Fairfax County Property Tax Assessment Search

Map Owner Property Address Last Sale Ascending Descending. Home Tax Collector.

Desegregation The Schools Fairfax County Public Schools

Desegregation The Schools Fairfax County Public Schools

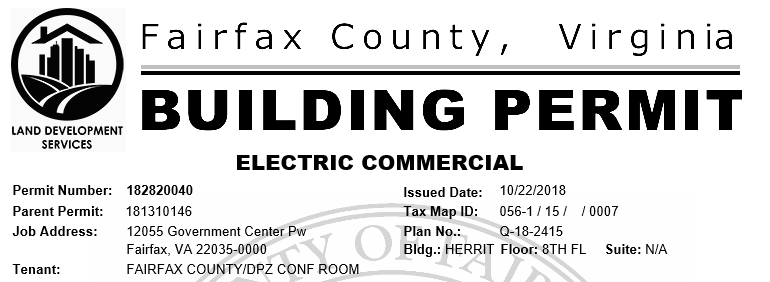

Fairfax County Land Development Services LDS is offering free training for site design professionals that prepare residential infill lot grading INF plans.

Fairfax county property tax assessment search. Welcome to the Department of Tax Administration DTA Real Estate tax payment system. Select a Pay Status. The event will be hosted on Zoom.

This site contains basic information for all properties located in the City of Fairfax including tax map and account numbers property owners names and addresses the propertys legal description land size zoning building areas sales history current assessment and multiyear assessment history. 200 West Houston Suite 108. Select a Tax Year.

DTA uses that data to annually assess real property in a fair and uniform manner at estimated fair market value as of January 1 of each year. Name last name first name Property ID Number PIN Account Number. In-depth Property Tax Information.

Address 1184 Springmaid Map ID. The Department of Tax Administrations DTA Real Estate Division is tasked with collecting data for all real property in Fairfax County. Choose Search Criteria for Real Estate.

Get FREE RUSK COUNTY PROPERTY RECORDS directly from 7 Texas govt offices 13 official property records databases. Property records contain descriptive property information as well. The Department of Tax Administrations DTA Revenue Collection Division is responsible for collecting taxes fees and miscellaneous revenues for Fairfax County.

Child Abuse Prevention Month Resources. Search for Next Fairfax County Police Chief. Click here to read download forms regarding this program or call 7033592486.

For information pertaining to the calculation of supplemental assessments please call the Real Estate Assessment Office at 7033857840. Increase the speed and accuracy of your search by selecting criteria in the dropdown menus. It is our goal to achieve the full collection of all current and delinquent charges while providing quality customer service.

Records include Rusk County property tax assessments deeds title records property ownership building permits zoning land records GIS maps more. Data Current as of 05Apr2021 DBPORA34PRYR. 2021 Real Estate Assessments Now Available.

Fairfax County VA Property Tax Search by Address. Board of Supervisors Increases Affordable Housing Options. The Department of Tax Administration DTA is charged with uniformly assessing and collecting taxes and fees for Fairfax County including Real Estate tax Vehicle Car tax Vehicle Registration fees Business taxes Dog Licenses and Parking Tickets.

View Real Estate Taxes currently due on the parcel s you own in the County of Fairfax. Library Branches Reopen for Express Service. Records include Harrison County property tax assessments deeds title records property ownership building permits zoning land records GIS maps more.

15 20 25 30 50. Information and Due Dates The 2020 real property tax rate was set by the City Council when they adopted the. Using this system you may securely.

Cicadas Hatching Late April to Early May. SSN or Federal ID. In addition DTA collects past due fees for other county agencies.

The tax rate set by the Board of Supervisors is applied to that value to determine the tax amount due. See Fairfax County VA tax rates tax exemptions for any property the tax assessment history for the past years and more. 2 days agoTo strike back against scammers AARP and the Fairfax Silver Shield Task Force are bringing together top experts and law enforcement officials to present at a free informational virtual Scam Jam on Friday April 23 from 9 am.

Pay Real Estate Taxes by e-Check or credit carddebit card using our online payment vendor NIC Virginia. Fairfax County Assessors Website Report Link httpswwwfairfaxcountygovtaxes Visit the Fairfax County Assessors website for contact information office hours tax payments and bills parcel and GIS maps assessments and other property records. Tax Relief Program City of Fairfaxs Finance Office administers this program.

The Constitution of Virginia Article X Section 2 and the Code of Virginia 581-3201 require real estate assessments to represent fair market value. Vehicles include cars trucks trailers motorcycles motor homes buses and mobile homes. Select the Tax Type.

See what the tax bill is for any Fairfax County VA property by simply typing its address into a search bar. The Department of Tax Administrations DTA Personal Property and Business License Division is responsible for the assessment of all vehicles normally garagedparked in Fairfax County. For additional information related to our third party processor NIC Virginia.

As part of the Fairfax County annual assessment program the Department of Tax Administration DTA reviews the assessed values for all real property each year with January 1 as the effective date of the assessments. Get FREE HARRISON COUNTY PROPERTY RECORDS directly from 8 Texas govt offices 13 official property records databases. The speed consistency and predictability of the plan review process is substantially affected by the quality of plans submitted for review and approval.

Read more »Labels: assessment, fairfax, search