Michigan Homestead Property Tax Credit For Apartment Rent

Your permanent residence is in Michigan. Many people who rent their homes or apartments often do not claim the credit since they are paying rent and not property taxes.

Looking Into Property Management Software Use This Checklist To Make Sure Property Management Rental Property Management Real Estate Investing Rental Property

Looking Into Property Management Software Use This Checklist To Make Sure Property Management Rental Property Management Real Estate Investing Rental Property

This credit is available both to homeowners and to renters provided they live in a property for which property taxes are paid.

Michigan homestead property tax credit for apartment rent. Your homestead is located in Michigan. You may claim a property tax credit if all of the following apply. The State of Michigan offers a refundable Homestead Property Tax Credit of up to 1200 per year for property taxes you pay on your homestead principal residence.

You were a resident of Michigan for at least six months during the year. Do you live in a state with a renters tax credit. Michigan Homestead Property Tax Credit Examples.

Who May Claim a Property Tax Credit Youaylaim m c a property tax credit if all of the following apply. You own or are contracted to pay rent and occupy a Michigan homestead on which property taxes were levied. Bob Owns a House with a market value of 270000.

If you rent or lease housing subject to a service charge or fees paid instead of property taxes you may claim a credit. 395 x 12 4740 annual rent 4740 x 023 1090 taxes attributable to the apartment homestead. Filers who own a home may qualify for a Homestead Property Tax Credit if.

You should complete the Michigan Homestead Property Tax Credit Claim MI. 40 Median Home Cost. Filers Full Social Security No.

You are eligible for the credit if you either own a residence or contracted to pay rent on a residence in the state. His taxable value is therefore 135000. MI recognizes that are a portion of your rent goes towards paying the landlords.

Rent Eligible for Credit You must be under a lease or rental contract to claim rent for credit. You own or are contracted to pay rent and occupy a Michigan homestead on which property taxes were. United States Median Home Age.

Yes renters qualify for the Michigan Homestead Credit. Michigans homestead property tax credit is how the State of Michigan can help you pay some of your property taxes if you are a qualified Michigan homeowner or renter and meet the requirements. 05-19 Page 1 of 3 Amended Return 2019 MICHIGAN Homestead Property Tax Credit Claim MI-1040CR Issued under authority of Public Act 281 of 1967 as amended.

Who qualifies for a homestead property tax credit. Can an apartment be filed as a homestead credit. Type or print in blue or black ink.

You were a Michigan resident at least six months of 2020 You own your homestead within Michigan and property taxes were levied in 2020 or under a rental contract you paid rent. You may claim a property tax credit if all of the following apply. Means that you have not claimed a principal residence exemption and all of your property is subject to school operating tax.

Condo located at 8708 Metropolitan Ave Warren MI 48093 sold for 125000 on Jun 14 2019. The Homestead Property Tax Credit is a refundable credit avail-able to eligible Michigan residents who pay high property taxes or rent in relation to their income. Bob lives in a median taxed district and pay a total millage rate of 25 mills.

You were a resident of Michigan for at least six months during the year. You own or were contracted to pay rent and occupied a Michigan homestead for at least 6 months during the year on which property taxes andor service fees were levied. Your homestead is in Michigan.

Michigan Homestead Property Tax Credit While Michigan renters are not provided with any federal tax breaks for rental payments they can sometimes take advantage of the Michigan Homestead Property Tax Credit. Michigan Department of Treasury Rev. Michigan Homestead Property Tax Credit Example 1 Best Case Scenario.

If you own your home your taxable value was 135000 or less. Your homestead is located in Michigan You were a Michigan resident at least six months of 2019 Youwnour o y Michigan homestead and property taxes wereevied l in 2019rouaid o y p rent under a rental. In most cases 20 percent of rent paid is considered property tax that can be claimed for credit.

This amounts to 3375 per year. In Michigan the Homestead Property Tax Credit is available to renters allowing them to receive a credit of the difference between your total household resources and the property taxes you are required to pay. How to compute your homestead property tax credit if your PRE is between 1 and 99 PRE.

The homestead the principal place of residence is in. You may qualify for a homestead property tax credit if all of the following apply. 100 of your total household resources is not received from Michigan Department of Health and Human Services.

The following are exceptions. This credit applies to both renters and homeowners as long as the property in question has a taxable value of 135000 or less. REALCOMP 2 beds 2 baths 1296 sq.

Find out if you qualify and take a little off the top of this years taxes. Filers First Name MI.

