Property Tax Relief Grant Illinois

The amount of tax relief is relatively minor. Aand information on financial assistance programs for elderly Illinois residents is available here.

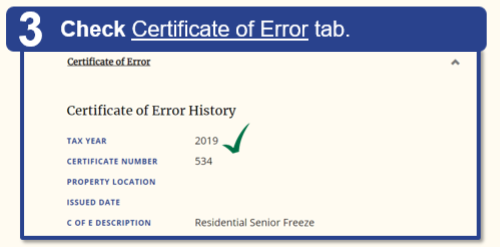

Property Tax Assistance Cook County Assessor S Office

Property Tax Assistance Cook County Assessor S Office

Projections indicate that Property Tax Relief.

Property tax relief grant illinois. The grant can cover the past due rent from the previous 12 months and future rental assistance for the next three months if deemed necessary. LAKE COUNTY IL The Illinois State Board of Education announced the 39 school district that are eligible for a property tax relief grant from. The Relief Grants are part of the ISBEs switch to Evidence-Based Funding.

The grants are disbursed by the Illinois State Board of Education. Seniors with income of less than 45000 a year can expect rebate amounts ranging from 1 to 350. The emergency rental assistance is provided by the Federal government and is free to tenant and housing provider.

The Circuit Breaker Property Tax Relief program provides rebates to qualified seniors for rent property taxes or nursing home charges. The Illinois Property Tax Credit is a credit on your individual income tax return equal to 5 percent of Illinois Property Tax real estate tax you paid on your principal residence. There is not sufficient appropriation in fiscal year 2021 for a new round of Property Tax Relief Grants Illinois State Board of Education spokeswoman Jackie Matthews said Friday.

Property owners in McHenry County are getting some relief. You must own and reside in your residence in order to take this credit. Beginning January 1 2001 legislation will take effect that may significantly increase the cost of the Circuit Breaker Program.

Twenty-eight school districts in the state will be getting a combined 50 million in Property Tax Relief Grants from the Illinois State Board of Education. SPRINGFIELD The Illinois State Board of Education ISBE today announced the 39 school districts that are eligible for the fiscal year 2020 Property Tax Relief Grant a significant increase in eligible districts over the previous year. General Homestead Exemption GHE This annual exemption is available for residential property that is occupied by its owner or owners as his or their principal dwelling place or that is a leasehold interest on which a single family residence is situated which is occupied as a residence by a person who has an ownership interest therein legal or equitable or as a lessee and on which the person is liable.

The 50 million state grant covers a portion of local property reductions up to the statutory limit. The Program will provide 560 million in property tax relief and 453 million in pharmaceutical assistance to Illinois senior citizens. Jack Franks McHenrys County Chair told the I-Team they are waiving late fees and.

Money from the grant replaces the lost tax revenue according to the Illinois State Board of Education. For questions please contact State Funding and. But homeowners would likely see a less than 1 decrease in the tax rate according to an.

Harris announces state grant that provides tax relief for South Suburbs Joyce announces property tax relief for residents of the South Suburbs Lifting property tax burden on South Suburban residents State grant to provide tax relief for Lake County school districts. Tenants who are approved will receive one-time grants of 5000 paid directly to their landlords to cover missed rent payments beginning in March 2020 and prepay payments through December 2020 or. The maximum grant amount is 25000.

A property tax relief provision added to Illinois school funding law during final negotiations includes grants for a few districts that already have adequate funding such as Oak Park River Forest High School. More Illinois counties have approved plans to delay property tax payments offering economic relief to homeowners who have suffered as Illinois. What is the Illinois Property Tax Credit.

The grant part of the Evidence-Based Funding for Student Success Act allows eligible school districts to cut local property taxes and replace that revenue with state funds. Oak Park-River Forest High School.

Column State Lacks New Money For School Funding Program That Grants Property Tax Relief Chicago Tribune

Column State Lacks New Money For School Funding Program That Grants Property Tax Relief Chicago Tribune

Column Homeowners Expect Property Tax Relief As State Gives 26 5 Million In Grants To 20 South Suburban Schools Chicago Tribune

Column Homeowners Expect Property Tax Relief As State Gives 26 5 Million In Grants To 20 South Suburban Schools Chicago Tribune

Property Tax Assistance Cook County Assessor S Office

/gettyimages-1197184592-2048x2048-22e8a8e779514a43a8347a0b583c1813.jpg) Property Tax Exemptions For Seniors

Property Tax Exemptions For Seniors

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

What Is The Disability Property Tax Exemption Millionacres

What Is The Disability Property Tax Exemption Millionacres

Http Www Lasallecountytreasurer Com Wp Content Uploads 2015 06 Taxpayers 20guide Pdf

Springfield Housing Authority Receives Massive Grant For Illinois Housing Grant Money Springfield Free Grants

Springfield Housing Authority Receives Massive Grant For Illinois Housing Grant Money Springfield Free Grants

Tax System In India Tax Payment Debt Counseling Tax Debt

Tax System In India Tax Payment Debt Counseling Tax Debt

What The Gov Will The Coronavirus Pandemic Affect Your Property Tax Bills Better Government Association

What The Gov Will The Coronavirus Pandemic Affect Your Property Tax Bills Better Government Association

Column State Lacks New Money For School Funding Program That Grants Property Tax Relief Chicago Tribune

Column State Lacks New Money For School Funding Program That Grants Property Tax Relief Chicago Tribune

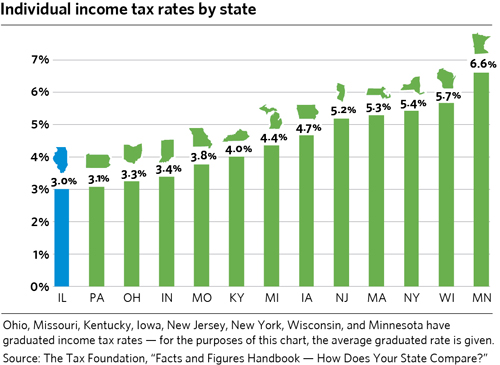

Dusting Off The Income Property Tax Swap Debate Cmap

Dusting Off The Income Property Tax Swap Debate Cmap

Deducting Property Taxes H R Block

Deducting Property Taxes H R Block

Property Tax Relief In House Bill 861 Ryan Law

Disabled Veterans Property Tax Exemptions By State

Disabled Veterans Property Tax Exemptions By State

What Is The Disability Property Tax Exemption Millionacres

What Is The Disability Property Tax Exemption Millionacres

Tax Reform S 10k Property Tax Deduction Is Worthless Don T Mess With Taxes

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home