Property Tax Rate Washington County Utah

The County Assessor is responsible for listing valuing and maintaining records on each piece of real and personal property in Washington County. 06 of home value.

Salt Lake County Utah Property Taxes 2014 Property Tax Home Icon House Outline

Salt Lake County Utah Property Taxes 2014 Property Tax Home Icon House Outline

The median property tax in Utah is 135100 per year for a home worth the median value of 22470000.

Property tax rate washington county utah. 197 East Tabernacle St. Washington County Administration Building 197 East. The primary responsibility of the Assessors Office is to review annually all property in the County and appraise that property at market value.

Utahs average effective property tax rate is just 058 good for 11th-lowest in the country. Payment at 10 penalty. Washington County collects on average 051 of a propertys assessed fair market value as property tax.

The average yearly property tax paid by Washington County residents amounts to about 222 of their yearly income. George UT 84770 435 634-5703. The median property tax also known as real estate tax in Washington County is 123100 per year based on a median home value of 24090000 and a median effective property tax rate of 051 of property value.

The percentage cap is subject to change but here is the formula. Sec 59-2-1347 allows a county for property assessed by the county or USTC for property assessed by the Commission to accept an amount less than the full amount of taxes due and allows a county to defer the full amount of taxes due where in the judgment of the county legislative body for property assessed by the county. Added July 1 2019.

Tax rate to cover the costs of administering the property tax system. George UT 84770 Phone. If the buyer is planning to make their Washington County home their PRIMARY RESIDENCE then the homeowner will pay only 55 of that tax amount so they will receive a 45 exemption as a primary resident.

If the buyer plans to use the home as a vacation home or a second home that homeowner will pay 100 of the assessed market value tax. The maximum property tax abatement is 271736 rated at 100 service-connected disability Multiply your percentage of disability by 271736 Example. The last day to pay real estate tax prior to liening is December 31 2019.

Official site of the Property Tax Division of the Utah State Tax Commission with information about property taxes in Utah. Utah is ranked number thirty two out of the fifty states in order of the average amount of property taxes collected. Tax rate beaver county 2019 tax rates by tax area utah state tax commission property tax division tax area 001 - 0000 1010 beaver 0001181 0001581 0001581 1015 multicounty assessing collecting levy 0000009 0000009 0000009.

2021 Property Tax Abatement and Exemption Programs Utah law allows Utah residents four types of property tax relief. Requires the certified tax rate for the county to be decreased on a one-time basis to offset the estimated sales tax revenue. Tom Durrant 87 North 200 East STE 201 St.

00008 303. Multicounty Assessing. Here the typical homeowner can expect to pay about 1900 annually in property tax payments.

Counties in Utah collect an average of 06 of a propertys assesed fair market value as property tax per year. Utah is ranked 1131st of the 3143 counties in the United States in order of the median amount of property taxes collected. Historical Overview of Utahs Property Tax 1896.

This sale will be located in. Veterans Exemption Blind Exemption Circuit Breaker Indigent County Abat. 15 rows Tax rate Tax amount.

The median property tax in Washington is 263100 per year for a home worth the median value of 28720000. Notice is hereby given that on May 28 2020 at 1000 AM Kim Hafen Clerk-Auditor will offer for sale unless redeemed prior to sale at public auction pursuant to the provisions of section 59-2-1351 Utah Code the described real estate situated in said county and now held by it under preliminary tax sale. 100 East Center Street Suite 1200 Provo Utah 84606 Phone Number.

Counties in Washington collect an average of 092 of a propertys assesed fair market value as property tax per year. Tax amount varies by county. A 10 disability X 271736 2717360 tax abatement This amount is then subtracted from the taxable value of the property and taxes are paid on the remaining amount.

Utah Property Tax Calculator Smartasset

Utah Property Tax Calculator Smartasset

Ranking Of Best Places To Buy A House Based On Home Values Property Taxes Home Ownership Rates And Real Estate Home Ownership Houses In America Property Tax

Ranking Of Best Places To Buy A House Based On Home Values Property Taxes Home Ownership Rates And Real Estate Home Ownership Houses In America Property Tax

Gorgeous Master Bathroom In Sunriver St George 55 Home St George Sunriver George

Gorgeous Master Bathroom In Sunriver St George 55 Home St George Sunriver George

Top 5 Reasons To Use Property Management In Utah Property Management Utah Management

Top 5 Reasons To Use Property Management In Utah Property Management Utah Management

Property Tax Search Results Washington County Of Utah

Property Tax Search Results Washington County Of Utah

/cdn.vox-cdn.com/uploads/chorus_asset/file/17819266/1519399.jpg) Utah County Votes To Raise Property Taxes For First Time In 23 Years Deseret News

Utah County Votes To Raise Property Taxes For First Time In 23 Years Deseret News

Https Tax Utah Gov Forms Pubs Pub 36 Pdf

Property Taxes Go Up This Year You Can Appeal The County S Assessment St George News

Property Taxes Go Up This Year You Can Appeal The County S Assessment St George News

Oregon Property Tax Calculator Smartasset

Oregon Property Tax Calculator Smartasset

Colorado S Low Property Taxes Colorado Fiscal Institute

Colorado S Low Property Taxes Colorado Fiscal Institute

Utah Property Tax Calculator Smartasset

Utah Property Tax Calculator Smartasset

States With The Highest And Lowest Property Taxes Property Tax Tax States

States With The Highest And Lowest Property Taxes Property Tax Tax States

Property Tax Search Results Washington County Of Utah

Property Tax Search Results Washington County Of Utah

King County Wa Property Tax Calculator Smartasset

King County Wa Property Tax Calculator Smartasset

Property Tax Estimate Washington County Of Utah

Property Tax Estimate Washington County Of Utah

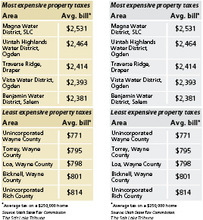

Where Utah Taxes Are Highest Lowest The Salt Lake Tribune

Where Utah Taxes Are Highest Lowest The Salt Lake Tribune

Labels: county, property, rate, washington

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home