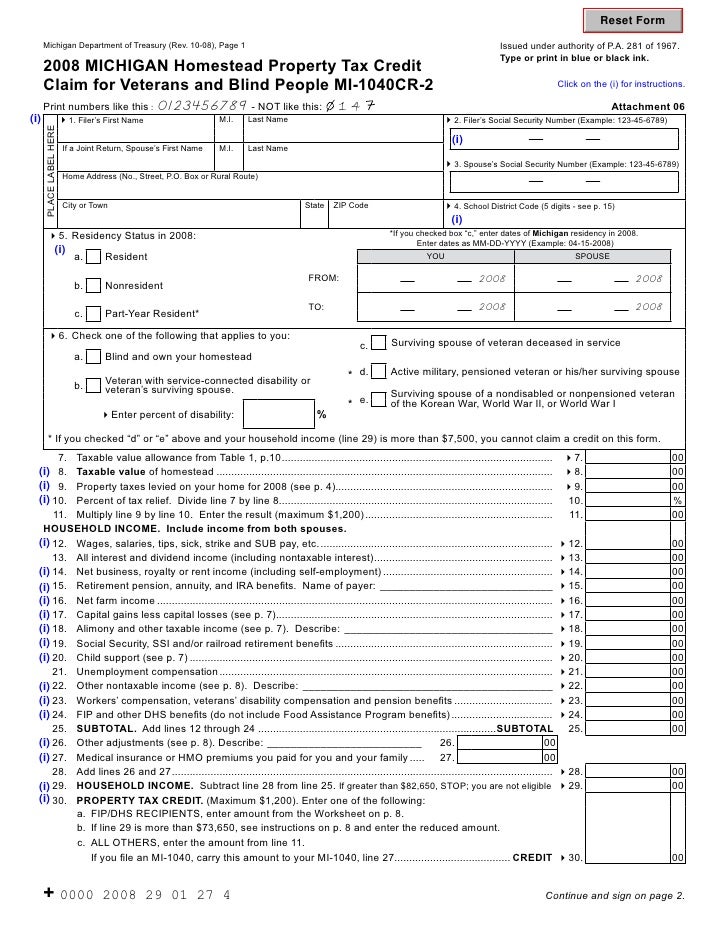

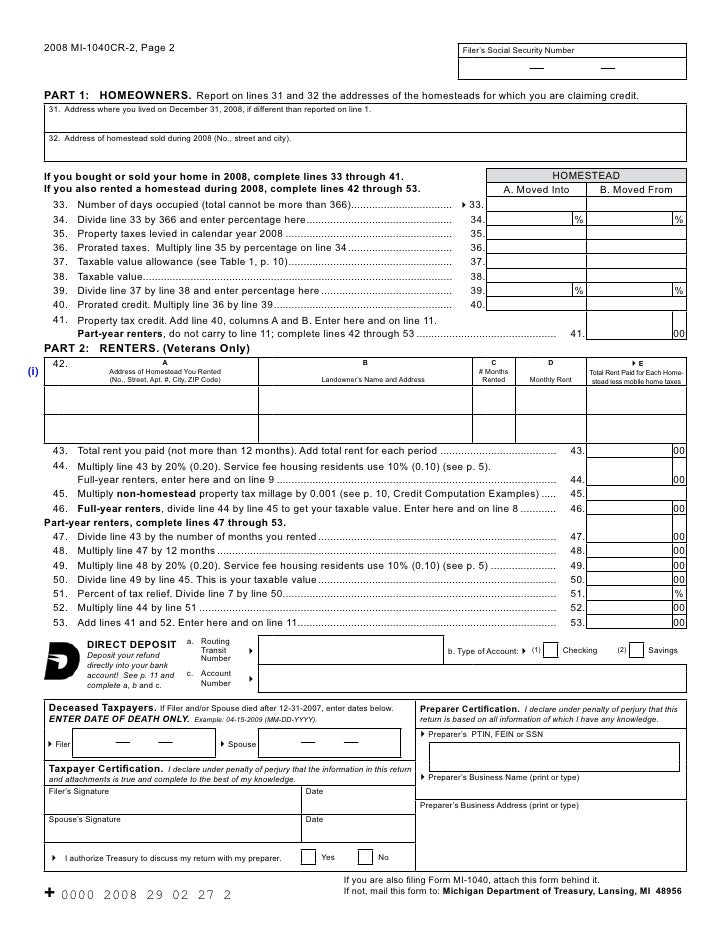

Homestead Property Tax Credit Claim For Veterans And Blind People Ins

Homestead Property Tax Credit Claim For Veterans And Blind People Ins

Applying For The Michigan Homestead Property Tax Credit Advancing Smartly

Applying For The Michigan Homestead Property Tax Credit Advancing Smartly

Homestead Property Tax Credit Claim For Veterans And Blind People

Homestead Property Tax Credit Claim For Veterans And Blind People

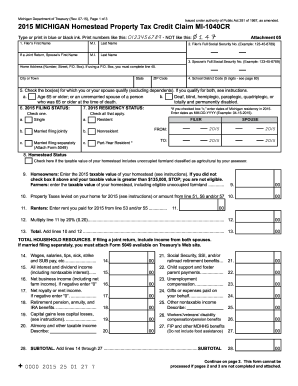

Form Mi 1040cr Homestead Property Tax Credit Claim

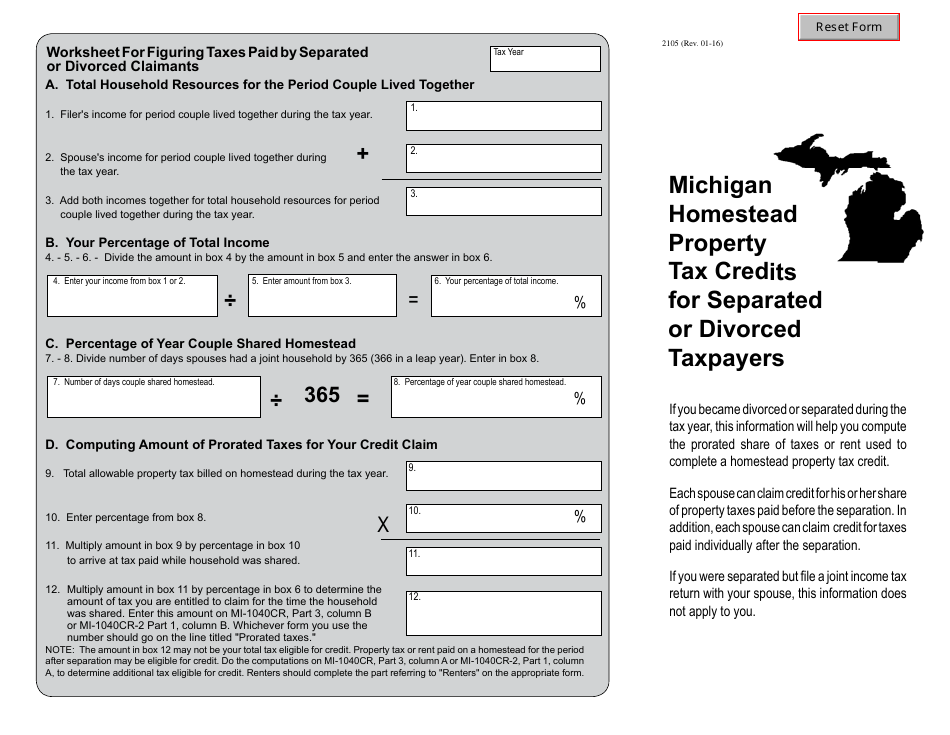

Form 2105 Download Fillable Pdf Or Fill Online Michigan Homestead Property Tax Credits For Separated Or Divorced Taxpayers Michigan Templateroller

Form 2105 Download Fillable Pdf Or Fill Online Michigan Homestead Property Tax Credits For Separated Or Divorced Taxpayers Michigan Templateroller

Https Www Michigan Gov Documents Taxes Resident Rent Or Share Of Facility Property Tax 2016 545635 7 Pdf

My Seven Step Process For Buying A Rental Property Addicted To Roi Buying A Rental Property Rental Property Investment Buying Investment Property

My Seven Step Process For Buying A Rental Property Addicted To Roi Buying A Rental Property Rental Property Investment Buying Investment Property

Form Mi 1040cr 2 2011 Homestead Property Tax Credit Claim For Veterans And Blind People

