Uk Property Tax Wear And Tear Allowance

Income tax on UK property. Claiming Wear and Tear Allowance or Replacement Relief.

Uk Tax Archives The Evidence Based Investor

Uk Tax Archives The Evidence Based Investor

The wear and tear allowance is 10 of the relevant rental amount.

Uk property tax wear and tear allowance. How its worked out. Wear and tear allowance Until the 5 th of April 2013 landlords of furnished property were able to claim 100 of the cost of replacing items such as cookers fridges TVs etc known as the renewals basis or a 10 wear and tear. We may terminate this trial at any time or decide not to give a trial for any reason.

Now you will have to provide itemised receipts if you wish to have the costs deducted from your tax. It is a deduction against rental profits and is calculated at 10 of rent less rates commonly referred to as net rent. The Wear and Tear Allowance for fully furnished properties will be replaced with a relief that enables all landlords of residential dwelling houses to deduct the costs they actually incur on.

Wear tear allowance. A taxpayer is allowed to claim simultaneously both repairs and renewals expenses and the 10 wear and tear allowance. In a fully furnished property whereas the repairs.

Money and tax Passports travel and living abroad. UK property SA105 Help and support for. The claim is made in box 34 of page SA105 Income from UK property.

The complete guide for 20192020 03 Taxes for UK landlords. Tax accounting and audit services. As of April 2016 landlords can only claim for wear and tear costs they have actually incurred.

This allows the landlord to deduct 10 of net rents to cover the cost of replacing furniture furnishings and fixtures when working out the profit of the overseas property business. The Alternative The Renewals Allowance. Previously a landlord could claim 10 of their net rent as tax relief for wear and tear even when there was little or no expenditure on fully furnished properties.

How rents from UK properties are taxed Cookies on GOVUK. Tax relief for residential landlords. As things stood before landlords were allowed to deduct an annual allowance for wear and tear from their taxable profits.

The complete guide for 20192020 Getting on top of capital gains tax stamp duty corporation tax expenses and all the other things landlords have to think about can be a minefield. Thats where this guide comes in. Sales acquisitions and flotations.

However obviously you understand that the 10 wear and tear allowance applies to furniture etc. As much as is. Wear and Tear Allowance is available to landlords renting out a furnished property.

How to Calculate the Allowance. This allowance has been replaced by a relief that only allows landlords to claim tax relief when they replace furnishings. 02 Taxes for UK landlords.

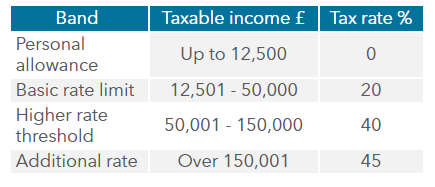

The simplest method is the wear and tear allowance. Landlords claim 10 Wear and Tear Allowance by completing the relevant boxes on the property pages of their self-assessment tax returns for 2015-16 tax year. UK income tax facts and figures 20202021 In the UK there is an income tax-free personal allowance and it is available to all non-resident British expats.

Income from British property is taxable as income in the UK. Wear and tear allowance. The 10 wear and tear allowance is claimed on the property supplementary pages of the self-assessment tax return.

HMRC will update the forms for claiming Replacement Relief in the 2016-17 tax year. Details This legislation will replace the wear and tear allowance for fully furnished properties with a relief that enables all landlords of residential dwelling houses to deduct the costs they. Tax-free allowances on property and trading income.

You cannot claim wear and tear allowance on a property you are not letting as fully furnished. Free trials are only available to individuals based in the UK. The relevant rental amount is.

The receipts from furnished residential lettings recognised in arriving at the profits.

Read more »