Property Tax Inquiry North Vancouver

While payment is made in the middle of the year it covers the time period of January 1 to December 31 of the current year. The annual property tax bill includes both municipal taxes and levies collected on behalf of schools BC Assessment Authority Greater Vancouver Regional District TransLink and the Municipal Finance Authority.

Taxes Utility Fees.

Property tax inquiry north vancouver. My Utility and Tax Account is a secure online service that allows property owners and utility customers to view information regarding their District of North Vancouver accounts 24 hours a day. These statements are for water sewer both sanitary and storm and curbside pick up of. Property tax is payed annually by the homeowner.

Metro Vancouver Planning Policy and Environment Department. Receive your tax notice and utility invoice via email no more paper. Various individuals at the Vancouver Sea-to-Sky North Fraser South Fraser and Fraser Valley Offices of BC Assessment.

The Home Owner Grant page will no longer work in Internet Explorer. While homeowners in the UNA pay a Rural Tax to the BC government and the Services Levy to UBC the two added together are the SAME as the City of Vancouver municipal tax for a. Thursday July 2 2020.

Tsleil-Waututh Nation 3178 Alder Court North Vancouver BC V7H 2V6 General Inquiries. Property tax and utility balance. Metered Utility Statements are mailed out four times a year.

Date of next tax sale or listing of properties. View your property tax and utility balance. On January 1 2021 all outstanding 2020 property taxes will be moved to arrears and an interest charge of 545 effective July 1 2021 will incur.

Its easy and safe. Remember to claim your Home Owners Grant by. Greater Vancouver Property Tax And BC Assesment Frequently Asked Questions.

Stormwater right-of-way charge. It consists of municipal and provincial part so the exact rate is different for each municipality. Property tax bills are mailed out each year in mid-May.

BC Municipalities Property Tax Calculator This calculator can help you determine the property taxes in more than 160 different jurisdictions across British Columbia. July 5 2021 Grant may be claimed once the main tax notice is received. The results are based on proper.

