King County Personal Property Tax Online

State law requires that property used in a business on January 1 be reported in that year to the assessor of the county in which the property is located for assessment purposes. While the department has sought to provide current and correct information it makes no warranties representations or guarantees whatsoever.

PAY NOW View and pay for your Property Tax bills for King County Washington online.

King county personal property tax online. Prepay Real Estate Tax. In-depth King County WA Property Tax Information. Personal property tax rates are the same as for real property.

Payment must be made via personal check or money order. Either expressed or implied regarding the quality content. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property.

Pay Real Estate taxes online. The assessor uses the affidavit to value personal property for taxes due the following year. Enter by DeptTicket Number or Account Number.

Visit the web link provided for site and schedule options. FBO - Property Tax. EListing is an online application for reporting this information.

Pay Personal Property taxes online. Mobile Homes and Personal Property Commercial Property Tax 206-263-2844. Property Tax The property tax team handles billing collecting distributing and reporting of real and personal property taxes gambling taxes and local improvement district assessments.

Pay Real Estate Tax. This site can be used to make online payments to the King George County Treasurers Office and inquire into tax ticket information from the comfort of your home or office. If your business does not have a personal property account number you can complete an initial form by clicking here DOC.

You must use King County personal Property Listing form or eListing. Pay Personal Property Tax. Can I file using other personal property forms or software or must I use Lewis Countys listing form.

The tax relief for qualifying vehicles in King William County for 2020 is 35. Pay Personal Property Taxes Online enables online payments for personal property tax bills received from King George County. The King County Department of Assessments strives to provide the public with accurate business personal property account information.

The current tax rate for personal property in King George County is 350 for each 100 of assessed value. Enter by DeptTicket Number Parcel Number Name or Account Number. No cash is accepted at Community Service Centers.

FBO - Personal Property Tax. The Personal Property Tax Relief Act was changed in 2006 to allocate a set amount of relief annually to each locality. Personal Property returns business and personal are due on May 1.

Use the links on the left side of the screen for navigation. King County Treasury Operations provides services to King County cities and special districts in the county and most importantly our residents. Please note that you dont get receive additional statements ahead of the April and October payment deadlines from the county Treasurers office.

King County Treasury Operations 201 S. Property tax real estate tax pay taxes pay property tax. Personal property tax relief provides tax relief for any passenger car motorcycle pickup or panel truck having a registered gross weight of less than 10001 pounds.

Real Property Tax Real Estate 206-263-2890. Jackson Street Suite 710 Seattle WA 98104 NOTE NEW MAILING ADDRESS. If your business has a personal property account number and needs another listing or if you have questions about how to complete the form please contact us at 206-296-5126 or by e-mail at PersonalPropertykingcountygov.

King County eListing Home Page. Pay Real Estate taxes online. On the Pay Personal Property Taxes Online Screen press the button containing your preferred method for finding tax information.

Under state law current year King County property tax statements are mailed once a year in mid-February. PROPERTY TAX BILLS ARE NOT AVAILABLE ONLINE PLEASE CALL OR EMAIL OUR OFFICE TO INQUIRE ABOUT YOUR PROPERTY TAX BILL AT. Personal property used in a business on January 1 must be reported in that year to the assessor of the county in which the property is located.

FBO - Property Tax Payment Processing. Prepay Real Estate taxes before bills are issued. Reports must be filed by April 30 or the taxpayer will incur a monthly penalty of 5 percent of the tax due not to exceed 25 percent.

Access by PIN Access by Department Number Ticket Number or Access by Account Number. FBO - Property Tax Customer Service. Enter by DeptTicket Number Parcel Number Name or Account Number.

View Personal Property taxes paid by year. Lewis County requires you to use our listing form or use Lewis Countys eFile. In Washington State business personal property is assessed for tax purposes unless specifically exempted by law.

