Property Tax Missouri Clay County

The Missouri Property Tax Credit Claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid for the year. The Clay County Auditor administers the delinquent tax and forfeited property system.

How To Use The Property Tax Billing Portal Clay County Missouri Tax

How To Use The Property Tax Billing Portal Clay County Missouri Tax

For answers to questions concerning the assessed value call 816-407-3500.

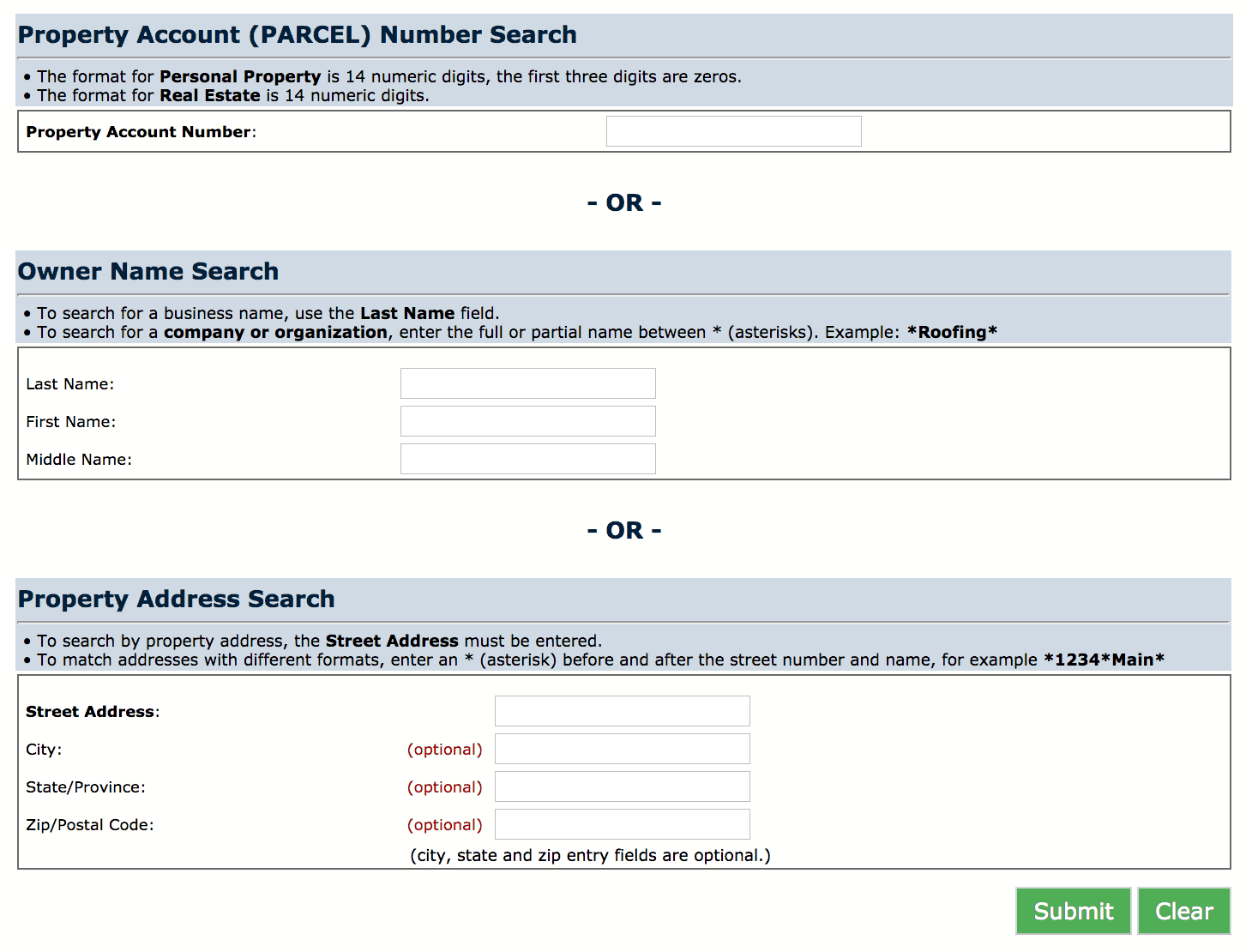

Property tax missouri clay county. To return to the main county. 816 407 - 3370 email. To match addresses with different formats enter an asterisk before and after the street number and name for example 1234Main.

Bills are mailed out November 1 for the current calendar year ie. Ad Valorem taxes are assessed every January 1 for calendar year. They may be able to answer your questions or address your concerns over the phone.

In order to determine the tax bill your. If you would like further information about delinquent taxes or tax forfeited property go to the Clay County Auditor page. Unpaid property taxes from prior years are called delinquent tax.

The Assessors Office is tasked to ensure that the tax burden is distributed equitably among all property owners. Clay County has one of the highest median property taxes in the United States and is ranked 535th of the 3143 counties in order of median property taxes. ClayCountyMotax is a joint resource provided and maintained by Lydia McEvoy Clay County Collector and Cathy Rinehart Clay County Assessor.

Download print tax receipt Clay County Missouri Tax 2018-11-20T130250-0500 ABOUT ClayCountyMotax is a joint resource provided and maintained by Lydia McEvoy Clay County Collector and Cathy Rinehart Clay County Assessor. 816 407 - 3370 email. Clay County collects on average 121 of a propertys assessed fair market value as property tax.

To provide appraisals used for property tax assessment to all taxing jurisdictions in Clay County at 100 percent of market value both uniform and equal while providing professional courteous and ethical service to the taxpayer. Our goal is to create a hub of information for Clay County taxpayers. Ad valorem taxes are levied annually based on the value of real property and tangible personal property.

Pay your bill online Clay County Missouri Tax 2018-11-20T130004-0500 ABOUT ClayCountyMotax is a joint resource provided and maintained by Lydia McEvoy Clay County Collector and Cathy Rinehart Clay County Assessor. Property Address Search To search by property address the Street Address must be entered. The Tax Collector collects all ad valorem taxes and non ad valorem assessments levied in Clay County.

Why does Clay County reassess real property. The median property tax in Clay County Missouri is 1863 per year for a home worth the median value of 153900. If you have suggestions please contact us here.

The credit is for a maximum of 750 for renters and 1100 for owners who owned and occupied their home. GISMapping Assessors Office phone. Business Personal Property - The business dept.

The median property tax on a 15390000 house is 186219 in Clay County. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Clay County Tax Appraisers office. How much is my property tax.

To accomplish this Missouri Revised Statutes Chapter 137 is followed when assessing all real property. The Clay County Treasurers Office operates in accordance with the statues of the State of Missouri. 11 rows In-depth Clay County MO Property Tax Information.

The City of Liberty property tax levy is 08908 per 100 assessed valuation this includes 07574 for the Citys General Fund and 01334 for Liberty Parks Recreation. You may either call 816-407-3460 or send an email to bppassessorclaycountymogov for assistance before driving to the office. The actual credit is based on the amount of real estate taxes or rent paid and total household income taxable.

We will abide by the Texas Property Tax Code and its requirements in the operation of the appraisal district. The median property tax on a 15390000 house is 140049. Is located at the Clay County Annex and is open Monday through Friday 8am-4pm.

The Treasurer is responsible for receipting all County revenues making bank deposits investing County monies balancing County bank accounts banking funds held in trust by the County and tracking all county. The assessed valuation is provided from the Clay County Assessors Office by requirements of the Missouri State Statutes.

Read more »