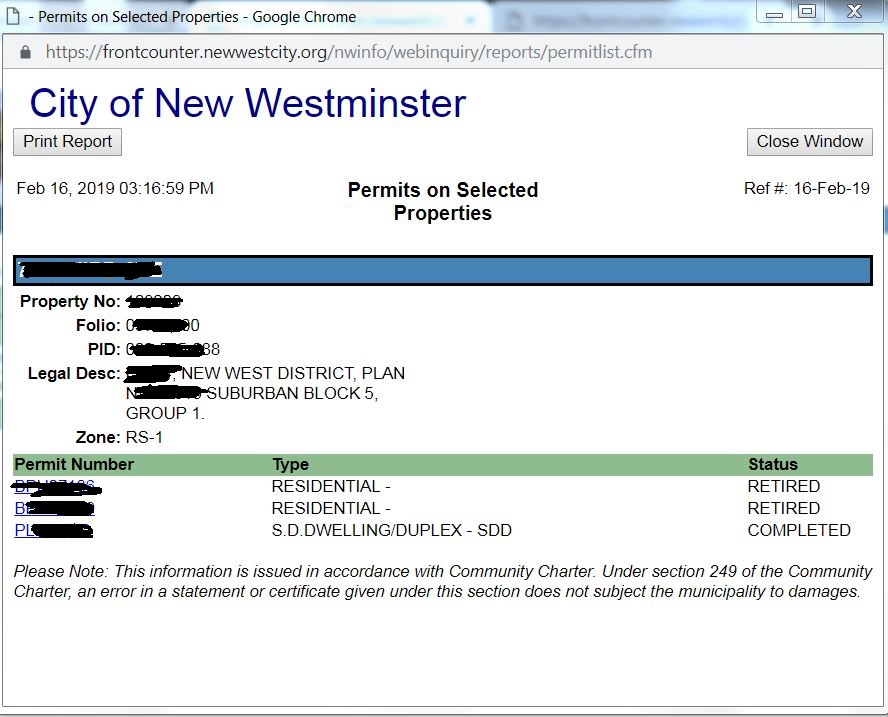

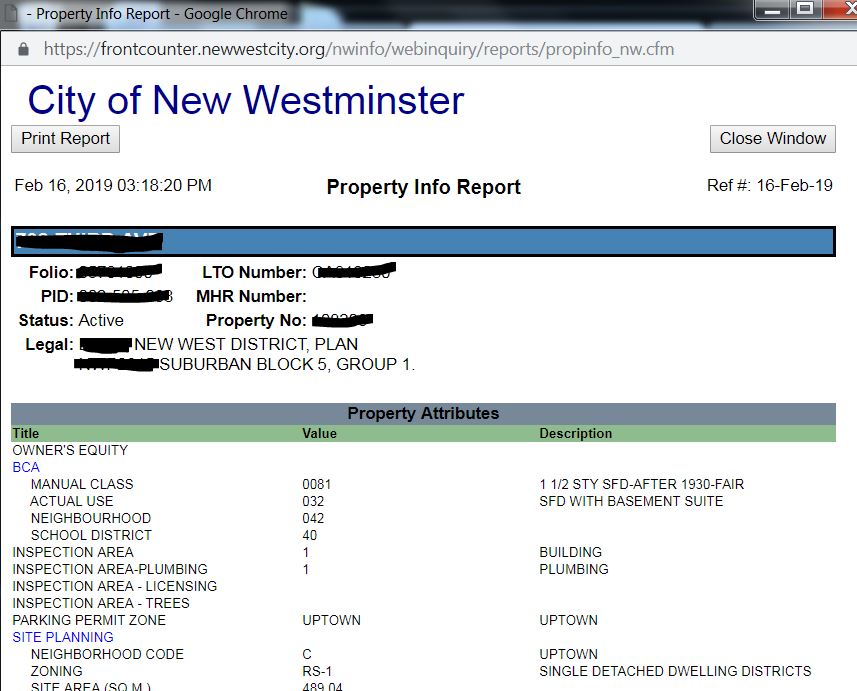

UBC is required to ensure that the total property taxes paid by UNA homeowners is the same as the property taxes of a comparable property in the City of Vancouver. The tax is based on unified BC value assessment of. Look up a property to get information about property tax levies assessed property values legal description of property utility charges local improvement information other property information.

February 2 2021 Main taxes. Property tax sale. Property Tax Account Information City of North Vancouver Property Tax Account Information Property owners can view their tax transactions balances and billing summaries from current and previous years online.

Due to physical distancing requirements we encourage you to pay online via your financial institution. Welcome to the District of North Vancouvers Property Information Inquiry Instructions for using the Property Information Inquiry Service. Property tax and utility 2020 City of Vancouver 2020 City of Vancouver.

Property Tax Notices are mailed out in May and are due each year on the first business day in July. The home owner grant reduces the amount of property taxes you pay each year on your principal residence. Search for City of North Vancouver under payee.

Property tax due dates. Communicationstwnationca More contact information Facebook. Use the Search tab to add properties to your selection list.

To claim your Home Owner Grant you will need your Roll Number and Access Code located on the front top right portion of your Property Tax Notice. 355 West Queens Road North Vancouver BC V7N 4N5. Please enter your 12-digit folio number in full and with dashes to avoid receiving multiple results.

Type in your address folio PID or plan number as displayed in the search examples shown below. Information about objectives and policy options for the municipal commercial tax system. The City of Port Coquitlam collects property taxes each year to pay for a range of services.

Follow us on Twitter. If youre a senior aged 65 or older your property is assessed at 1625000 or less and you meet certain requirements you may be eligible for the additional grant of. Areas for further investigation were completed in conjunction.

Common questions and information regarding tax bills during COVID-19. And individuals with the property tax departments of the concerned municipalities. It is fast and easy to sign up.

Whats the difference between Property Tax and Property Transfer Tax. Review your tax account activities history and assessment information. Arrears taxes 2019 outstanding will be moved to delinquent and if these property taxes plus any delinquent interest are not paid by Friday September 24 2021 the property will go for Tax Sale on Monday September 27 2021.

Basic property information is available using the above tabs at no charge. July 5 2021 Home owner grant. No login or registration required.

Read more »