Seattle King County Coalition On Homelessness Blog Everyone Counts

Seattle King County Coalition On Homelessness Blog Everyone Counts

Brand Guidelines United Way Of King County

Brand Guidelines United Way Of King County

King County Washington Quit Claim Deed Form Vincegray2014

King County Washington Quit Claim Deed Form Vincegray2014

Seattle King County Coalition On Homelessness Blog Everyone Counts

Seattle King County Coalition On Homelessness Blog Everyone Counts

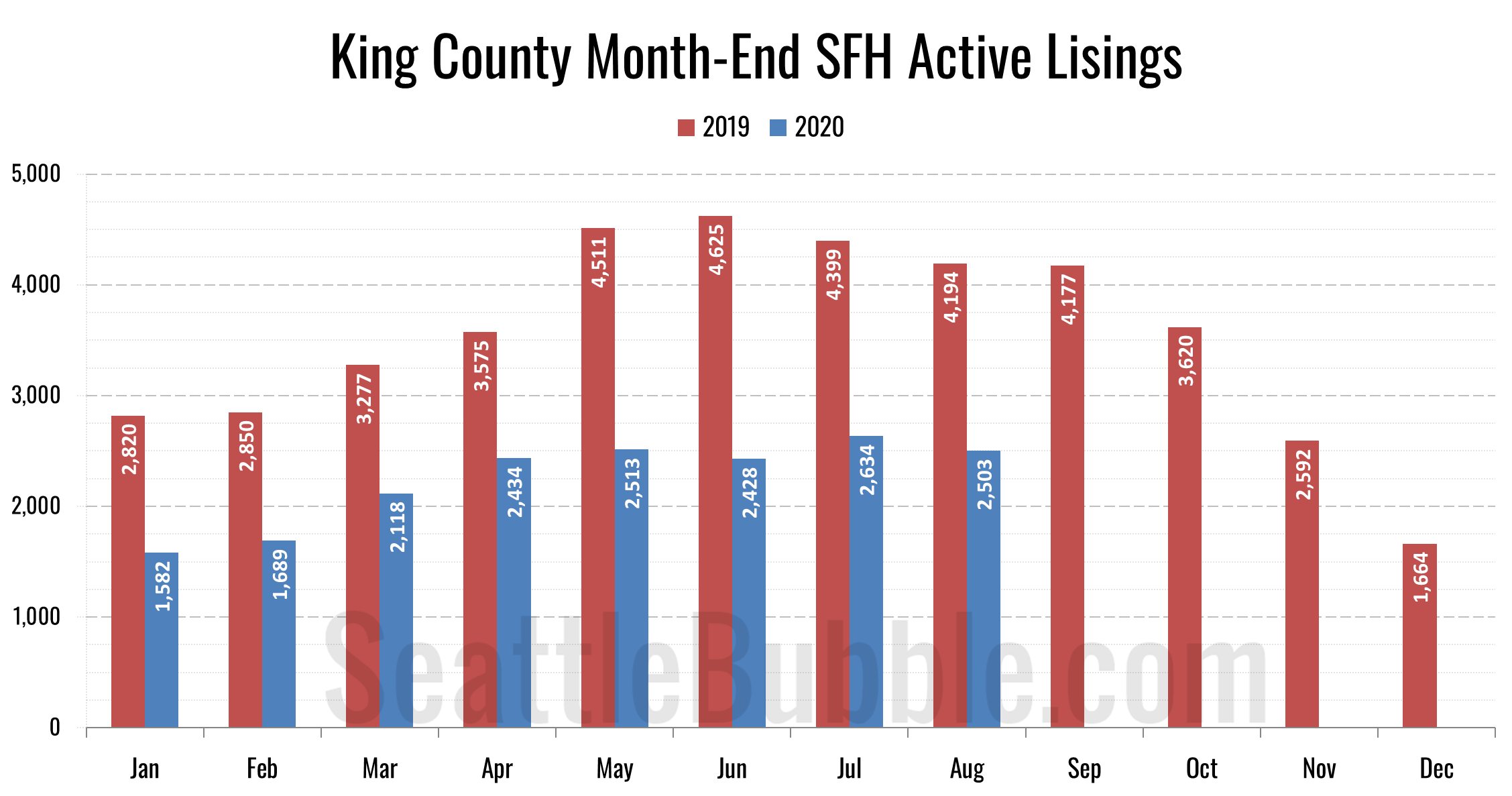

August Stats Preview Plenty Of Demand Still So Little Supply Seattle Bubble

August Stats Preview Plenty Of Demand Still So Little Supply Seattle Bubble

Subsidized Annual Pass Programs Projects King County Metro Transit King County

Subsidized Annual Pass Programs Projects King County Metro Transit King County

King County Appraisal District

Brand Guidelines United Way Of King County

Brand Guidelines United Way Of King County

Most King County Property Tax Bills Are Higher Due To Voter Approved Measures Puget Sound Business Journal

Most King County Property Tax Bills Are Higher Due To Voter Approved Measures Puget Sound Business Journal

King County Wa Property Tax Calculator Smartasset

King County Wa Property Tax Calculator Smartasset

Seattle Real Estate Short Sales Realtor And Seattle Mortgage Mediation Attorney Jonathan Smith Offers Ful Sales Strategy Mortgage Assistance Sales Motivation

Seattle Real Estate Short Sales Realtor And Seattle Mortgage Mediation Attorney Jonathan Smith Offers Ful Sales Strategy Mortgage Assistance Sales Motivation

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home