Property Tax Appraisal Williamson County

The maps have been prepared according to Section 93002 Tax Maps Texas Property Tax Laws. Tax rates for Williamson County and each city or town within Williamson County are set each year by their respective legislative bodies County Commission and governing bodies based on the budgets they pass to fund programs and services.

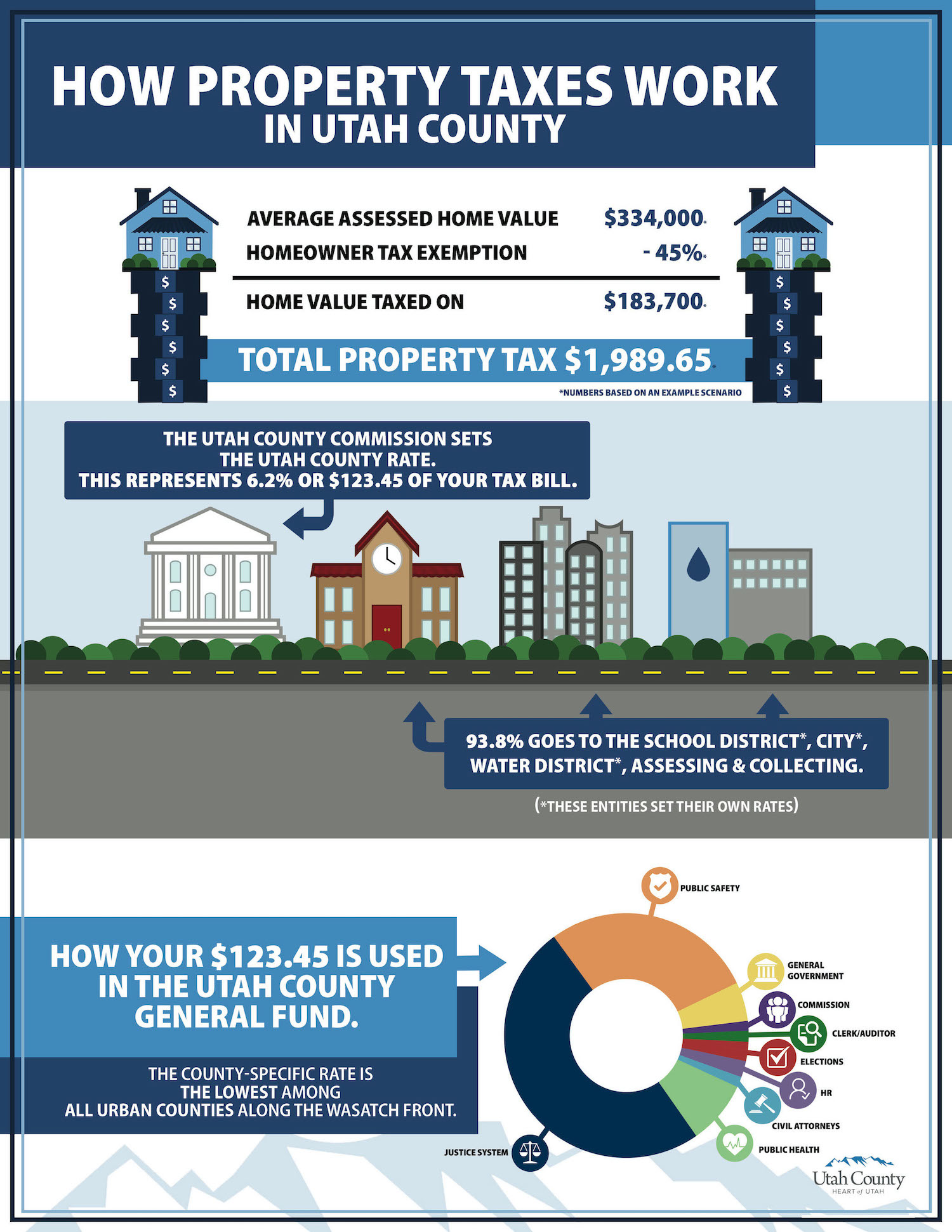

Utah County Property Tax Increase On The Horizon Lehi Free Press

Utah County Property Tax Increase On The Horizon Lehi Free Press

Contact ASHLEY GOTT Treasurer Williamson County Treasurer 407 N.

Property tax appraisal williamson county. This data could include inaccuracies or typographical errors. Contrary to popular belief the Property Assessor does not set the tax rate does not send out tax bills and does not collect property taxes. Property owner property tax protests in Williamson County results in savings of 2891 million in 2018 or 498 per account protested.

Property Tax Payment Dates Make checks payable to. The Williamson County Assessor of Property is a Tennessee constitutionally elected official who serves at the pleasure of the Williamson County citizens for a four-year term of office. The Williamson Central Appraisal District provides this information as is without warranty of any kind.

Online Payments Online payments are only available during a portion of the tax collection period. The maps have been prepared according to Section 93002 Tax Maps Texas Property Tax Laws. Payment can be made by.

