Nyc Property Tax Telephone Number

The Department issues the appropriate annual tax bill predicated on the final assessed value. Log in to your account.

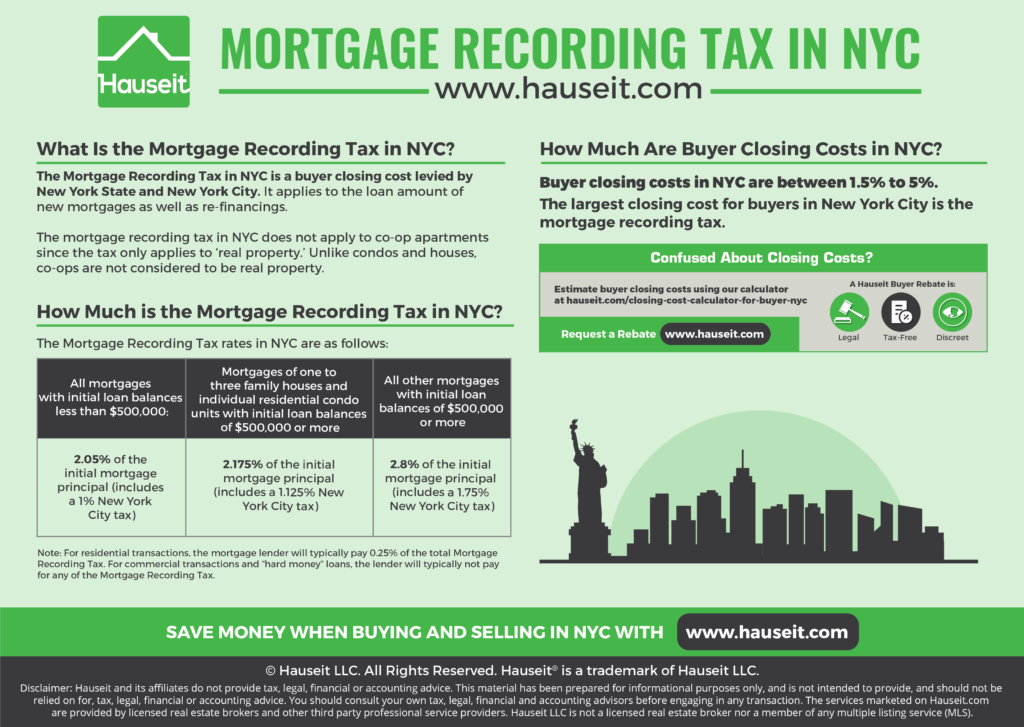

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2021 Hauseit

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2021 Hauseit

Respond to your notice or bill online.

Nyc property tax telephone number. NYC is a trademark and service mark of the City of. If youre interested in making a contribution review our guidance to learn more. Directory of City Agencies Contact NYC Government City Employees Notify NYC CityStore Stay Connected NYC Mobile Apps Maps.

Contacting New York State Department of Taxation and Finance - by phone or otherwise. The FY 2019 Budget created a new Charitable Gifts Trust Fund in the joint custody of the New York State Commissioner of Taxation and Finance and the State Comptroller to accept donations for the purposes of improving health care and public education in New York State. Self-help services are available 247.

If you have questions about your outstanding violations or payments please contact the Department of Consumer Affairs customer service call center at 212 487-4397. Simply begin by searching for a property by address or borough-block-lot BBL number. Customer service representatives are available to assist you Monday through Friday during normal business hours.

Enter your billing address and Borough-Block-Lot BBL number. Disagree with your personal income tax refund. Business Taxes Audits Appeals.

You will need your case number from your bill or notice and the following information from an income tax return for one of the last four years. If you have any questions contact us. Contact Housing Preservation and Development at 212-863-8494 For Mitchell-Lama Redevelopment Company developments Article XI co-ops Federally-assisted co-ops.

Property Assessments Assessment Lookup How to Challenge Your Assessment Assessment Challenge Forms Instructions Assessment Review Calendar Rules of Procedure PDF. To set up auto pay. View your property tax bills annual notices of property value NOPV and other important statements.

Property tax payment notifications. 2021 All Rights Reserved NYC is a trademark and service mark of the City of New York. Online Services Respond to a department notice demo.

Apply for tax exemptions and see which exemptions you already receive. Temporary Assistance Centers Hours Locations. 9 rows realpropertytaxnygov.

Directory of City Agencies Contact NYC Government City Employees Notify NYC CityStore Stay Connected NYC Mobile Apps Maps Resident Toolkit. Property Tax Bills Bills are generally. Include DOFs phone number 212 291-4085 and zip code 07101.

While 518-457-5181 is New York State Department of Taxation and Finances best toll-free number it is also the only way to get in touch with them. Looking for a partner for next event training or presentation. New York State Department of Taxation and Finance.

You can set up an auto payment of your property tax from your bank account through a bank or bill pay website. Add NYC Department of Finance as a new payee. Jamestown NY 14701 This TAC is currently closed Office Information 716-961-5100.

Your billing address and BBL are on your property tax bill. New York NY 10038-4648 Refunds and Credits If you overpay your property taxes or other property charges or were given a credit after you got your tax bill the extra money will automatically be applied as a credit to future payments. Call 212-NEW-YORK or 212-639-9675 Out-of-City TTY 212-639-9675 Hearing Impaired Cash Bail.

The next best way to talk to their customer support team according to other New York State Department of Taxation and Finance customers is by telling. Pursuant to the New York State Real Property Tax Law The Department of Assessment and Taxation is responsible for the implementation of a fair and equitable assessed valuation of all property within the City of Buffalo. Pay using Quick Pay for individuals only Pay directly from your bank account for free.

Available 24 hours New York City Personal Income Tax and Sales Tax. City of New York. The Town Of Babylon 200 E Sunrise Highway Lindenhurst NY 11757 Phone.

Which is your borough block and lot number on any payment that you mail to us along with the tax period the payment is for.

Read more »