Texas State Comptroller Property Tax

Thus all property taxes collected in the state are imposed and further managed by local governments and are spent directly to local needs. Help Taxable Entity Search.

Property Classification Guide Reports Of Property Value The Portal To Texas History

This website provides you with easy access to tax forms lookup tools and the ability to file and pay taxes.

Texas state comptroller property tax. A The comptroller shall appoint the property tax administration advisory board to advise the comptroller with respect to the division or divisions within the office of the comptroller with primary responsibility for state administration of property taxation and state oversight of appraisal districts. TAXABLE PROPERTY AND EXEMPTIONS. DUTIES OF COUNTY CLERK.

Thats up to the local taxing units that use property tax revenue to provide local services such as schools streets and roads police and fire protection and many others. Property taxes are collected by local authorities in accordance with Texas laws. Box 13528 Austin Texas 78711-3528.

Acts 1981 67th Leg p. The course must be approved by the Texas Comptrollers Property Tax Assistance Division PTAD and offered by an approved TDLR Property Tax. In response to the spread of COVID-19 the Texas Comptrollers office has implemented agency-wide teleworking beginning Monday March 16.

PROPERTY TAX ADMINISTRATION ADVISORY BOARD. Penalties on late taxes are reduced to 6. He or she is the states principal tax administrator and collector of tax revenue.

The State laws and rules update changes each legislative session. There are no federal taxes either. The Texas Legislature passed House Bill 855 which requires state agencies to publish a list of the three most commonly used web.

You may order a hard copy by completing a form at comptrollertexas. TAXABLE PROPERTY AND EXEMPTIONS. A All real and tangible personal property that this state has jurisdiction to tax is taxable unless exempt by law.

Once the property is no longer owned by the person with a disability the taxes and interest are due immediately. REAL AND TANGIBLE PERSONAL PROPERTY. The county clerk of each county shall provide at the expense of the county a well-bound book entitled State Tax Liens in which notices of state tax liens filed by the comptroller are recorded.

A owned by one or more individuals at least one of whom claims the property as the individuals residence homestead. This office strives to provide you the best possible services and resources to do business in Texas. It includes a detailed summary of bills passed in the previous legislative session affecting the Property Tax Professionals industry.

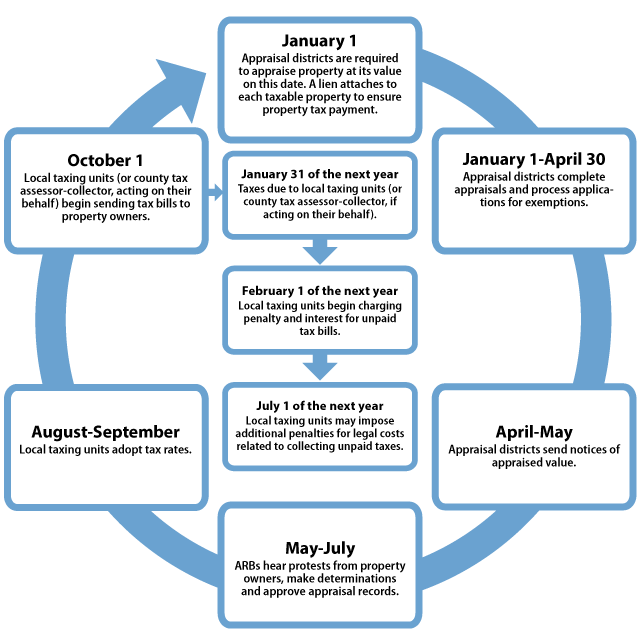

The Texas property tax system has four main phases or sets of functions that occur within certain dates. Govtaxesproperty-tax or by calling PTADs Information and Customer Service Team at 800-252-9121 press 2 Legal questions should be directed to an attorney. You may contact us at ptadcpacpatexasgov or 800-252-9121 or write to us at Texas Comptroller of Public Accounts Property Tax Assistance Division PO.

Provides that veterans with disabilities may qualify for property tax exemption home or other property ranging from 5000 to 12000 depending on the severity of the disability. Provide the Property Tax Code on our website at comptrollertexasgovtaxesproperty-tax96-297-19pdf. Texas Comptroller of Public Accounts Glenn Hegar.

20 Heir property means real property. These records document the ad valorem property tax revenue owed andor received by the State of. There is no state property tax in Texas.

I a large data center project that is certified by the comptroller as a qualifying large data center under Tax Code 1513595 Property Used in Certain Large Data Center Projects. The Texas Comptrollers office does not collect property tax or set tax rates. This tool allows you to explore and compare property tax data for counties cities and school districts.

19 Comptroller means the Comptroller of Public Accounts of the State of Texas. Due to this our walk-in office is currently closed. Search Tax ID Use the 11-digit Comptrollers Taxpayer Number or the 9-digit Federal Employers Identification Number.

The Texas Comptroller of Public Accounts is the central accounting officer or chief fiscal officer of the state and as such is responsible for maintaining effective methods for accounting for the states funds. STATE TAX LIEN BOOK. The Texas Comptrollers office serves the state by collecting more than 60 separate taxes fees and assessments including local sales taxes collected on behalf of more than 1400 cities counties and other local governments around the state.

Temporary Exemption in the processing storage and distribution of data by a qualifying owner qualifying operator or qualifying occupant of the data center. Texas Comptroller of Public Accounts The Texas Comptrollers office is the states chief tax collector accountant revenue estimator and treasurer.

Read more »Labels: comptroller, property, texas