Property Plant And Equipment Historical Cost

For property and equipment how is historical cost defined. The historical or acquisition costs are used in recording fixed assets.

Property Plant And Equipment Ppe Covering Financials Reynolds Center

Property Plant And Equipment Ppe Covering Financials Reynolds Center

Property plant and equipment under US.

Property plant and equipment historical cost. Property plant and equipment items are always acquired at their original historical cost. Determination of costs is critical to proper accounting for property plant and equipment. On the balance sheet these assets appear under the heading Property plant and equipment.

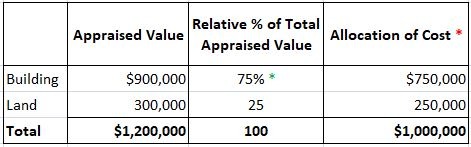

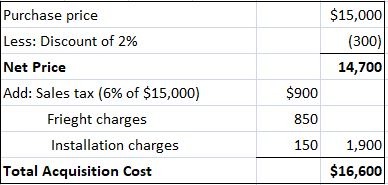

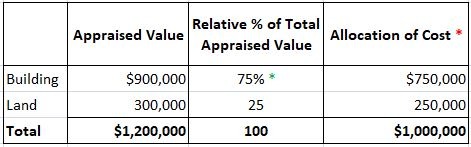

At the date of acquisition cost reflects fair market value. In the previous chapter the cost of a companys inventory was identified as the sum of all normal and necessary amounts paid to get the merchandise into condition and position to be sold. When a plant asset is purchased for cash its acquisition cost is simply the agreed on cash price.

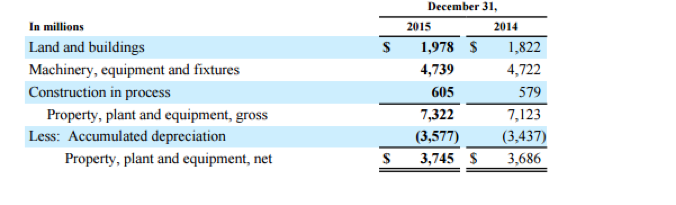

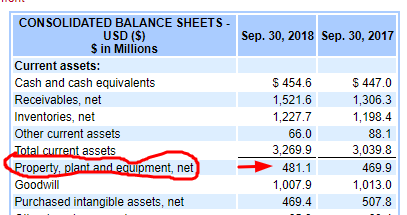

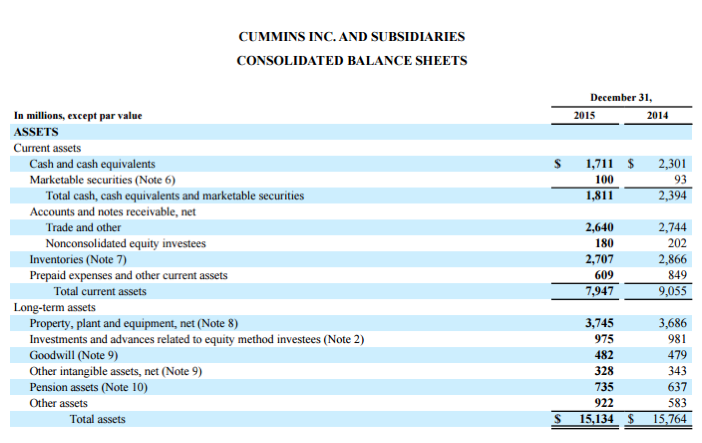

We can see that Exxon recorded 249153 billion in net property plant and equipment for the period ending September 30 2018. Consequently the amounts reported for these balance sheet items often differ from their current economic or market values. Historical cost measures the cash or cash equivalent price of obtaining.

According to the FASB the historical cost of acquiring an asset includes the costs necessarily incurred to bring it to the condition and location necessary for its intended use In terms of property plant and equipment this means that all the reasonable and necessary costs required to get the asset to its location and ready for use are included in the acquisition cost. Property plant and equipment are some of the most significant items in the statement of financial position and usually represent a substantial investment by the entity. While use of historical cost.

