Net Youtube

Gross Rent Multiplier Explained Http Realbench Net Youtube

How Do I Use The Gross Rent Multiplier In Commercial Real Estate Argus Software Solutions For Commercial Real Estate

How Do I Use The Gross Rent Multiplier In Commercial Real Estate Argus Software Solutions For Commercial Real Estate

The One Percent Rule Getting Down With Real Estate Investing Math

The One Percent Rule Getting Down With Real Estate Investing Math

Labels: determine, multiplier

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home