What Is The Difference Between Comprehensive Car Insurance And Third Party Property Damage Insurance

READ MOREThird-party insurance explained Why should I consider fully comprehensive car insurance. Third party car insurance is more restrictive covering damage to other vehicles and their passengers but typically not much else.

5 Types Of Car Insurance Coverage You Must Know Car Insurance Car Insurance Online Cheap Car Insurance

5 Types Of Car Insurance Coverage You Must Know Car Insurance Car Insurance Online Cheap Car Insurance

Third Party Car Insurance covers damage to other peoples vehicle or property.

What is the difference between comprehensive car insurance and third party property damage insurance. Difference Between Comprehensive Insurance and Third Party Insurance Comprehensive insurance is insurance coverage that pays for the repair or replacement of vehicle damages resulting from an incident. 8 rows As mentioned above comprehensive car insurance is a combination of third party. Which policy you choose depends on how much protection you want.

Comprehensive car insurance is the most extensive car insurance available in Australia. While CTP covers personal injury claims arising from an accident youve caused it doesnt cover the cost of damage to your or anyone elses car or property. While a third-party bike insurance only covers for third-party related liabilities a comprehensive bike insurance covers for your bikes own damages as well and also gives you the option to extend your coverage beyond just basic benefits with a range of add-ons and covers.

Comprehensive is a higher level of insurance and therefore has you covered more than third party fire and theft. Offering more extensive cover than third party only and TPFT policies comprehensive car insurance covers everything that third party policies cover including fire. Its also called your green slip.

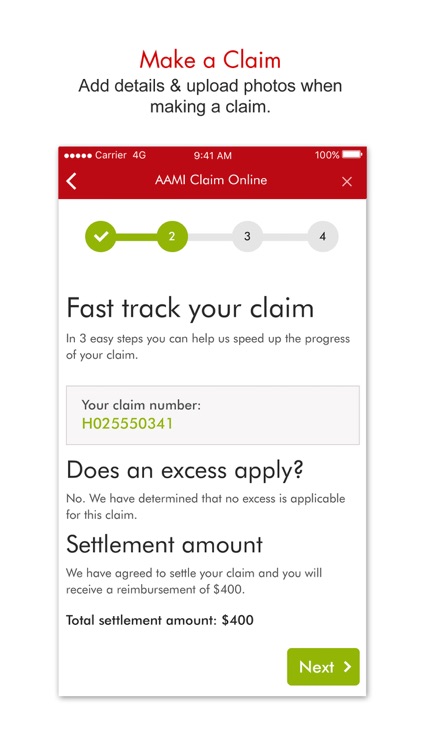

Third party fire and theft insurance TPFT has the same basic features as third party only but your losses will be covered in the case of a fire or. Third-party fire and theft is the same as third-party only but the insurance will also cover your car if its stolen or catches on fire. Comprehensive Car Insurance covers all your bases including damages to your own vehicle or property plus you can access the AAMI Safe Driver Rewards program.

Thats where Comprehensive and Third Party insurance come in. In general a comprehensive car insurance policy will cover you for a wide range of damages injuries and loss to your passengers your vehicle and other property. Comprehensive car insurance on the other hand will cover damage to your car as well.

Whereas Compulsory Third Party CTP also known as Green Slip insurance in New South Wales is compulsory in order to register any vehicle in NSW and the ACT. Meanwhile a Comprehensive insurance policy will cover all of the above and also cover the costs of any damage to your own vehicle if youre involved in an incident. A Third Party Fire and Theft policy covers any damage to a third party or their property resulting from an incident as well as any damage to your own vehicle caused by fire or theft.

The primary difference between a Third-Party and Comprehensive Bike Insurance is that of coverage benefits. Comprehensive car insurance covers damage to your car whereas third party fire and theft do not when an accident is deemed your fault. Third Party Property Damage Insurance is optional and provides cover if you need to pay for damage your vehicle causes to another persons vehicle or property.

8 rows The main purpose of a Third-Party car insurance is to cover you from losses and damages. However it is worth getting a quote as it comes with many more benefits which you may feel are suited to your needs. TPFT picks up where CTP leaves off by also protecting you if you damage someones property like their car bicycle or fence.

The key differences between compulsory third party insurance and comprehensive car insurance are these. All registered vehicles must be covered by CTP insurance whereas comprehensive car insurance is. It is also worth remembering the added peace of mind this level of car insurance cover provides.

CONSIDERATIONS OF COMPREHENSIVE INSURANCE Comprehensive car insurance is typically more expensive than third party fire and theft. 29 Jan 2019 Real Insurance is an award-winning provider of car insurance. The mandatory compulsory third party insurance CTP only pays for injuries that you cause to others with your car.

It covers you for everything included in third party fire and theft insurance namely damage to other peoples property and damage to your own car caused by fire or theft as well as for damage caused to your vehicle in an accident regardless of who was at fault. Whats the difference between CTP and third party insurance.

Read more »Labels: between, difference, property