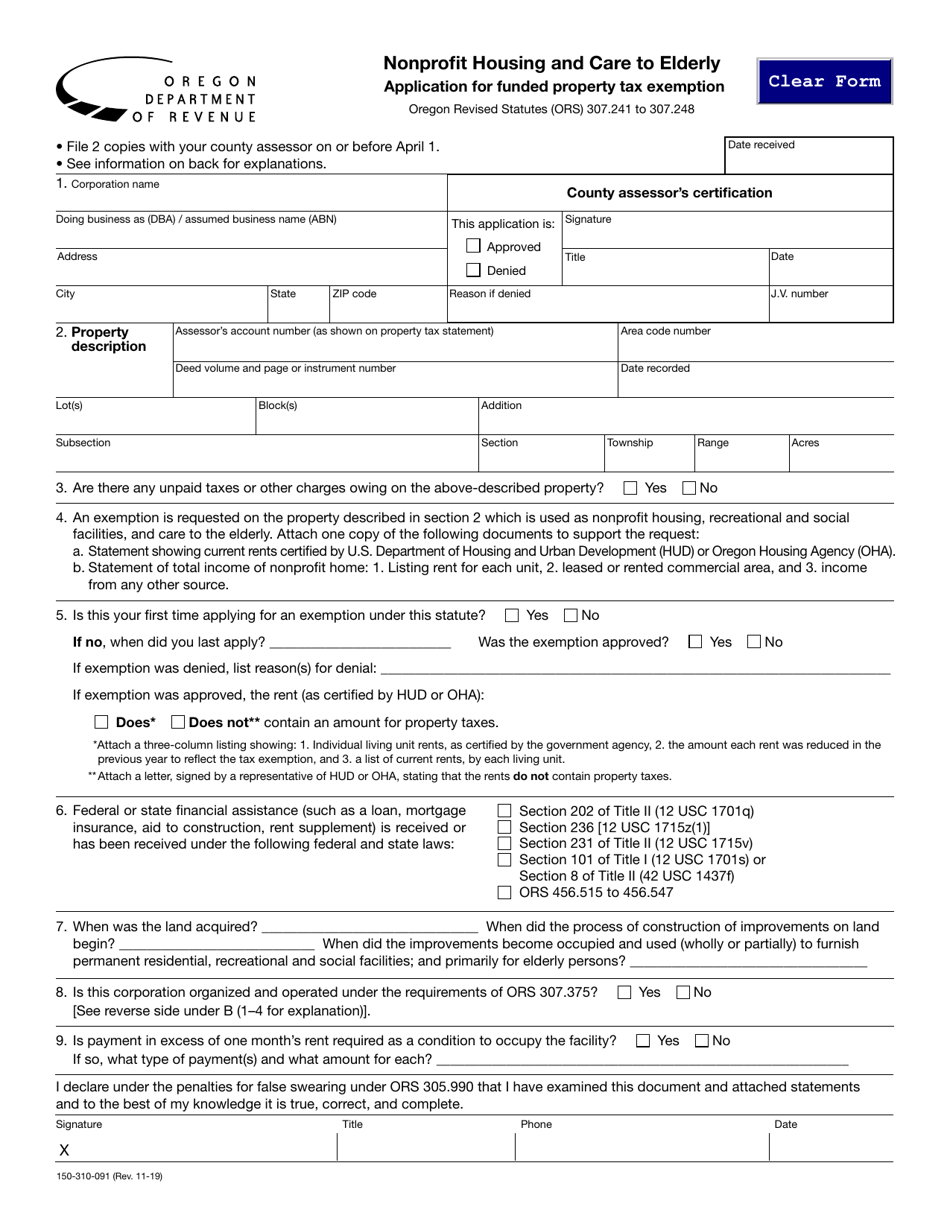

Form 150 310 091 Download Fillable Pdf Or Fill Online Nonprofit Housing And Care To Elderly Application For Funded Property Tax Exemption Oregon Templateroller

Form 150 310 091 Download Fillable Pdf Or Fill Online Nonprofit Housing And Care To Elderly Application For Funded Property Tax Exemption Oregon Templateroller

Https Www Michigan Gov Documents Taxes Resident Rent Or Share Of Facility Property Tax 2016 545635 7 Pdf

Https Www Michigan Gov Documents Taxes 4791 545636 7 Pdf

Pin By Wade Hunsaker On Diligence With Finances Rental Property Investment Real Estate Investing Rental Property Renting Out Your House

Pin By Wade Hunsaker On Diligence With Finances Rental Property Investment Real Estate Investing Rental Property Renting Out Your House

Important Tax Credits Michigan Free Tax Help

Http Origin Sl Michigan Gov Documents Taxes Mi 1040cr 711858 7 Pdf

Https Www Uwwashtenaw Org Sites Uwwashtenaw Org Files Mi 2017 Training 20state 20 Pdf

What Is Michigan S Homestead Property Tax Credit Kershaw Vititoe Jedinak Plc

What Is Michigan S Homestead Property Tax Credit Kershaw Vititoe Jedinak Plc

Homestead Credit Michigan Fill Out And Sign Printable Pdf Template Signnow

Homestead Credit Michigan Fill Out And Sign Printable Pdf Template Signnow

Homestead Property Tax Credit Claim For Veterans And Blind People

Homestead Property Tax Credit Claim For Veterans And Blind People

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home