How To Apply For Homestead Exemption In Collin County Texas

You may receive the Over 65 exemption immediately upon qualification of the exemption by filing an application with the Collin County appraisal district office. Early applications will not be accepted.

Https Www Collincountytx Gov Tax Assessor Documents Taxratesummary Pdf

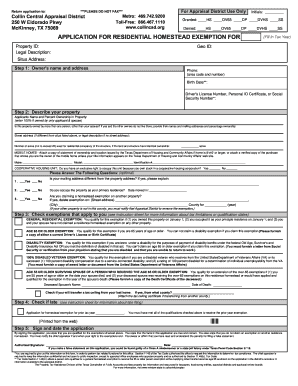

Tax Year Prop ID.

How to apply for homestead exemption in collin county texas. You may only apply for residence homestead exemptions on one property in a tax year. If you apply for an Over Age 65 Exemption or a Disabled Person Exemption. Individuals age 65 or older or disabled residence homestead owners qualify for a 10000 homestead exemption for school district taxes in addition to the 25000 exemption for all homeowners.

Tax Deferral for Age 65 Older Disabled Homeowner or Disabled Veteran. Please contact the Collin County Central Appraisal District for additional information regarding exemptions or to apply for an exemptions at 469-742-9200. To submit the homestead application utilizing the mobile app you will need 4 items.

Applications for property tax exemptions are filed with appraisal districts. If the owner qualifies for both the 10000 exemption for age 65 or older homeowners and the 10000 exemption for disabled homeowners the owner must choose one or. Appraisal district chief appraisers are responsible for determining whether or not property qualifies for an exemption.

Qualified applicants are owners of residential property owners of residential property over 65 a surviving spouse of a person who received the over 65 exemption. Eldorado Pkwy McKinney TX 75069. There is no fee to file the homestead exemption form.

MORE INFORMATION General Residence Homestead. If you turn 65 become totally disabled or purchase a property during this year you can apply to activate the Over 65 Exemption or Disabled Person Exemption for this year. The above Collin County appraisal district forms are in Adobe Acrobat PDF format.

To the appraisal district by the individual in an application for a general residence homestead exemption. For Over 65 or Disabled Person Exemptions. Over-65 or Disabled Person.

You must apply before the first anniversary of your qualification date to receive the exemption in that year. For a general exemption you should file your exemption application between January 1 and April 30. Homestead You can now electronically file your residential homestead exemption online utilizing the HCAD Mobile App.

If you do not have Adobe Acrobat Reader software on your computer you may download a free copy below. The typical deadline for filing a county appraisal district homestead exemption application is between January 1 and April 30. Residence Homestead Exemption Application includes Age 65 or Older Age 55 or Older Surviving Spouse and Disabled Person Exemption Transfer Request for Tax Ceiling of Age 65 or Older Age 55 or Older Surviving Spouse or Disabled Person.

To apply for the homestead exemption download and print the Residential Homestead Exemption Application and mail the completed application to. The exemptions apply only to property that you own and occupy as your principal place of residence. Age 65 or older and disabled exemptions.

Use this form to apply for any of the following. The typical delinquency date is February 1. The date of occupancy on your residence.

See filing deadline info on page 2. Download Homestead Exemption Application. Central Appraisal District of Collin County 250 W.

Once you receive the exemption you do not need to reapply unless the chief appraiser sends you a new application. Download this form to apply for a residential homestead exemption. If you do not have Adobe Acrobat Reader software on your computer you may download a free copy below.

The above Collin County appraisal district form is in Adobe Acrobat PDF format. How to file for the Homestead Exemption A qualified Texas homeowner can file for the homestead exemption by filing the form that can be downloaded below. Certain exemptions may also require Form 50-114-A.

The exemptions apply only to property that you own and occupy as. Tax Code exemption requirements are extensive. This application is for use in claiming residence homestead exemptions pursuant to Tax Code Sections 1113 11131 11132 11133 11134 and 11432.

For the 25000 general homestead exemption you may submit an Application for Residential Homestead Exemption PDF and supporting documentation with the appraisal district where the property is located. This application is for claiming residence homestead exemptions pursuant to Tax Code Sections 1113 11131 11132 11133 11134 and 11432. Residential Homestead Exemption Application.

All three locations listed below accept Property Tax payments. The general deadline for filing an exemption application is before May 1.

Read more »