Property plant and equipment is initially measured at its cost subsequently measured either using a cost or revaluation model and depreciated so that its depreciable amount is allocated on a systematic basis over its useful life. Historical cost is globally accepted as a measure to record the property plant and equipment. ACQUISITION OF PROPERTY PLANT AND EQUIPMENT Most companies use historical cost as the basis for valuing property plant and equipment.

Generally the cost at the time of purchase is documented with contracts invoices payments transfer taxes and so on. Property plant and equipment is initially measured at its cost subsequently measured either using a cost or revaluation model and depreciated so that its depreciable amount is allocated on a systematic basis over its useful life. Initial recording of plant assets.

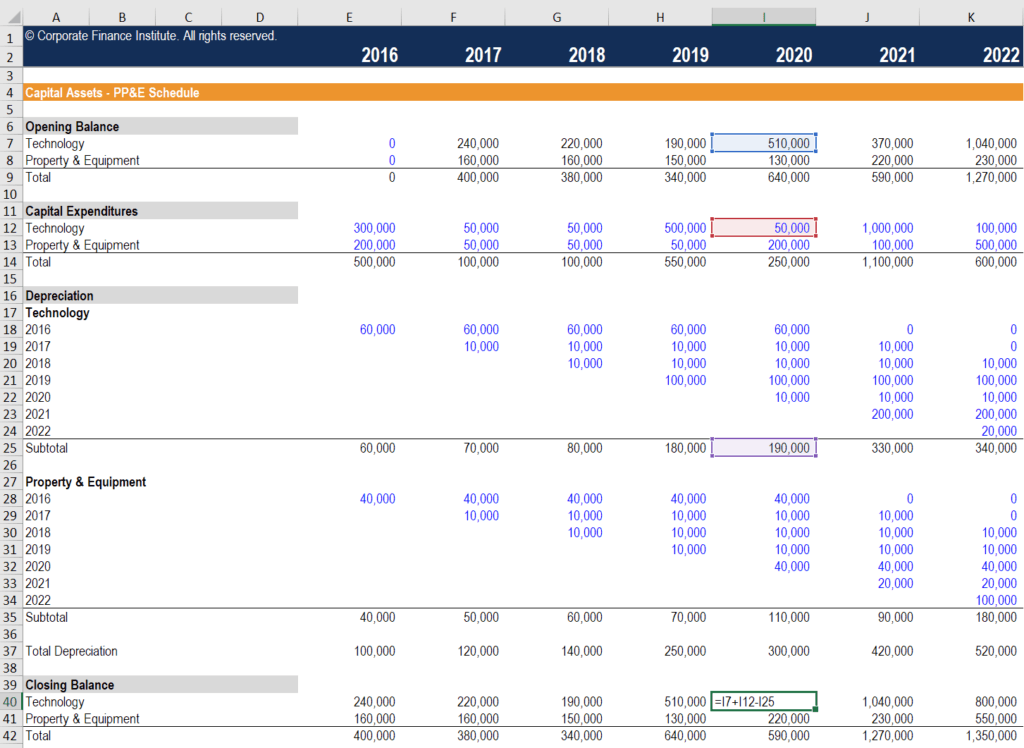

Study on the go. It will always show assets on a historical basis which will be considered for calculating depreciation and for other statutory matters. The historical cost of plant and equipment not land is also used to determine the amount of depreciation expense reported on the income statement.

IAS 16 outlines the accounting treatment for most types of property plant and equipment. In accounting an economic items historical cost is the original nominal monetary value of that item. Ever property plant and equipment do not physically become part of a prod-uct held for resale.

IAS 16 was reissued in December 2003 and applies to annual periods. Fair value means the actual value of the asset in the market as on the day. When a company acquires a plant asset accountants record the asset at the cost of acquisition historical cost.

