How To Avoid Property Tax Reassessment

To avoid inadvertently triggering reassessment property owners should also consult with legal counsel before transferring real estate into or out of legal entities and before making intrafamily transfers of interests in legal entities that own California real estate. A A sale of property to your child in exchange for a promissory note is a change of ownership for property tax purposes and the current parent-child exemption applies to.

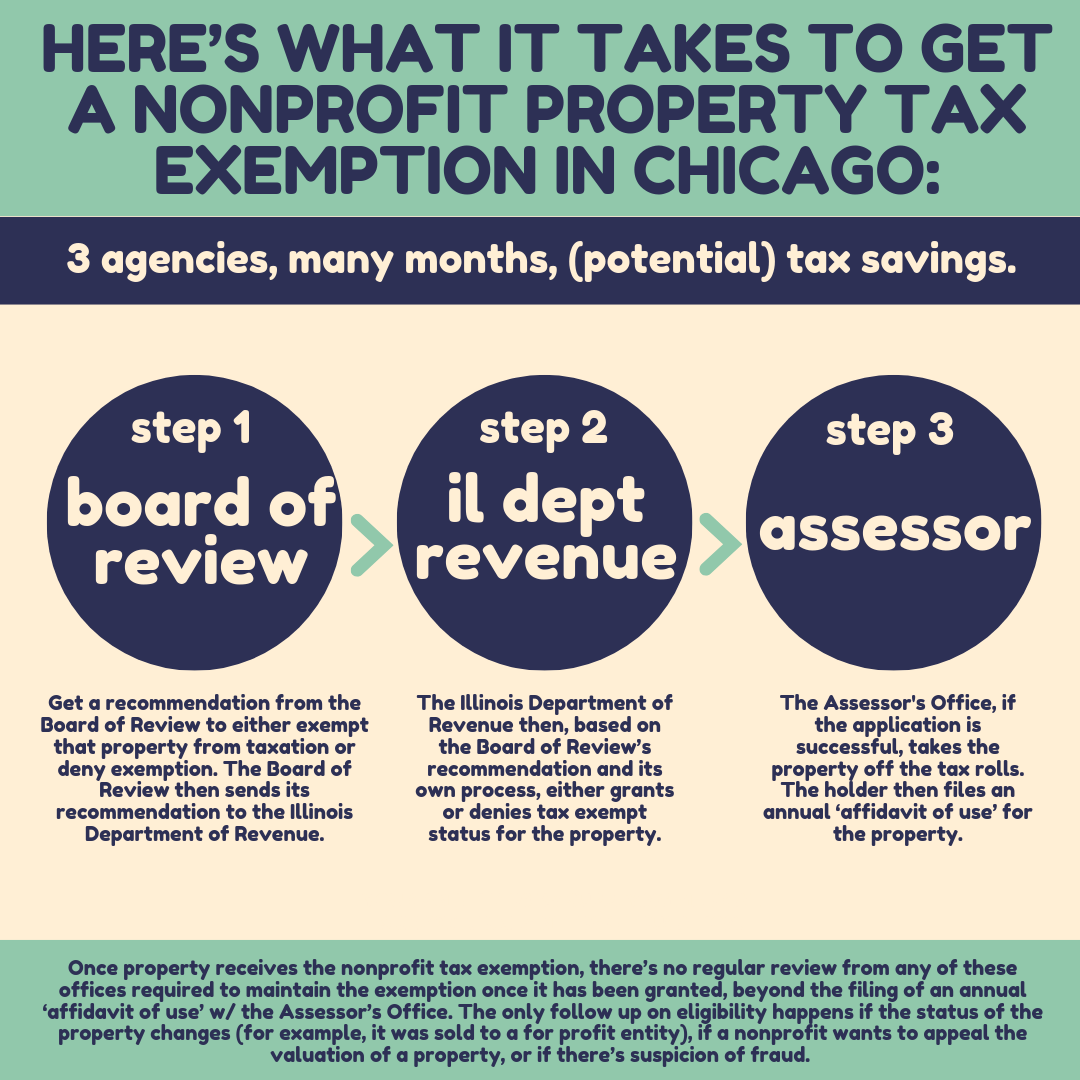

Here S What It Takes To Get A Nonprofit Property Tax Exemption In Chicago By H Medium

Here S What It Takes To Get A Nonprofit Property Tax Exemption In Chicago By H Medium

But if you have to transfer ownership or sell the property then make sure your transfer or sale qualify for one of the following exclusions.

How to avoid property tax reassessment. Commercial real property is exempt for reassessment if the proper forms are filled out on a timely basis. California Proposition 58 has eligibility requirements. There is no state property taxProperty tax brings in the most money of all taxes available to local government to pay for schools roads police and firemen emergency response services libraries parks and other services provided by local government.

The key to avoiding property tax increases is to avoid a change in ownership. In other words a beneficiary buyout of co-beneficiary property shares while avoiding property tax reassessment can be re-drawn so there is no 12-month deadline for beneficiaries to follow Plus the ability to avoid property tax reassessment on certain investment properties that have revenue potential. Under the new law a parent may only transfer their primary residence meaning they filed a homestead exemption for the residence to their child at a value of up to 1 million and the child must live in the property as their primary residence for the transfer to be excluded from property tax reassessment.

Property tax in Texas is a locally assessed and locally administered tax. But if you have to transfer ownership or sell the property then make sure your transfer or sale qualify for one of. Under certain conditions as described below a taxpayer who is 55 years of age or older may transfer the Proposition 13 base-year assessment value of his or her principal residence to any replacement dwelling of equal or lesser value in the same county and sometimes in another county Cal.

Is there a property tax reassessment exemption for taxpayers 55 years of age or older. You move your industrial property into an LLC so you can protect yourself while renting it out accidentally triggering a reassessment because you didnt file the right form on time. A process needs to be done correctly and proper documentation needs to be filed in order to receive and exclusion from property reassessment on a parent to child transfer of real estate.

The key to avoiding property tax increases is to avoid a change in ownership. Principal residence exclusion. A transfer of your principal residence to your child may be fully excluded from property tax reassessment regardless of.

You do not consider creating a Family Property LLC to protect your properties from reassessment when you die. Without proper Trust drafting the only way to avoid such a tax penalty is through hard-money loans that will typically carry interest at 10-15 and add approximately 5000 or. Transfers Between Parents and Children RT 631.

Change in Ownership Exceptions. A transfer of a principal personal residence and up to 1000000 of assessed value before death of other ie. One of the stipulations is that when a parents home is held in a trust an equal distribution of the trust assets must be made to qualify for.

Read more »Labels: property, reassessment