How To Determine Historical Property Value

The Department of Finance values and assesses your property every year to calculate your property tax bill. When someone dies it is necessary to value all of the decedents assets including real property such as real estate.

Inspection Vs Appraisals Home Appraisal Appraisal Real Estate Buyers

Inspection Vs Appraisals Home Appraisal Appraisal Real Estate Buyers

We use MLS data on recently sold homes in your area to calculate your propertys current market value.

How to determine historical property value. This will allow you to do a property history search for free. This will then show you a list of the different online public records that are maintained by the county. To be considered eligible a property must meet the National Register Criteria for Evaluation.

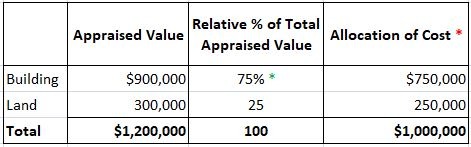

DOF determines your propertys market value. Turbotax is asking me to Fill in the fair market value of your rental property on the date it was ready and available to rent I take it this is referring to the market sale value of the property for calculating depreciation not the monthly market rent. The entries to record the cost of acquiring this building and the annual depreciation expense over the five-year life are as follows.

I needed historical median home prices on the United. First click on the state where youre searching on the interactive map display. The history of the property including any sales within the five 5 years preceding the valuation date or any sales since the valuation date to the present.

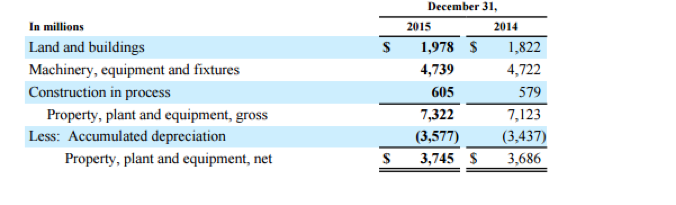

In other cases records before a certain date may be manually or electronically stored at another location. Other situations may require a historical appraisal. Historical cost is a measure of value used in accounting in which an asset on the balance sheet is recorded at its original cost when acquired by the company.

PennyMacs Home Value Estimator can take the address of a property and weigh multiple factors in order to give you a reliable estimate. How we do this varies by tax class. The FAIR MARKET VALUE should have appeared in the estate tax return.

As part of the valuation of assets at death by an estate tax appraiser a date of death valuation determines the Fair Market Value of real estate as of the date that the owner died. Based on the most up-to-date data available. In some towns for example records of assessment for properties may extend throughout the history of the property.

Each having equal shares. Vacant land may be difficult to value because so much is based on speculative future uses. The process is complex but essentially it works like this.

An appraiser can use historical sales records to determine a retroactive value. Then select which county the house is in. To determine the market value of property as of the date that a taxing district assessed the value for.

Consult a real estate agent or a licensed appraiser. This property valuation is used to determine if a federal estate tax return is due to the IRS and the amount of estate. To determine a decline in value of a property that you sold at a loss like an investment property in order to claim a loss for tax purposes.

Both periods of sales should include the sales dates prices mortgage amounts and the names of the sellers buyers and mortgage lenders. In addition to the overall value you also get estimated price per square foot property details sales history and value history. 817 rows Historical Median Home Value.

Whoever values it would look at comparable suburbs where older houses are being renovated to a similar standard. Since you both appeared on the deed as tenents you shared the tenancy and there for you shared the cost bases form 1998. The straight-line method is used here to determine.

Visit or contact online the jurisdiction site of your property. Thus the assets present book value as well as its original historical cost are both still in evidence. How can I determine the historical fair market value in a way that is acceptable to the IRS.

Farmland is often quite easy there will be reliable values for cost per acre of productive farmland. Redfin has complete and direct access to multiple listing services MLSs the databases that real estate agents use to list properties. They would look at a few sales that are in original condition and then look at sales of similar houses that have had an extension done and the.

This involves examining the propertys age significance and integrity. When you inherited the home in 1998 the fair market value became the cost basis of the home based on the time or day of death. Is the property old enough to be considered historic generally at least 50 years old and does it still look much the way it did in the past.

Read more »Labels: historical, property, value