We find that companies are more likely to choose the historical cost model than the revalua-tion model the model based on fair value for owner-occupied properties and plant and equipment and the fair value model rather than the historical cost model for investment properties. Historical cost accounting involves reporting assets and liabilities at their historical costs which are not updated for changes in the items values. The main advantage of using historical cost on the balance sheet for property plant and equipment is that historical cost can be verified.

Mark-to-market is dependent on a. There is evidence that estimation techniques used to establish historical cost for G-PPE acquired prior to the. Entities use historical cost to value property plant and equipment.

Historical cost is the standard when recording property plant and equipment PPE on financial statements. Net plant property and equipment represent the original costs of these items less accumulated depreciation and amortization. Terms in this set 18 Historical cost is the basis advocated for recording the acquisition of property plant and equipment for all of the following reasons except.

Historical cost is the basis advocated for recording the acquisition of property plant and equipment for all of the following reasons except a. IAS 16 was reissued in December 2003 and applies to annual periods. IAS 16 outlines the accounting treatment for most types of property plant and equipment.

What is Fair Value. The primary objective for this project is to amendment the standards to provide a cost effective mechanism for attaining initial compliance with SFFAS 6 as amended. GAAP still under historical cost and both GAAP and International Financial Reporting Standards IFRS require property and equipment to be initially recorded at cost but IFRS allows the option IAS 16 to chooose between historical cost or revaluation to fair value.

Subsequent measurement of property and plant and equipment in Serbia. Property plant and equipment items are always acquired at their original. Share this link with a friend.

Estimating the Historical Cost of General Property Plant and Equipment Project Objective.

/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg) Property Plant And Equipment Pp E Definition

Property Plant And Equipment Pp E Definition

Pp E Property Plant Equipment Overview Formula Examples

Pp E Property Plant Equipment Overview Formula Examples

Chapter 23 Statement Of Cash Flows Mc Computational Flashcards Quizlet

Chapter 23 Statement Of Cash Flows Mc Computational Flashcards Quizlet

How To Measure The Acquisition Cost Of Property Plant And Equipment Play Accounting

How To Measure The Acquisition Cost Of Property Plant And Equipment Play Accounting

Distinguish Between Tangible And Intangible Assets

Distinguish Between Tangible And Intangible Assets

Pp E Property Plant Equipment Overview Formula Examples

Pp E Property Plant Equipment Overview Formula Examples

Components Of Asset Cost Boundless Accounting

Components Of Asset Cost Boundless Accounting

Maintenance Capital Expenditures The Easy Way To Calculate It

Maintenance Capital Expenditures The Easy Way To Calculate It

Https Www Bdo Ca Getattachment Ff30b5be 7956 4df5 Bc1c 7941d0496fdf Attachment Aspx

Property Plant And Equipment Pp E Definition

Property Plant And Equipment Pp E Definition

Distinguish Between Tangible And Intangible Assets

Distinguish Between Tangible And Intangible Assets

How To Measure The Acquisition Cost Of Property Plant And Equipment Play Accounting

How To Measure The Acquisition Cost Of Property Plant And Equipment Play Accounting

Pp E Property Plant Equipment Overview Formula Examples

Pp E Property Plant Equipment Overview Formula Examples

The Quality Of Fair Value Measures For Property Plant And Equipment Sciencedirect

The Quality Of Fair Value Measures For Property Plant And Equipment Sciencedirect

The Quality Of Fair Value Measures For Property Plant And Equipment Sciencedirect

The Quality Of Fair Value Measures For Property Plant And Equipment Sciencedirect

Property Plant And Equipment Ppe Covering Financials Reynolds Center

Property Plant And Equipment Ppe Covering Financials Reynolds Center

Cost Model In Accounting Definition Ias 16 Ifrs Us Gaap Journal Entries Depreciation Example

