Do Apartment Managers Get Paid

How much does a Apartment Manager make. The manager pays his or her rent and receives payment for each hour worked.

Business Cards For Apartment Marketing And Retention Sprout Marketing Apartment Marketing Marketing Marketing Slogans

Business Cards For Apartment Marketing And Retention Sprout Marketing Apartment Marketing Marketing Marketing Slogans

Filter by location to see Apartment Manager salaries in your area.

Do apartment managers get paid. Not a single court decision or IRS ruling has ever held otherwise. Usually this is an amount over and above the percentage of rent collected or other standard monthly fee. The national average salary for a Apartment Manager is 53683 in United States.

4 rows As of Apr 6 2021 the average annual pay for an Apartment Property Manager in the United States. You may be charged an hourly rate around 25 to 50 an hour or a flat fee. The average salary for an Apartment Manager is 39312.

Apartment managers collect monthly rent pay utilities and other bills incurred by the complex mediate disputes between tenants and facilitate the repair and upkeep of the apartments and grounds. The landlord will almost always pay the property manager the cost of repairs and supplies before the property manager will actually perform them. 23 of the market rent is 120000 which is the Managers monthly rental payment.

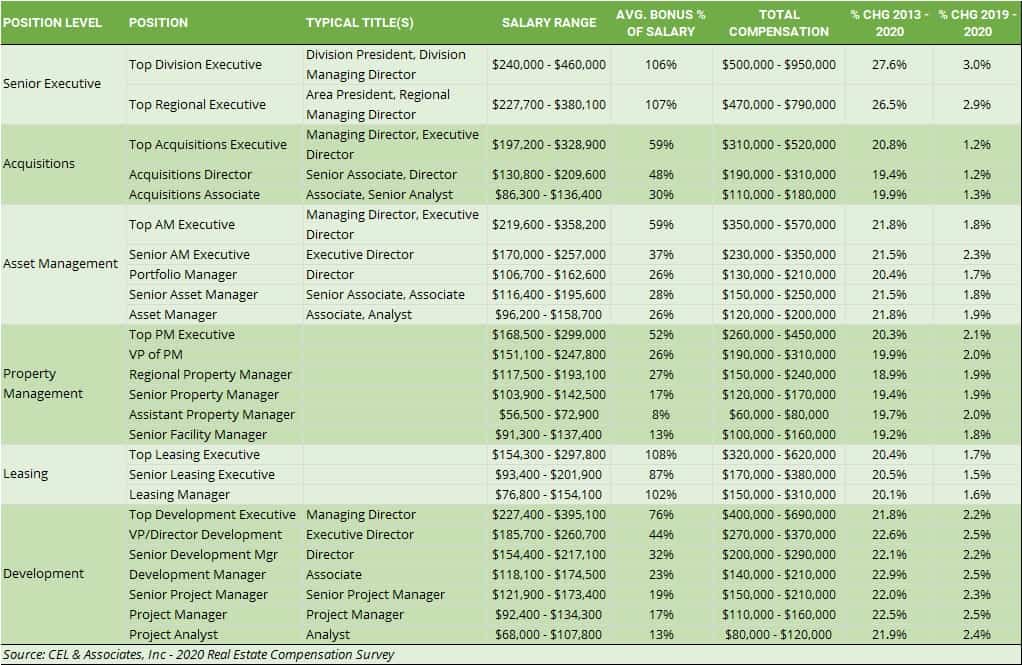

Unpaid property management fee. Resident apartment managers and live-in maintenance personnel must be paid in accordance with minimum wage laws. The average compensation for an apartment manager ranges anywhere from 47150 to 101928.

Salary estimates are based on 249 salaries submitted anonymously to Glassdoor by Apartment Manager employees. Apartment managers earned average annual salaries of 32000 as of 2013 according to the jobsite Indeed. The average salary for a apartment manager is 1699 per hour in the United States.

I am an apartment manager. However when your property is vacant you dont pay your property management company for the time. The manager works 30 hours per week and is paid at least minimum wage for each hour he or she works.

This may or may not be a good deal for you but most property managers charge the small percent of the monthly rental payment. It may be a better decision to pay rent and ask to be paid for your time. You normally pay your property management company 100 a month when your unit is occupied.

Apartment managers with more than 450 units under management can earn twice the pay of a manager at a smaller property. The national average salary for a Apartment Manager is 44183 in United States. How much do apartment managers get paid.

You may be offered pay or reduction of the rent for your unit if you live onsite. Property size plays a major role in determining how much apartment managers make. This is so whether they are paid a regular salary or are compensated wholly or partly with reduced rent.

The average salary for a apartment manager is 1723 per hour in California. Resident managers also called apartment managers are employees of the landlords who hire them. If you do get free rent it is still taxable so considered income to you.

As of January 1 2008 the minimum wage in California was raised to 800. Manager receives a 3 bedroom apartment with a market rent of 1800month. For running a complex with 56 units we get paid our apartment phone bill and 300 per month.

This provision encourages your property management company to do their job. At a minimum apartment managers are required to have a high school diploma and one or two. Apartment Manager salaries in your area.

Property managers will typically charge for serving the eviction notice dealing with attorneys appearing in court and other services that take up their time. Some companies may charge say 100 per month flat rate. This entitles Resident Apartment Managers to be paid at least 800 for every hour worked.

Visit PayScale to research apartment manager salaries by city experience skill employer and more. As a baseline expect to pay a typical residential property management firm between 8 12 of the monthly rental value of the property plus expenses. Filter by location to see.

Read more »