New York Enhanced Property Tax Credit

The New York City enhanced real property tax credit can get renters up to 500 back on their New York State tax returns. What is the New York City enhanced real property tax credit.

Https Www Budget Ny Gov Pubs Archive Fy21 Exec Book Briefingbook Pdf

The average tax break is about 790 a year while.

New york enhanced property tax credit. The credit can be as much as 500. You may apply for Enhanced STAR if you are a Basic STAR recipient and are eligible for Enhanced STAR. If you are receiving an Enhanced STAR exemption or credit you will not be affected by the new law.

No more handwritingtype your entries directly into our form. If the amount of the credit is. New York City enhanced real property tax credit may be available to New York City residents who have a household gross income of less than 200000 and pay either real property taxes or rent for their residences.

How much is the credit. However you can register online for New York State STAR tax credit or by calling 518 457-2036. The New York City enhanced real property tax credit may be available to New York City residents who have household gross income of less than 200000 and pay real property taxes or rent for their residences or both.

Basic STAR is for homeowners primary residence if their household income is less than 500000. If you did not receive STAR in tax year 2015-16 you cannot apply for STAR or Enhanced STAR with the Department of Finance. The credit can be as much as 500.

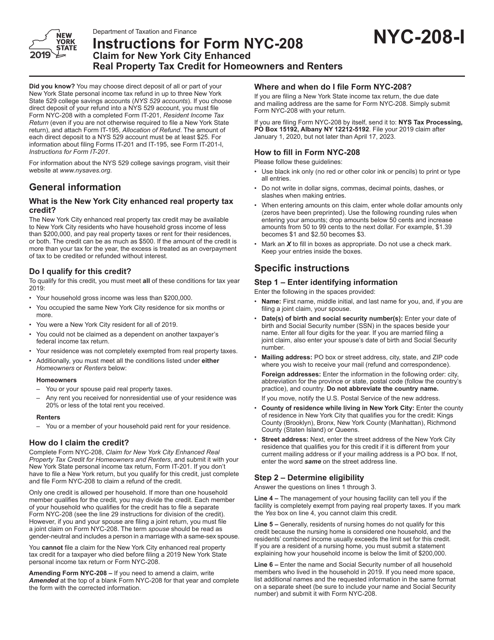

You can likely apply for a credit of 10 or more. Claim for New York City Enhanced Real Property Tax Credit For Homeowners and Renters Tax Law Article 22 Section 606e-1 NYC-208 Street address of New York City residence that qualies you for this credit if different from above Apartment number City State ZIP code NY You must enter dates of birth and Social Security numbers above. If youre a renter in New York City you may think tax credits are just for owners but you can also get a discount on your taxes through the New York City enhanced real property tax credit which can reduce how much you owe in state taxes.

The credit can be as much as 500. Helpful Information Guide for 2020. What is the New York City enhanced real property tax credit.

The property tax relief credit was approved four years by Cuomo and the Legislature to reimburse middle-class homeowners for a portion of their school taxes based on. If the amount of the credit is. If you are experiencing a hardship you may be eligible for a property tax payment plan.

But before doing please consult with a tax professional. How to claim the credit. NEW STAR APPLICANTS MUST REGISTER WITH NEW YORK STATE for the Personal Income Tax Credit Check Program by telephone at 518 4572036 or online NYS will determine a First-TimeNew homeowners eligibility for the Basic or Enhanced STAR Tax CreditCheck Program.

The New York City enhanced real property tax credit expired 12312019. Automatic calculation of your refund or tax due amountthe form does the math. The New York City enhanced real property tax credit may be available to New York City residents who have household gross income of less than 200000 and pay real property taxes or rent for their residences or both.

ALBANY New York has created a new property tax credit for homeowners who make less than 250000 a year with about a quarter of the states estimated 45 million owner-occupied homes expected. Exemption Forms for Homeowners. December 18 2020 Department of Taxation and Finance.

Continue to Form NYC-208 Claim for New York City Enhanced Real Property Tax Credit instructions. If you live in a rental rejoice. The credit can be as much as 500.

Electronic filing is the fastest safest way to filebut if you must file a paper Claim for New York City Enhanced Real Property Tax Credit use our enhanced fill-in Form NYC-208 with 2D barcodes. See Income tax forms by year to file Form NYC-208 for a prior year. For more information please visit httpswwwtaxnygovpitpropertystarrp-425-delehtm or call 311.

NYCs Enhanced Real Property Tax Credit for Renters. These include tax credits like the New York City Enhanced Property Tax Credit more commonly referred to as the Circuit Breaker or the New York State Residential Property Tax Credit. Renters in New York City may claim a tax credit on their state tax returns Wang says.

Read more »