Wyoming Property Tax Exemption For Seniors

CHEYENNE While rejecting the governors proposed property tax relief for senior citizens on Friday a House committee approved a potential change to the Wyoming Constitution that would create a. Wyoming has no estate or inheritance tax.

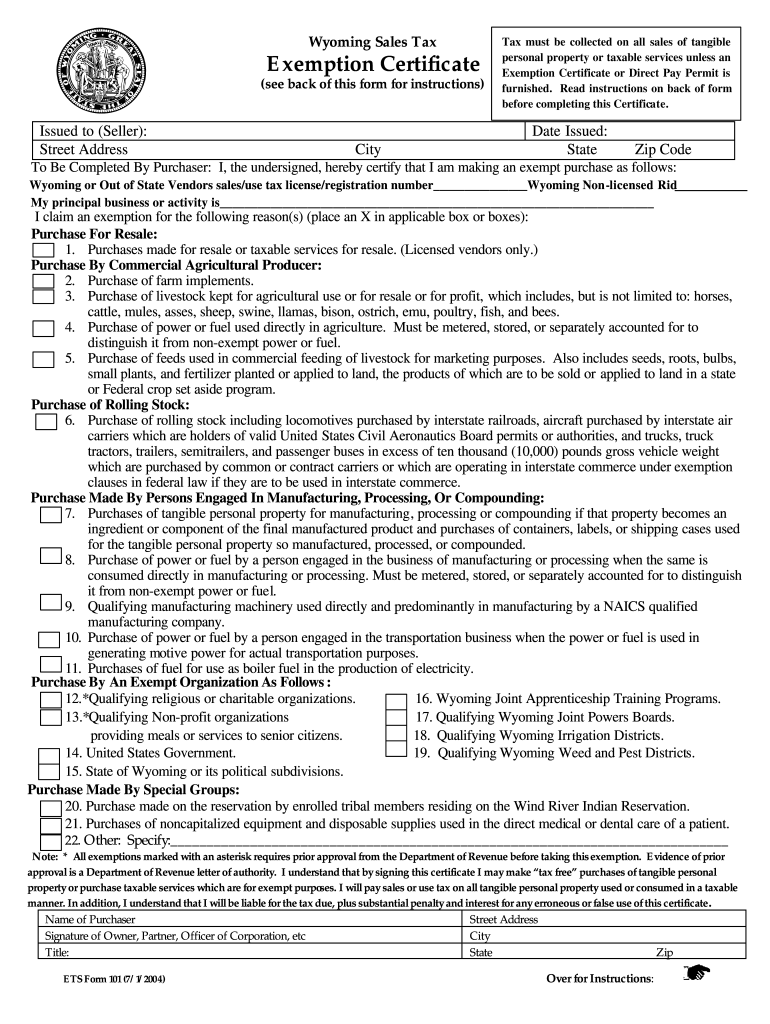

2004 2021 Form Wy Ets 101 Fill Online Printable Fillable Blank Pdffiller

2004 2021 Form Wy Ets 101 Fill Online Printable Fillable Blank Pdffiller

Wyoming homeowners who are age 65 or older or disabled can receive an annual tax refund of up to one-half the property taxes paid the previous year but not more than one-half the median residential property tax liability in their county of residence.

Wyoming property tax exemption for seniors. For the 50 exemption the law allows each county city town village or school district to set the maximum income limit at any figure between 3000 and 29000. Only one spouse must typically be 65 or over if youre married and you own your property jointly. For additional information please see the application.

Property Tax Refund Program. As well as to administer collect and distribute designated taxes in accordance with Wyoming Statutes and Rules for the benefit of Wyoming taxpayers and citizens. Average property tax 432 per 100000 of assessed value 2.

The first 20000 of assessed value of owner-occupied residential property owned by a person age 65 or older or by a person who is permanently and totally disabled is exempt. Veteran of the armed forces of the United States receiving compensation from the United States Department of Veterans Affairs at one of the. Retired from regular gainful employment due to a disability.

To qualify seniors generally must be 65 years of age or older and meet certain income limitations and other requirements. Note that a property will only qualify for a homestead exemption if it is occupied by the person claiming the exemption or his or her family. The forms are due to our office before June 3 2019.

Household assets other than your house a car for each adult household member and IRA and other pension funds worth less than 120339 per adult household member. No estate or inheritance tax. No taxes on Social Security benefits defined benefit plan payments and military retirement plans.

If a taxpayer is qualified there will be a reduction of up to 18 mills of the school operating taxes. The exemption may be used on property tax and it reduces the assessed valuation by 3000 annually. The state and average local sales tax rate is 534.

It does not have its own income tax which means all forms of retirement income will not be taxed at the state level. Principal Residence Exemption PRE Affidavits are filed with our office. Streamlined Sales Tax Project.

Assess value and allocate public utility property. The state pays the exempted portion of the property tax. Tax Rebates for the Elderly and Disabled The funding for this program was reinstated for 2019.

Eligible property must be owned by the Veteran and or Spouse as of January 1st and be their primary residence. Also if a person entitled to a Wyoming homestead exemption dies and he or she leaves behind a widow a widower or minor children as survivors then the survivors will be entitled to the homestead and it will be exempt from the debts of the deceased. The mission of the Property Tax Division is to support train and guide local governmental agencies in the uniform assessment valuation and taxation of locally assessed property.

Combined service-connected evaluation rating of 80 or. Of course there are qualifying rules for all these tax breaks and the first of these is your age. 2019 Median Property Tax.

Property tax paid timely. Household income less than the greater of 34 of the county or state median household income. Ownership andor possession after November 1 will qualify you for the following tax year.

No taxes on federal government income and some state and local government income. Sales Use Tax Exemption Reports. You must meet the minimum age for a senior property tax exemption The person claiming the exemption must live in the home as their primary residence The minimum age requirement for senior property.

The average effective property tax rate in Wyoming is just 057. A property tax exemption is available to senior citizens surviving spouses of senior citizens and disabled veterans. Household goods and personal effects not used for commercial purposes.

For those who qualify 50 of the first 200000 in actual value of their primary residence is exempted. Due to Department of Revenue budget cuts Property tax relief will not be funded in 2021 for 2020 tax year. The tax dollar amount varies depending on mill levy for tax district.

Wyoming Fire Safe Cigarettes. Resident of Wyoming for past 5 years. As noted these exemptions are generally reserved for those who are age 65 or older.

At least 61 years of age or older. Below is a representative nonexclusive list of property that may be exempt from property tax. Wyoming may be the most tax-friendly state south of Alaska.

Homeowners 65 and older exempt from state property taxes. To receive this exemption you must own and occupy your home before June 1 for the summer tax bill and before November 1 for the winter tax bill.

Read more »