Property Tax Deduction Married Filing Separately

Married filed separately - house is in wifes name pays all expenses from account solely in her name - can she take the total property tax deduction max 10k. The maximum credit per return is 650 and the amount you may qualify for depends on your MAGI less exemption amounts.

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Filing separately to guard the future.

Property tax deduction married filing separately. Couples who reside in one of the nine community property states must follow special rules for allocating income and deductions when they file separately. You may claim itemized deductions on a separate return for certain expenses that you paid separately or jointly with your spouse. First the spouse who paid an expense that results in a tax deduction should claim the full deduction.

Most deductions will be split evenly with each spouse reporting half the total but some must be allocated separately. If youre considered married on Dec. 31 of the tax year then you may choose the married filing separately status for that entire tax year.

If you file a separate return from your spouse you are automatically disqualified from several of the tax deductions and credits mentioned earlier. The IRS wont apply your refund to your spouses balance due. When paid from separate funds expenses are deductible.

Spouse would have to also itemize and get no standard deduction no property tax deduction just deductions related to himis this correct. First the spouse who paid an expense - non joint account that results in a tax deduction should claim the full deduction. Married filing separately itemized deductions appears to be a complicated issue but in reality it can be quite simple if you follow some basic rules.

As married filing separately if one spouse itemizes deductions the other spouse can not claim the standard deduction. Katrine is not entitled to any deduction related to Cales contribution. If you and your spouse file separate returns and one of you itemizes deductions the other spouse must also itemize because in this case the standard deduction amount is zero for the non-itemizing spouse.

They choose to file separate tax returns each using the Married Filing Separately MFS filing status. 1 Married no children filing separately. Second In community property states expenses paid with community property a joint checking account should be.

Taxpayers married filing jointly with each spouse having an AGI of 500 or more may qualify for a credit depending on their income tax base. You and your spouse can both take the standard deduction instead of itemizing as long as you are both entitled to use this option. When you dont want to be liable for your partners tax bill choosing the married-filing-separately status offers financial protection.

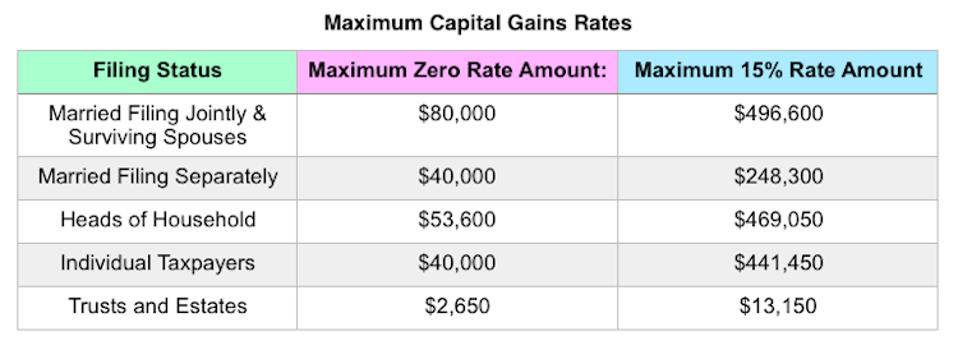

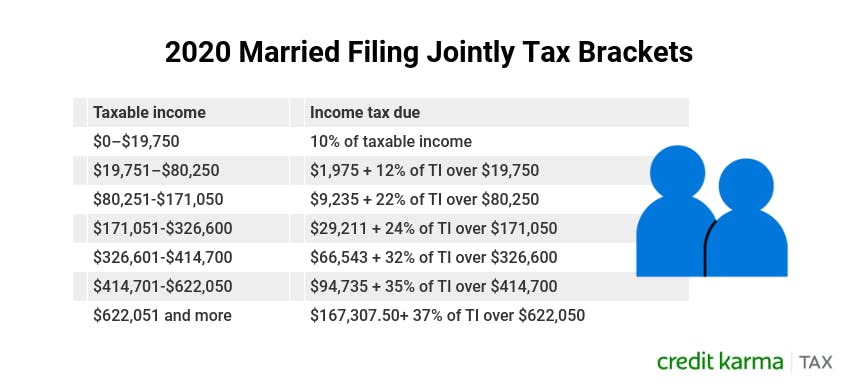

In 2020 married filing separately taxpayers only receive a standard deduction of 12400 compared to the 24800 offered to those who filed jointly. If two spouses cant agree to file a joint return then theyll generally have to use the married filing separately status. Married taxpayers may deduct up to a maximum of 4000 per beneficiary whether their filing status is married filing jointly or married filing separately.

Separate returns make sense to prevent the IRS from seizing a spouses tax refund when the other has fallen behind on child support payments. Taxpayer A has adjusted gross income AGI of 7000 none of which is earned income or other qualifying income. You may be able to claim itemized deductions on a separate return for certain expenses that you paid separately or jointly with your spouse.

The community property states are California Arizona New Mexico Texas Louisiana Nevada Idaho Washington and. Taxpayer B has AGI of 12000 and net income. If you and your spouse file separate returns and one of you itemizes deductions the other spouse must also itemize because in this case the standard deduction amount is zero for the non-itemizing spouse.

Residents with gross income of 20000 or less 10000 if filing status is single or marriedCU partner filing separate return are eligible for a property tax credit only if they were 65 years or older or blind or disabled on the last day of the tax year. Second if you and your spouse paid the expense from a joint account you will need to divide the deduction according to your. The married filing separately status cuts the deductions for IRA contributions and eliminates child tax credits among other tax breaks.

Married filing separately itemized deductions appears to be a complicated issue but in reality it can be quite simple if you follow some basic rules. Married couples who choose not to file joint returns must identify their community income and community deductions so they know how much each spouse should report on a separately filed tax return. Spouses SSN or ITIN this is still required even though you are filing separately from your spouse Spouses date of birth.

If one spouse itemizes deductions then the other spouse must also itemize deductions in order to claim deductions. Joint filing credit. Both have valid Social Security numbers SSNs Married couple no children.

Cale is entitled to a 4000 deduction on his current-year return and has 1000 he can deduct in a future tax year. This is usually the deal breaker for couples who are thinking about filing separately because most dont have enough itemized deductions to split between two tax returns.

Read more »Labels: married, property, separately