The Williamson Central Appraisal District makes no warranties or representations whatsoever regarding the quality content completeness accuracy or adequacy of such information and data. Property owners have until May 17 to protest their appraisals. The primary responsibility of the property assessor is to discover list classify and value all real personal or mixed property within the jurisdiction of Williamson County for tax purposes.

The Williamson Central Appraisal District provides this information as is without warranty of any kind. The 10 increase is cumulative. Do not be surprised but yes.

Online payments will be available again starting approximately May 31 2020 and ending November 27 2020 at 400 pm. While we seek to present accurate reliable complete current and useful information and products on this site we do not guarantee or warrant the accuracy reliability completeness or usefulness of the information at this site or at other sites to which. One property has a driveway in Williamson County but the home is located and pays property taxes in Davidson County.

Depending on your property this may be done online or you may need to file your protest in person meet with an appraiser and attend a hearing. The Williamson Central Appraisal District makes no warranties or representations whatsoever regarding the quality content completeness accuracy or adequacy of such information and data. The Williamson Central Appraisal District is not responsible for any errors or omissions.

The information included on these pages has been compiled by County staff from a variety of sources and is subject to change without notice. The homeowners property tax is based on the county appraisal districts appraised value of the home. To do so alone youll have to go through the Williamson County Tax Appraisal District and file a formal protest.

The 2018 budget for the Williamson Appraisal District was. This data could include inaccuracies or typographical errors. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property.

Williamson County - TN disclaims any responsibility or liability for any direct or indirect damages resulting from the use of this data. Why go through the hassle. The Property Assessors Office of Williamson County TN presents this web site as a service to the public for informational purposes only.

Technically a Texas homesteads assessed value is limited to the lesser of either its market value or the sum of the market value of any new improvements and 110 of the appraised value of the preceding year. The information included on these pages has been compiled by County staff from a variety of sources and is subject to change without notice. Williamson County Appraisal review Board appeals were successful for 74 of the owners.

Monroe Street Suite 104 Marion IL 62959 Phone. Please call 615 790-5709 if you need additional information. In another case nine homes are taxed in Davidson County but owners have to.

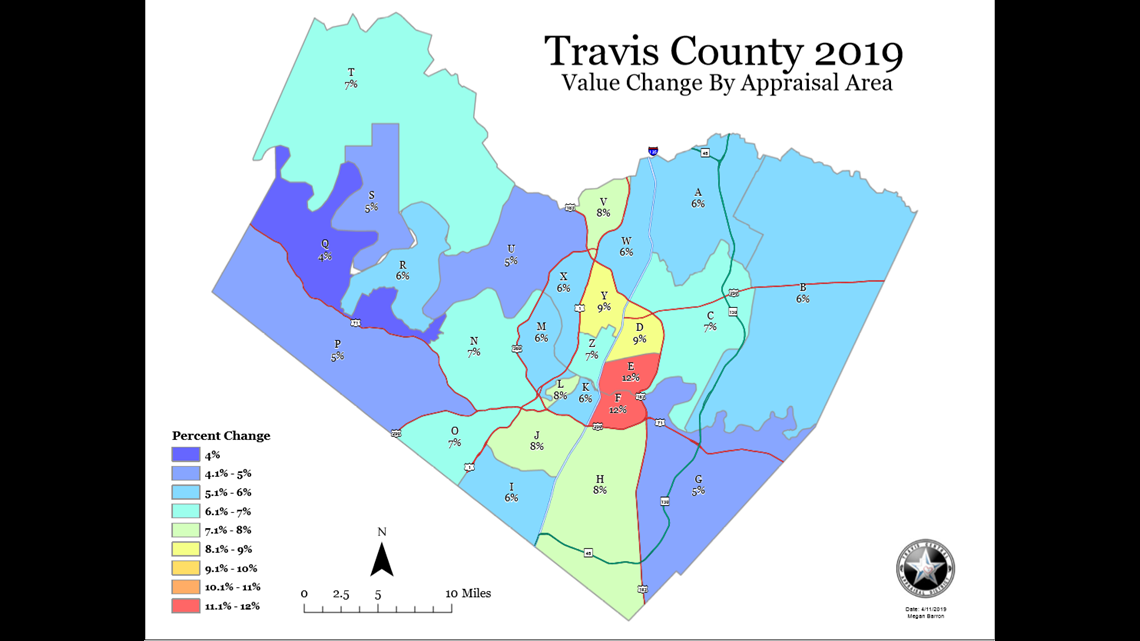

Tax experts anticipate more home appraisal protests than ever in Travis County. As property values continue to rise in Williamson County property taxes have been increasing too at an alarming rate for all the Williamsons homeowners of 2018. American Express Visa MasterCard and Discover credit cards see Convenience Fee Schedule below An added fee.

In-depth Williamson County IL Property Tax Information. The Williamson Central Appraisal District is not responsible for any errors or omissions. Williamson County Treasurer Resources Property Tax Payment Instructions Property Tax Exemptions Tax.

Many homeowners find this premise daunting. You may now access historical property tax information for the cities of Brentwood Franklin Nolensville and Thompson Station HERE.

Read more »Labels: county, property, williamson