Property Tax Office Independence Missouri

0634100 of assessed value. Helpful information for businesses that must withhold taxes for employees.

Old Lincoln High School Kansas City Kansas City Missouri Central Business District

Old Lincoln High School Kansas City Kansas City Missouri Central Business District

Interest is charged after the 10th of the month in which taxes are due.

Property tax office independence missouri. The Historic Truman Courthouse is located at. 3730 South Elizabeth Street. Address and Phone Number for Independence Missouri IRS Office an IRS Office at South Elizabeth Street Independence MO.

It operates six lines of businesses including administration development. County Parish Government Government Offices. For general tax questions call 816 881-3232.

Both courthouses are open 8 am. File Sales or Use Tax Return. Property taxes may be paid online in person by mail or by phone.

816-881-1330 Business Personal Property Phone. Taxes not paid in full on or before December 31 will accrue interest penalties and fees. Taxes are due February 1st May 1st August 1st and November 1st.

303 W Walnut St. We process this information in the aggregate to determine site performance issues such as popular pages most frequently downloaded forms and other site performance characteristics. The Jackson County Public Works Department is governed by Jackson County Mo.

To make an online payment visit our Online Payment Program. 112 W Lexington Suite 114 Independence MO 64050. If you have any question regarding these special assessments please contact the Finance Department at 816 325-7067.

Do not place cash in either drop box. Consumer Information and Assistance. The regular hours of the Tax Collectors Office are Tuesday and Thursday 1000 AM 100 PM.

816-881-3074 Individual Personal Property Phone. To 5 pm Monday through Friday excluding holidays observed by Jackson County. Jackson County Public Works.

For business personal property tax questions call 816 881-4672. 0075 of Gross Earnings. There is a 30 administrative charge for incorrect information entered or payments dishonored by your financial institution or rejected by your service provider.

Real Property Tax Real Estate 206-263-2890. Paying Prior Year Taxes. Telephones are staffed during normal business hours.

Mobile Homes and Personal Property Commercial Property Tax 206-263-2844. Individual Consumer Use Tax. If a tax bill is not received by December 1 contact the Collectors Office at 816-881-3232.

Independence Missouri IRS Office Suggest Edit. Address and Phone Number for Jackson County Clerk a Clerk Office at North Liberty Street Independence MO. 2019 Withholding Tax and.

For individual personal property tax questions call 816 881-1330. For real property tax questions call 816 881-3530. Both drop boxes will close at midnight.

Taxes Tax Rates Payable Online. A drop box for property tax payments is located at the west door of the Jackson County Courthouse in Kansas City 415 E 12th Street and at the front door of the Historic Truman Courthouse in Independence 112 W Lexington. The program closed in 2017 for new applicants.

Failure to receive a tax bill does not relieve the obligation to pay taxes and applicable late fees. When you visit the City of Independence Missouri website we use automated tools to log information about each visit. Occupational Tax on Gross Receipts.

816-881-3530 Commercial Real Estate Phone. Senior Citizen and Veterans deduction forms are available at the Tax Collectors office. Independence Missouri 64057.

The Collectors Office mails tax bills during November. Make checks payable to. 0271100 of assessed value.

125 of Gross Earnings. Pay or view your account online do a property search or sign up for e-Reminder Notices via text or email. Independence MO 64050 Directions Residential Real Estate Phone.

The Tax Office accepts both full and partial payment of property taxes. A page to assist small businesses in complying with Missouri tax requirements. 816-881-4672 Hours Except Holidays Monday - Friday 8 am.

Businesses registered with the Department to collect and remit sales or use tax. For questions related to a pending BOE appeal call 816 881-3309.

Https Www Rent Com Missouri Kansas City Apartments Courtyard Apartments 4 500317 Courtyard Apartments Kansas City Apartments Courtyard

Https Www Rent Com Missouri Kansas City Apartments Courtyard Apartments 4 500317 Courtyard Apartments Kansas City Apartments Courtyard

Low Income Apartments With No Waiting List Low Income Apartments Low Income Low Income Housing

Low Income Apartments With No Waiting List Low Income Apartments Low Income Low Income Housing

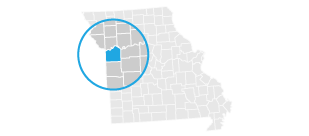

Personal Property Morgan County Missouri

Personal Property Morgan County Missouri

Paying Your Taxes Online Jackson County Mo

Paying Your Taxes Online Jackson County Mo

Fourth Lawsuit Asks Judge To Stop Collection Of Rising Property Taxes In Jackson County Investigations Kctv5 Com

Fourth Lawsuit Asks Judge To Stop Collection Of Rising Property Taxes In Jackson County Investigations Kctv5 Com

Thinking Of Buying Or Selling Your Home Now Is A Great Time And I M Not Just Saying That Call Me For More Insight Into Th Things To Sell Real Estate Casey

Thinking Of Buying Or Selling Your Home Now Is A Great Time And I M Not Just Saying That Call Me For More Insight Into Th Things To Sell Real Estate Casey

Charlotte Foreclosure Notice Sell House Fast Sell House Fast Foreclosures Selling House

Charlotte Foreclosure Notice Sell House Fast Sell House Fast Foreclosures Selling House

Personal Property Tax Morgan County Missouri

Personal Property Tax Morgan County Missouri

Stl News Missouri State Jefferson City Jefferson State

Stl News Missouri State Jefferson City Jefferson State

Tax Bills Are Being Delivered Jackson County Mo

Jackson County Mo Property Tax Calculator Smartasset

Jackson County Mo Property Tax Calculator Smartasset

Missouri Property Tax Calculator Smartasset

Missouri Property Tax Calculator Smartasset

Assessment Notices Jackson County Mo

Did You Know That Mount Washington Cemetery Was Once An Amusement Park Called Washington Park Also That One O Kansas City Missouri Kansas City City Pictures

Did You Know That Mount Washington Cemetery Was Once An Amusement Park Called Washington Park Also That One O Kansas City Missouri Kansas City City Pictures

Missouri Property Tax Calculator Smartasset

Missouri Property Tax Calculator Smartasset

Property Kansas City Real Estate Home Real Estate

Property Kansas City Real Estate Home Real Estate

Labels: independence, missouri, office, property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home