Can You Go To Jail For Unpaid Property Taxes

There are stipulations to this rule though. Paying someone elses property taxes doesnt necessarily mean you get the property.

Computation Of Income From House Property House Property Self Investing

Computation Of Income From House Property House Property Self Investing

The short answer is maybe.

Can you go to jail for unpaid property taxes. And of course my best advice is not to engage in tax fraud or tax evasion since they are probably the only reason you could go to jail because of unpaid taxes. In rare situations some states may lock you up if you fail to file or pay taxes. Yes late filing is a serious non-compliance issue.

If the delinquent taxes are not repaid within the set time frame the property will be put up for auction in a tax. Just be sure not to write any bad checks when paying back the loan. If you owe back property taxes will you not get a tax refund.

Yes but only in. If you owe taxes and dont file your tax returns on time youll be subject to penalties amounting to 5 per month of the taxes you owe up to 25 Worse interest on unpaid taxes continues to compound daily which is known as the failure-to-file penalty. This may have you wondering can you go to jail for not paying taxes.

For example filing a false tax return or concealing taxable property or income. However you should be aware that there are certain situations that can lead to jail time in relation to the outstanding debt. And if you deliberately try to trick the IRS you may be risking jail time.

Learn how and when you can take someones property by paying taxes. Furthermore the IRS cannot simply take your bank account your car or your house. You can go to jail for lying on your return.

In San Francisco those who do not pay their property taxes on time are subject to a 10 percent penalty on the unpaid portion. Making an honest mistake on your tax return will not land you in. Property tax liens are issued by the county when property taxes go unpaid.

But you cant go to jail for not having enough money to pay your taxes. Yes You Can Go To Jail. Failing to Pay Income Taxes.

The Georgia Department of Revenue used to allow you to search for delinquent taxpayers who have had a tax lien filed in their name. The sheriff who collects the taxes can then sell the lien at a tax lien sale which is a public auction sometime after October 14 and before November 23. Fortunately this practice has been outlawed in modern society.

Any action you take to evade an assessment of tax can get one to five years in prison. It would take a lot for the IRS to put you in jail for fraud. Should they fail to.

Two unpaid debts you can be locked up for The first debt that you can indeed be prosecuted and put behind bars for is failure to pay taxes better known as tax evasion or in the words of the IRS tax fraud. The short answer is. As with the IRS a state would have to prove your willful intent to defraud or evade paying taxes.

If you fail to pay the amount you owe because you dont have enough money you are in the clear. You can go to jail for not filing your taxes. In the past it was possible to be sent to debtors prison for leaving your civil debts unpaid.

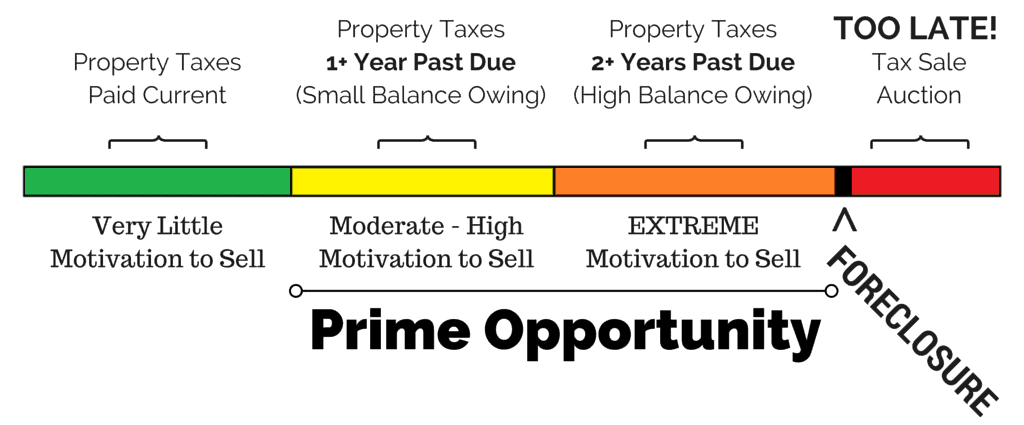

Learn about your options to avoid a tax sale if you cant keep up with the property taxes Notice Youll Get Before the Tax. You can go to jail for cheating on your taxes but not because you owe some money and cant pay. Can You Go to Jail for Civil Debt.

If youre prosecuted for this its possible that you could go to jail. Today in the United States no person can be sent to jail for failing to pay civil debt or debt between two non-government entities such as credit card debt or unpaid medical bills. They can still land you in legal trouble.

Do Delinquent Property Taxes Mean No Income Tax Refund. The statute of limitations for the IRS to file charges expires three years from the due date of the return. There are however two instances in which debt can land you in the slammer.

To better understand these distinctions lets take a closer look at when you risk jail time for failing to pay your taxes. Its illegal for payday lenders to threaten you with jail over unpaid loans. You may even face wage garnishment or property seizure.

But sometimes it does. You can always do your research and prepare yourself looking for the most common ways to pay taxes which taxes you have to pay why and when. And you can get one year in prison for each year you dont file a return.

Oftentimes youll be subject to tax penalties which will run you a pretty penny at up to 50 of your unpaid tax amount. Rather your local taxing authority will begin charging interest on your unpaid taxes but if youre able to catch up in a relatively short time frame you can avoid the harsh consequences. In fact the IRS cannot send you to jail or file criminal charges against you for failing to pay your taxes.

Not paying your income taxes is a crime.

Read more »