Property Tax Sale New Brunswick

Search Property Tax in the list of payees. These pages focus on NB Property Assessment.

Commercial property owners in New Brunswick can expect property tax relief in step with multifamily landlords.

Property tax sale new brunswick. New Brunswick has announced that the next tax sale is tentatively scheduled for April 2021. Sale prices are listed only for properties sold after January 1 2009. In person at City Hall.

Prince Edward Island PEI For PEI properties are assessed by the province which mails out property assessment notices along with the property tax bill every year in May. The HST was adopted in New Brunswick on July 1st 2010. Contact your Municipality or the Department of Environment and Local Government.

Tax Sale - Finance - New Brunswick. Where accounts are in arrears in excess of one year and no acceptable payment arrangements have been made the property can be sold by the Province to recover the taxes owing. Get detailed info about upcoming tax sales including houses cottages vacant land commercial or industrial properties island properties farmland residential etc.

Providing free tax sale property listings for New Brunswick Canada Sale of Lands Publication Act CHESTER WAYNE MACFARLANE of 6 Eaton Street in St. Stephen in the County of Charlotte and Province of New. Find out about Upcoming Tax Sales and Sales of Land for Tax Arrears in New Brunswick Canada.

Municipal tax sale properties listing in New Brunswick. However neither group of ratepayers will enjoy the outcome of this weeks provincial announcements until 2021. NB Property Assessment regularly uploads the most current assessment and.

Users of this data are hereby notified that the aforementioned public information sources should be consulted for verification of the information. Online Requests up to ten tax accounts per order Certificates may be ordered online by accessing the Government of New Brunswick Web site. Current Tax Sale Property Listings January 31 2007 - Tax Sale.

For more information about property tax or your property tax account please visit. Working within the prescribed statutory requirements and policies established by the New Brunswick City Council each division performs a specific group of tasks that collectively administer all aspects of the Citys finances. All data is compiled from recorded deeds plats and other public records and data.

Tax sales listing with images location on the map and tender documents package. The relatively high interest rate makes tax liens. The HST is applied to most goods and services although there are some categories that are exempt or rebated from the HST.

PROV NB - PROPERTY TAXES or New Brunswick Tax or New Brunswick Property Tax etc. Home buyers and Investors buy the liens in New Brunswick NJ at a tax lien auction or online auction. Send a check by mail.

All real property in New Brunswick is assessed annually for taxation purposes on the basis of its real and true value. All information on this site is prepared for the inventory of real and personal property found within Brunswick County. These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest payment from the property owner.

The next Tax Sale is to be determined. The map presents only an approximation of the size configuration and location associated with. Add the Property Account Number PAN to your list of payees.

View current assessed value for each property selected as well as assessment values dating back four years recent sales prices for the property and neighboring properties and tax levy information. An 10 provincial sales tax and a 5 federal sales tax. Nova Scotia municipalities are postponing tax sales until further notice.

In introducing the 2020-21 budget Finance and Treasury Board Minister Ernie Steeves reiterated a yet-to-be-delivered pledge to begin curbing New. Department of Finance and Treasury Board 1-800-669-7070. Currently you can pay your taxes.

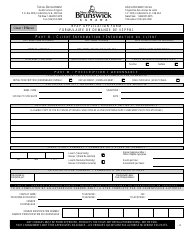

Surplus Property for Sale. Enter the property Account Number PAN PAN information is identified on Property Assessment and Tax Notices. For New Brunswick properties are assessed by the province through Service New Brunswick SNB which mails out property assessment notices every year in October.

The site and its content are made available by the New Brunswick Department of Transportation and Infrastructure DTI as a public service without warranties of any kind express or implied. Tax Sale Property Listings for Brunswick Canada Looking for a Dream House Vacation Property Vacant Land Commerical Property or even An Island. The HST is made up of two components.

Service New Brunswick prepares and issues available assessment information online for public inspection providing data updates monthly and map updates in October and January. Thursday March 12 2020. The fee for an online order is twenty dollars 2000 CAD per property tax account and must be paid by credit card at the time of the order.

New Brunswick is one of the provinces in Canada that charges a Harmonized Sales Tax HST of 15. Please revisit this page for more information. Are you an individual business organization or developer looking for property to invest or further develop.

Browse through our New Brunswick tax sale property listings and find your property.

Read more »