New York Mansion Tax Commercial Property

New York State Real Estate Transfer Tax Regulations. The New York City NYC mansion tax is a residential real estate transfer tax imposed on property purchases with a price over a specific dollar amount.

The Nyc And Nys Transfer Tax Rptt For Sellers By Hauseit Medium

The Nyc And Nys Transfer Tax Rptt For Sellers By Hauseit Medium

THE ORIGINAL MANSION TAX A brief history of the Mansion Tax is in order.

New york mansion tax commercial property. It is a 1 percent tax imposed on such purchases which means that you or your buyer will pay a minimum of 10000 to satisfy the New Jersey mansion tax. On October 19 1987a day known as Black Mondaythe stock market crashed. Mansion Tax New York State also imposes a mansion tax on transfers of residential real property including cooperative apartments for consideration of 1 million or more.

The mansion tax which applies throughout New York is payable by the buyer unless the buyer is exempt in which case the mansion tax is payable by the seller. As necessary they have been edited to apply specifically to the additional tax. Unlike the transfer tax the mansion tax is the responsibility of the buyer or grantee.

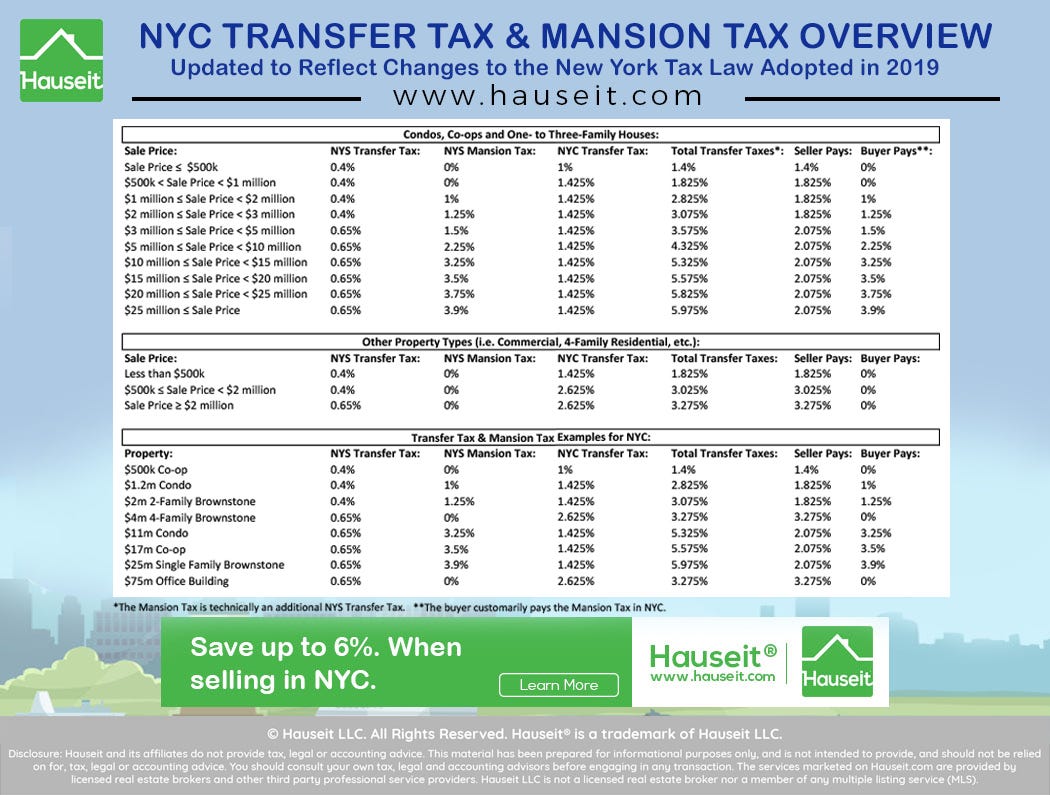

DUAL COMMERCIALRESIDENTIAL TAXATION The basic New York State transfer tax rate is 400 per thousand of consideration no matter what the consideration amount is. NYS Transfer Tax Rate Commercial Under 2 million 04 04 2 million up to 3 million 04 065 3 million or more 065 065 Mansion Tax For transfers of residential real property located in New York State when the total consideration is 1 million or more the Mansion Tax is imposed at a rate of 1 of the total consideration paid. The new rates start at 1 beginning with properties of 1000000 or greater and gradually increase to a maximum of 39 for properties purchased for 25000000 or greater.

In NYC commercial purchases of over one million dollars are not to subject to mansion tax but are subject to a higher rate of RPT transfer tax 2625. The mansion tax is one of the largest potential closing costs when buying a condo co-op or residential home for most New Yorkers. The Mansion Tax is in addi-tion to the New York State Transfer Tax.

A mansion tax is property tax imposed at closing on residential property equalling 1 million and up. The tax was paid by. The tax was first introduced in 1989 when 1 million would have afforded anyone.

The highest tax rate of 39 applies to sales of 25 or more. The second transfer tax on conveyances of real property imposed by New York State is the 1 Mansion Tax which applies to sales of residential property where the consideration of the sales is 1 million or more. Buyers of residential properties priced at 1 million or more in NYC are also required to pay an additional NYS Transfer Tax called the Mansion Tax.

For fiscal year 2020 the statewide mansion tax will remain at 1 percent for property purchased for 1 million or more. The new law levies an additional tax of 125 for each 500 or portion thereof of consideration on transfers of i residential property where consideration is in excess of 3 million and ii commercial property where consideration is in excess. Beginning on July 1 2019 certain conveyances of real property or interests therein located in New York City other than conveyances made pursuant to a binding written contract entered into on or before April 1 2019 are also subject to the following taxes.

On March 31 2019 the New York state Senate and Assembly agreed upon a new schedule of mansion tax rates as part of New Yorks 2020 budget. The mansion tax is payable by the buyer unless the buyer is exempt in which case the tax becomes payable by the seller. For properties in New York City however the new mansion tax will rise incrementally with purchase prices of 2 million or more capping out at a total of 390 percent for properties sold at 25 million or above.

The mansion tax applies to real estate purchases over 1 million. NYS transfer tax prior to the change was 2 for every 500 or fraction thereof of consideration subject to limited exceptions and exemptions. New York State Mansion Tax Buyers Beware.

Krasner Warshaw Burstein LLP was 1 million or more hence the term Mansion Tax. If you are lucky enough to afford a home valued at over a million dollars you should be aware that New York Tax Law Section 1402-a imposes a 1 tax upon the buyer in the purchase of residential one two or three family homes including condominium or cooperative units. Real property - means every estate or right legal or equitable present or future vested or contingent in lands tenements or.

This tax applies to both Class 2 and Class 4A Commercial properties. An additional tax of 1 of the sale price mansion tax applies to residences where consideration is 1 million or more. Historically this tax has been always a 1 tax on the purchase price regardless of amount above 1 million.

The Mansion Tax is between 1 and 39 of the sale price and there are 8 tax brackets which increase based on the sale price. The decline amounted WRITTEN BY Harvey I. The City of New York will tax the transfer of less than a 50 interest in an entity owning real property as if it is a controlling interest transfer when the property is transferred to a new entity in which the difference in ownership between it and the transferor is only to the extent of a minority ownership interest.

Recently the state the has converted the tax to a progressive system based on price brackets.

Read more »