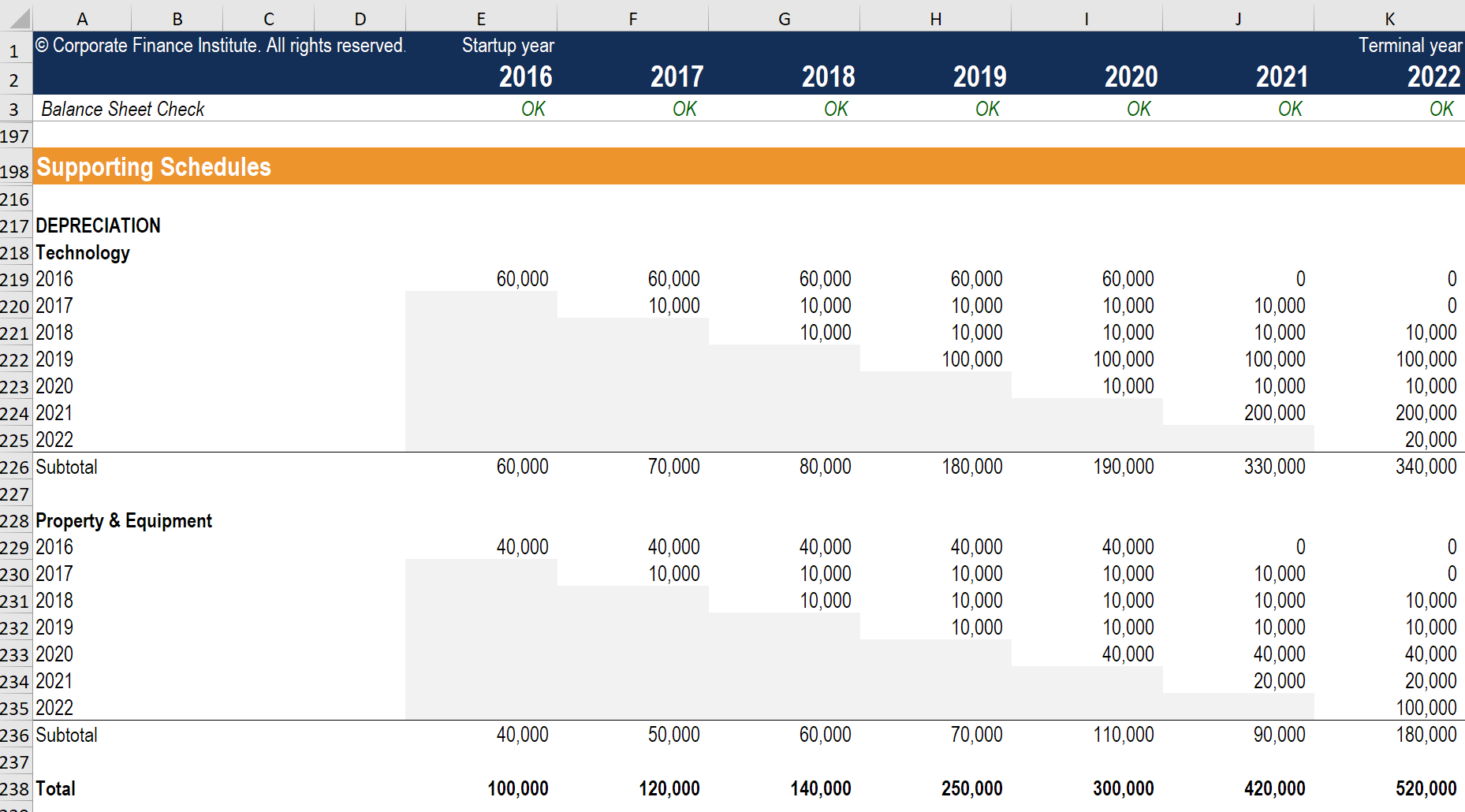

Depreciation Schedule Guide Example Of How To Create A Schedule

Depreciation Schedule Guide Example Of How To Create A Schedule

Distinguish Between Tangible And Intangible Assets

Distinguish Between Tangible And Intangible Assets

Labels: equipment, historical, plant, property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home