Ghmc Property Tax Last Date

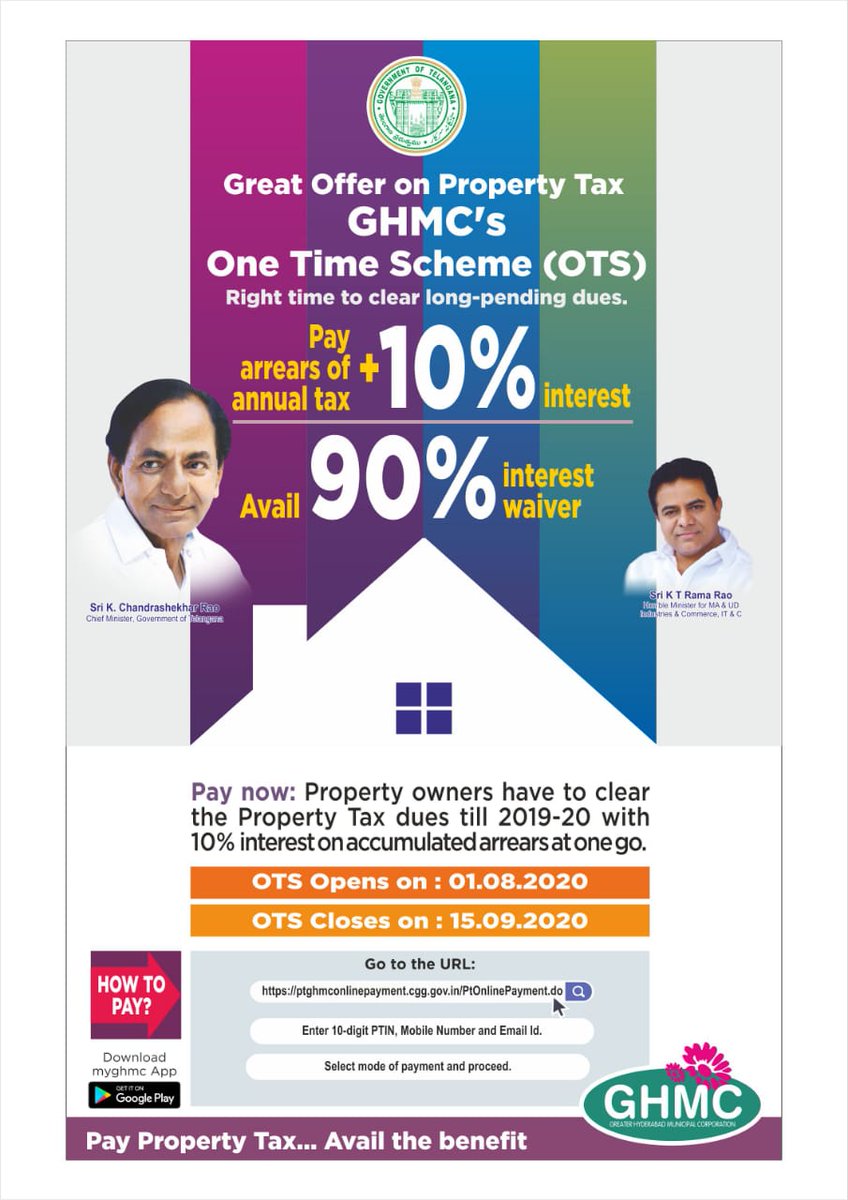

Rebates and Penalties from GHMC tax The GHMC conducts a. 2951017 2 711 6757 0 8 ² 29 ² 3urshuw 7d ² uhedwh lq 3urshuw 7d xqghu duo lug 6fkhph iru wkh lqdqfldo Missing.

Due Date and Penalty The last dates for payment of half-yearly property taxes 31 July and 15 October.

Ghmc property tax last date. The last date for the bi-annual payment of GHMC Property Tax is 31st July and 15th October. The last date for the payment of half-yearly property tax is 31 July and 15 October. Search for a Property Search by.

An interest of 2 pm. Delays attract a penalty of 20percent interest every month for the given amount. John Smith Street Address Ex.

July 31st and October 15th are the last dates for the payment of half-yearly property tax. With just four days left for claiming the five per cent discount on the payment of property tax many were seen lined up at the Citizens Service Centre at GHMC office here on Wednesday. 123 Main Parcel ID Ex.

GHMC has been taking initiatives to encourage taxpayers to clear previous arrears and present payment. The relief covers residents of all Urban Local Bodies in the State including those in the Greater Hyderabad Municipal Corporation GHMC C. The last date for half-yearly GHMC property tax payment is July 31 and October 15 of every year.

Will be charged if you delay the payment of GHMC Property Tax. If you miss this deadline then you are penalised 2 on the. But the last date has not been declared yet.

GHMC Property Tax Calculation. Counties in Ohio collect an average of 136 of a propertys assesed fair market value as property tax per year. Penalty on late payment of GHMC property tax The tax payer has to pay a penal interest of 2 per month on the outstanding amount in case of delay beyond the GHMC property tax due dates.

Enter your PTINASMT Property Tax Identification Number to check the Dues. Disclaimer Designed and Developed by Centre for Good Governance. Notices collection GHMC offers.

What is the last date of GHMC property tax. The County assumes no responsibility for errors in the information and does not guarantee that the. The GHMC has already set dates for tax payments.

The property tax payment is by July 31 st and 1st October. The last date for completing property tax payment is 31st July and 15th October for half yearly property tax payment. Delay in the payment of property tax results in levy of penal interest 2 per month on the outstanding amount.

Search your Property Tax. You dont need to have bank account to pay the property tax Any Online failure transaction status can be updated in 5-mins Information Provided Online is up-to Date and Physical Visit to the GHMC Office Department is Not Required. Government of Telangana provides Relief to property Owners by way of 50 reduction in Annual Residential Property tax for FY 2020-21 Location of Free WiFi Access Points in Hyderabad LRS 2020.

Due dates rebates and penalties. The Franklin County Treasurer makes every effort to produce and publish the most current and accurate information possible. Ohio is ranked number twenty two out of the fifty states in order of the average amount of property taxes collected.

As with any other form of taxation GHMC property tax has due dates and penalties for delayed payments. According to the official portal the Payment process will start on 5 April 2021. You can also contact the concerned deputy commissioner at the GHMC office in case you want to re-assess your property.

To address grievances related to property tax Greater Hyderabad Municipal Corporation GHMC is conducting Property Tax Parishkaram PTP. The dates are half-yearly where citizens have ample time to pay tax. No manual transactions in Tax assessment issue of special notice issue of annual demand notices and receipts 100 computerization of assessments notices collection GHMC offers the following modes.

Any delay in the payment of tax will attract a penal interest of 2 per month on the amount outstanding. The median property tax in Ohio is 183600 per year for a home worth the median value of 13460000. PTI NO Know Property Tax Dues.

Self Assessment Abstract Report. Whereas the amount of property tax increases. Property tax Must include.

The new deadline is June 30.

Read more »