Do I Have To Pay Back The Coronavirus Tax Relief

Workers can withdraw or borrow up to 100000 from 401ks under new COVID-19 aid package. Yes the value of leave donated in exchange for amounts paid before January 1 2021 to organizations that aid victims of COVID-19 is excludable from an employees income for California income tax purposes.

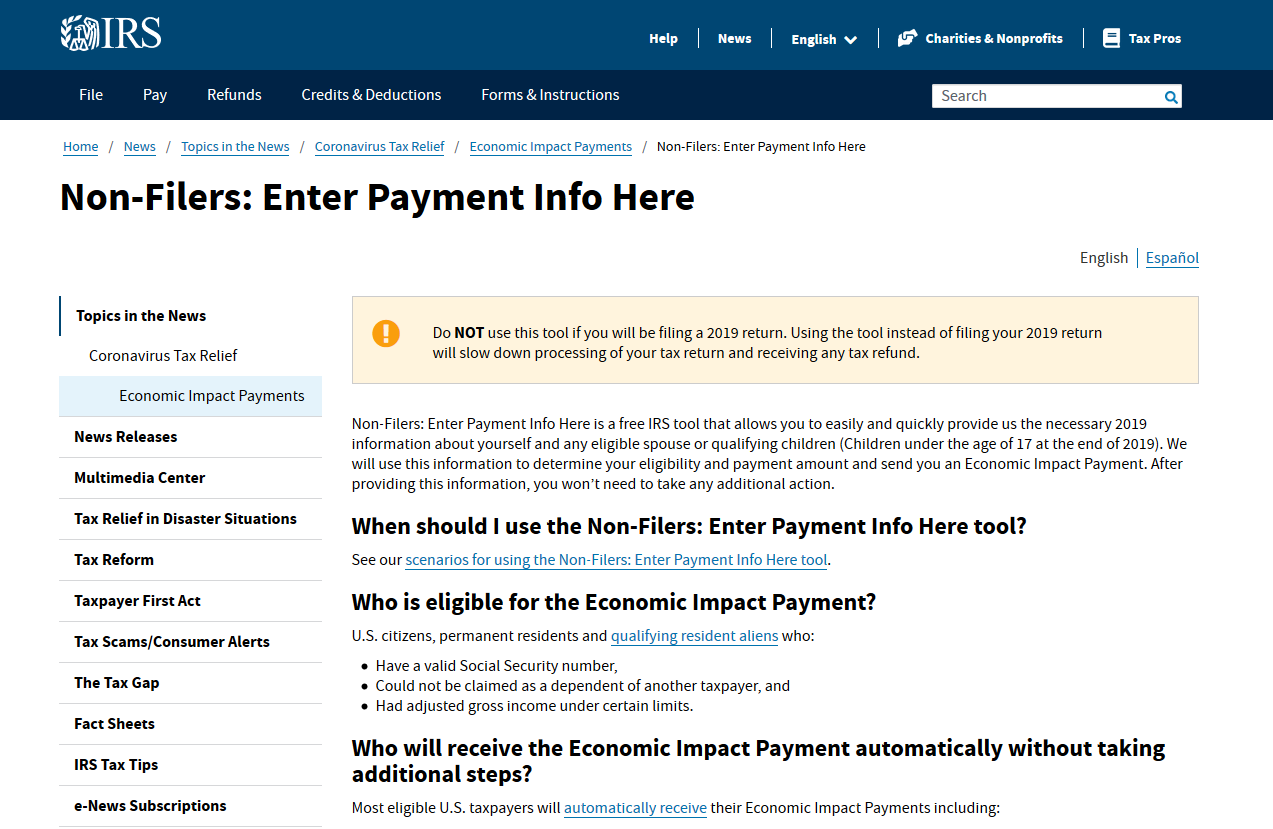

How To Fill Out The Irs Non Filer Form Get It Back Tax Credits For People Who Work

How To Fill Out The Irs Non Filer Form Get It Back Tax Credits For People Who Work

In response to coronavirus the Treasury and IRS have announced several changes to the tax filing season including an extension of the tax year 2020 federal tax filing deadline to May 17 2021.

Do i have to pay back the coronavirus tax relief. Because of that structure the. Taxpayers getting a refund are encouraged to file their taxes now to get their money. Stimulus checks for 1400 are still arriving -- and so are the catch-up payments if you didnt get your.

If you didnt get a first or second Economic Impact Payment or got less than the full amounts you may be eligible to claim the 2020 Recovery Rebate Credit and must file a 2020 tax return even if you are not required to file. It was authorized by the Coronavirus Aid Relief and Economic Security CARES Act and individuals who did not receive the full amount for the first or second stimulus check can claim this credit when filing their 2020 tax return. Its yours to keep said Lauren Saunders associate director of the National Consumer Law Center.

Normal tax year. You can break it up over three years or have it all counted as income for this year. Retirement planners say only do this if necessary.

Stimulus check status update. You still receive your 2000 refund when you file your 2020 taxes. While nearly all the spending and most of the tax cuts in the relief bills are scheduled to expire by the end of next year the fiscal damage will have been done.

American Rescue Plan Act of 2021 Were reviewing the tax provisions of the American Rescue Plan Act of 2021 signed into law on March 11 2021. CHICAGO AP Videos and online reports claiming that millions of Americans will have to repay the relief checks they receive from the federal government under the 22 trillion coronavirus economic recovery bill are not true. Most of the benefits for college students and graduates are around student loans.

Latest Updates on Coronavirus Tax Relief Tax Deadlines Changed. You receive the 1200 tax credit as early as mid-April. Ill have to pay back this money No you do not.

The coronavirus checks that people will receive will technically be an advance refund of that recovery rebate credit. You generally have two options for paying the taxes due on any money you take out of your retirement account. The deadlines for individuals to file and pay most federal income taxes are extended to May 17 2021.

If for example you receive a coronavirus-related distribution in 2020 you choose to include the distribution amount in income over a 3-year period 2020 2021 and 2022 and you choose to repay the full amount to an eligible retirement plan in 2022 you may file amended federal income tax returns for 2020 and 2021 to claim a refund of the tax attributable to the amount of the distribution that you included in income for those years and you will. You receive a 3200 tax refund when your return is processed. Stimulus relief checks approved through the CARES Act passed in March are a one-time payment from the government in an effort to relieve the.

The Committee for a Responsible Federal Budget projects that cumulative deficits from 2020-2025 will. Plus-up payments delivery schedule everything left to know. Federal Student Loan Relief.

Get details in this announcement. Electing employees may not claim a charitable deduction for the value of the donated leave. The 10 additional tax on early distributions does not apply to any coronavirus-related distribution.

See 2020 Recovery Rebate Credit for more information. The government began issuing the one-time payments this week. Typically distributions received from an IRA or retirement plan before reaching age 59 ½ are subject to an additional 10-percent tax unless an exception applies.

In addition a coronavirus-related distribution can be included in income in equal installments over a three-year period and an individual has three years to repay a coronavirus-related distribution to a plan or IRA and undo the tax consequences of the distribution. Youre a single filer who owes 2000 in taxes before a one-time 1200 credit is applied.

Read more »