Rental Property Private Use Adjustment

If you own a rental property the IRS allows you to deduct expenses you pay for the upkeep and maintenance of the property conserving and managing the property. Anything that increases the value of your rental property or extends its life is considered a capital expense.

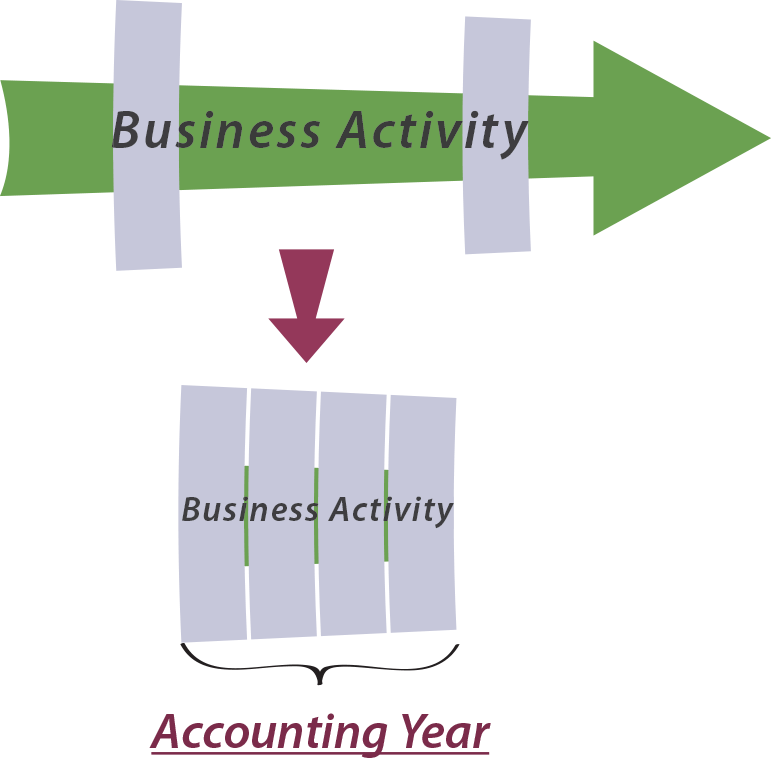

The Adjusting Process And Related Entries Principlesofaccounting Com

The Adjusting Process And Related Entries Principlesofaccounting Com

Rental property often offers larger deductions and tax benefits than most investments.

Rental property private use adjustment. 6 Rent paid repairs insurance and costs of services provided the total amount 0 0 7 Loan interest and other financial costs 0 0 8 Legal management and other professional fees 0 0 9 Other allowable property expenses 0 0 10 Private use adjustment if expenses include any amounts for non-business purposes. This can make a difference in making a profit or losing money on your real estate venture. The 481 a adjustment equals the difference between the total depreciation taken in prior years under the old method and the total depreciation allowable for those years under the new method.

Many of these are overlooked by landlords at tax time. Put another way for each full year you own a rental property you can depreciate. View solution in original post 0.

As of the beginning of the year of change the basis of the depreciable property must reflect the 481 a adjustment. The decision is often made as a result of the taxpayers inability to sell the property at a gain or a desire to retain the property for future personal use. Tenants out of their homes.

Many expenses can be deducted in the year you spend the money but depreciation is different. Combined Expenses for such calendar year. But you can deduct or subtract your rental expensesthe money you spent in your role as the person renting out the propertyfrom that rental income reducing your tax obligation.

10 of the total days you rent it to others at a fair rental price. Youre considered to use a dwelling unit as a residence if you use it for personal purposes during the tax year for more than the greater of. A property may be let for short periods in a tax year or only part of it may be let throughout a tax year or both.

In each calendar year during the Term of this Lease including the partial year commencing on the Commencement Date of this Lease the rent payable by Tenant for such calendar year shall be increased over the Basic Annual Rent as adjusted in accordance with Section 42 by the amount of the. Youll divide up the expenses over time and claim a small portion of those expenses. NEW YORK CITY RENT GUIDELINES BOARD.

Income Tax IT You should check the other guidance available on GOVUK from HMRC as Brexit updates to those pages are being prioritised before manuals. The basis adjustments under Code 1014 often referred to as a step-up in basis may be a disadvan-tage if the decedents basis in the property exceeds the fair market value of the property at the time of death because then a step-down in basis would result This basis adjust-ment is. 2020 Apartment Loft Order 52.

Order Number 52 Apartments and Lofts rent levels for leases commencing October 1 2020 through September 30 2021. Its possible that youll use more than one dwelling unit as a residence during the year. The adjustment can also work the.

PIM4702 - Rent from property outside the UK. The two major requirements landlords must follow are providing the tenant with written notice of the increase and giving this notice a certain number of days before the tenants lease is set to expire. For residential properties take your cost basis or adjusted cost basis if applicable and divide it by 275.

NOTICE IS HEREBY GIVEN PURSUANT TO THE AUTHORITY VESTED IN THE NEW YORK CITY RENT GUIDELINES BOARD BY THE RENT STABILIZATION LAW OF 1969 as. A taxpayer may decide to permanently convert a personal residence to rental property. The rest of the time the property is used for private or non-business purposes.

Here the bulk of the expense on the roof arises out of private use of the house and a further restriction is needed to reflect the true business use of the home. As such it must be capitalized and depreciated over multiple years. The Sheriff or Marshal executes a warrant of.

When you rent property to others you must report the rent as income on your taxes. Here the interest charged on a qualifying loan on that property has to be split between the rental business use and the private or non-business use. Landlords must often follow specific legal procedures when increasing a tenants rent.

Your Rights in Non-Payment Evictions Your landlord cannot bring you to court for non-payment of rent unless they have given you a 14-day written rent demand Until you are evicted ie.

Read more »Labels: adjustment, property, rental