What Is Council Tax Property Reference Number

As a part of this initiative the Geospatial Commission has developed a new strategy setting out a coordinated approach to unlock economic social and environmental value from geospatial dataAs a result the Unique Property Reference Number UPRN has been made. The local adjustment factor.

United Kingdom Wirral Council Tax Bill Template In Word Format Bill Template Word Template Templates

United Kingdom Wirral Council Tax Bill Template In Word Format Bill Template Word Template Templates

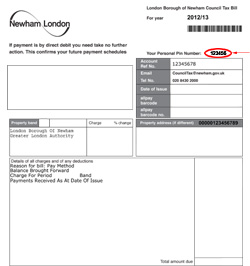

You will find your Council Tax account reference on your bill.

What is council tax property reference number. A UPRN will consist of comprehensive data of a property from the planning stages to demolition. Find out the Valuation Band values. Council tax and coronavirus.

Your account reference is located at the top of the bill. Council tax strategies and policies. 11th September 2017 Council Tax is a contribution that you must make to help pay for local services.

Information for landlords. If the property youve moved into doesnt have a Council Tax band youll need to contact your local council. All properties are assigned to a Valuation Band relating to the value of the property.

What your council tax pays for. How council tax is worked out and council tax bands. Your bill tells you the council tax account reference number for your household.

You will find your Council Tax account reference on your bill. Your Council Tax account number is an eight-digit number that starts with an eight. Search for your local council.

The number is 7 or 11 digits long. There is one bill f. UPRN stands for Unique Property Reference Number and was created by the Ordnance Survey OS.

Since 2015 local authorities can vary the basic LPT rate on residential properties in their area. Advice about council tax scammers. If you are struggling to meet your council tax payments due to the coronavirus pandemic please contact us.

How much are the Council Tax. The basic rates of LPT are 018 and 025. This is a 10-digit number that begins 22.

If you cant pay your council tax. Your online reference number is shown on the front of your latest Council Tax bill or recovery notice and will be located under your Council Tax account reference. Where you can find your council tax account number You can find your council tax account number in the top right-hand area of the first page of a council tax bill or summons notice.

You can also use Self Service to manage your Business Rates account and Housing Benefit or Council Tax Support. Find out the Council Tax band for a property in England Scotland or Wales by looking up the propertys postcode online Check your Council Tax band - GOVUK Cookies on GOVUK. Theyll arrange for your property to be assessed.

Your tax reference indicates which employer you are working for and appears on your payslip or letters from HMRC. We will only issue you with an account number after you have told us your are moving into a property. A UPRN is a unique reference number given to every location in Great Britain with an addressUPRNs are created solely by local authorities and shared by government agencies including the Valuations Office Agency and Ordnance SurveyThey ensure we have a consistent identifier for a property which helps us link up various processes such as planning permission street naming.

The Council decides on the Council Tax for each Band every year in FebruaryMarch. Your Council Tax reference account number and online key are printed in the top right corner of your latest bill or summons notice. Council Tax reference number and online key.

It consists of numbers of up to 12 digits in length. Revenue has developed an on-line calculator that you can use to work out how much Local Property Tax should be paid on your property based on your self-assessed valuation. Find out where your Council Tax goes and how much the District Council gets in our Council Tax Guide for 202122.

Local governments in the UK have allocated a unique number for each land or property. You must use this reference number when managing. Tell us that someone has died.

If you dont already have one you will need to register an account then our Self Service pages give you instant access to manage and view your Council Tax account. The Council Tax is based on the value of the subject property on 1 April 1991. The trend towards making key national data open for all citizens and organisations to use within the UK is gaining momentum.

Though they sound the same a tax reference number shouldnt be confused with a Unique Taxpayer ReferenceThey are separate numbers relating to different things.

Read more »