How To Reduce Your Property Taxes In Illinois

You may know that the Illinois authorities compute your property tax by multiplying your homes taxable value by the tax rate. The tax bill may still increase if any tax rates are increased or if improvements are added that increase the value of the property.

Pin By Bobbie Persky Realtor On Finance Real Estate Property Tax Tax Attorney Debt Relief Programs

Pin By Bobbie Persky Realtor On Finance Real Estate Property Tax Tax Attorney Debt Relief Programs

Freezing property taxes at current levels would achieve that objective by lowering the tax burden in relation to the.

How to reduce your property taxes in illinois. Check out The Illinois Property Tax System a detailed guide to local property taxes in the state published by the Illinois Department. Check with your local board of review about their deadline. You can get your property taxes lowered by proving that your house is worth less than the assessor says it is.

The second depends on whether you meet certain qualifications under the Illinois tax code. The most significant is the General Homestead Exemption which is available to homeowners living in their principal residence. The first thing to know is that property tax exemptions dont have any effect on the tax rate.

If you do you can seek tax relief using both methods. Learn More About Property Taxes in Illinois. It isnt subtracted from your homes value but rather its multiplied by the tax rate then this amount is subtracted from your tax bill.

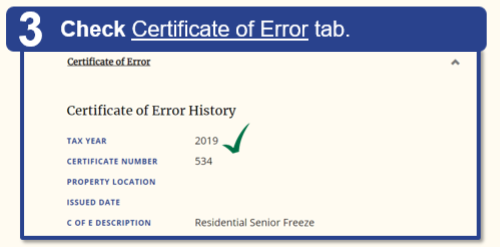

Appeal the Taxable Value of Your Home. This exemption allows senior citizens who meet the qualifications to elect to maintain the equalized assessed value EAV of their homes at the base year EAV and prevent any increase in that value due to inflation. To do this you have to appeal to your local board of review.

Instead they usually reduce the value of your. It may be too late to appeal your property tax. And they typically dont come off your tax bill.

To find out what measures you can take to reduce the taxable value see the companion article Procedures for Challenging Your Property Tax Assessment in Illinois. There are a number of exemptions that can reduce assessed value and therefore property tax payments in Illinois. The simple answer on why property taxes are so high in any given place ie.

Look for local and state exemptions and if all else fails file a tax appeal to lower your property tax bill. The average price of a single-family home was 227753. Homeowners in Illinois paid an average of 5048 in property tax in 2018 according to the Irvine California-based data company.

You can find contact information for your local board of review on the Illinois Property Tax Appeal Board website. Pritzkers progressive tax plan contains no guarantee that the 37 billion it is expected to take from the Illinois economy will do anything to lower property taxes. What is the deadline.

The state needs to reduce the property-tax burden for all Illinois residents. The Illinois Association of REALTORS presents a video that shows state residents how their property tax assessments are calculated and what they can do if t. At a tax rate of 3 you can deduct just 240 from the second installment of your annual tax bill.

New Jersey New York is that the burden for local public services mostly schools falls disproportionately on.

Read more »