York County Sc Property Tax Due Dates

County Council Learn About York County Council. Sign up for eBills.

Welcome To The City Of York Official Website

Welcome To The City Of York Official Website

Supplement bills are due within 30 days of the bill date.

York county sc property tax due dates. Stay Informed Receive Text Or Email Notifications. Assessment Tax Claim Office. Parcel number is 440-000-CD-81S the property is located in Penn Township 44 and the tax collector is Karen Little.

Penalty amount Face plus 10 due for payments postmarked or delivered to the City Treasurers Office between June 16 and December 31 2021. Local municipalities are reviewing the possibility of extending their deadlines but similar to the rest of the country our local leaders are reviewing the hardships our communities would face if there was a delay. An assessed value is then sent to the county where the business is located.

- Inquiries on vehicle real property tax amounts and due dates already billed-Questions about my decal and registration-Register as a new customer for York County watersewer services-Question about water bill. County and Local Property Taxes. Face amount due for payments postmarked or delivered to the City Treasurers Office on or before June 15 2021.

In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. Supplement bills are due within 30 days of the bill date. If the last day of the grace period falls on a weekend or a federal holiday the payment is due the next business day.

Hopefully by using the following links you will be able to navigate through the system. Tax Rate The Personal Property tax rate for 2020 is 4 per 100 of assessed value. Easily pay water and sewer payments to the York County Water and Sewer Department.

The drop box is located beside the Tax Collection front door. York County conveniently offers numerous ways to pay taxes. Property Taxes Welcome to the York County Property Taxes page a directory meant to help you access a variety of resources available to you through York County government.

View important dates for current supplements and due dates. Assessments Rates Assessments are determined by the Office of Real Estate Assessment757-890-3720. In-depth York County SC Property Tax Information.

Pay traffic tickets online. View important dates for current supplements and due dates. The median property tax in York County South Carolina is 1016 per year for a home worth the median value of 158900.

The county will send a BPP tax notice after September 1. South Carolina is ranked 1458th of the 3143 counties in the United States in order of the median amount of property taxes collected. This is called a grace period.

How do I pay my taxes andor water and sewer bill. Government Center - 6 South Congress Street York. Departmental Functions Responsible for collection and accounting of real and personal property taxes and watersewer payments.

Residents can make tax payments online. Tax Pay My Way. For additional information please visit the Magistrate Courts.

The number by the name of the township or borough corresponds with the first two numbers in the parcel number for example. Water and Sewer Payments. Real Estate Taxes are due semi-annually on June 25th and December 5th.

To find out additional information regarding taxes please visit Tax Collection. York County Complex - 1070 Heckle Blvd Rock Hill. York County collects on average 064 of a propertys assessed fair market value as property tax.

If you pay your property taxes quarterly you are entitled to pay interest-free if you pay by the 15th July 15 October 15 January 15 or April 15. This office is responsible for evaluating properties and placing market value assessments on. The drop box is located on the back side of the building.

Working through the maze of County Taxes can be confusing and difficult to understand. The York County Tax deadline discount period date has not been extended and is still April 15 2020 the final face value due date remains as June 15 2020. Personal Property Taxes are due semi-annually on June 25th and December 5th.

They are as follows. The Real Estate Tax rate for the current year is. While real estate taxes are usually pro-rated between the buyer and seller at a real estate closing York County issues one tax notice to the owner of record as of January 1 of each calendar year.

Taxes become due and payable on September 30 of each year. The payment is due on or before the following January 15 of each year. Sign up for eBills.

Tax Collectors The following is a listing of York Countys tax collectors for our 72 townships and boroughs. There is a 350000 per transaction limit on e-checks. 2021 York Business Improvement District Assessments.

Fort Mill York County South Carolina Land For Sale Land For Sale York County South Carolina

Fort Mill York County South Carolina Land For Sale Land For Sale York County South Carolina

Home Abbeville County South Carolina

Home Abbeville County South Carolina

York York County Sc 285 Acres Details On Landwatch Com Mobile Land For Sale York County Acre

York York County Sc 285 Acres Details On Landwatch Com Mobile Land For Sale York County Acre

Berkeley County Website Investing In Tomorrow Today

Berkeley County Website Investing In Tomorrow Today

Fairfield County South Carolina

Fairfield County South Carolina

Berkeley County Website Investing In Tomorrow Today

Berkeley County Website Investing In Tomorrow Today

Easyknock South Carolina Property Tax Rate A Complete Guide

Easyknock South Carolina Property Tax Rate A Complete Guide

Maps Of York County South Carolina

Maps Of York County South Carolina

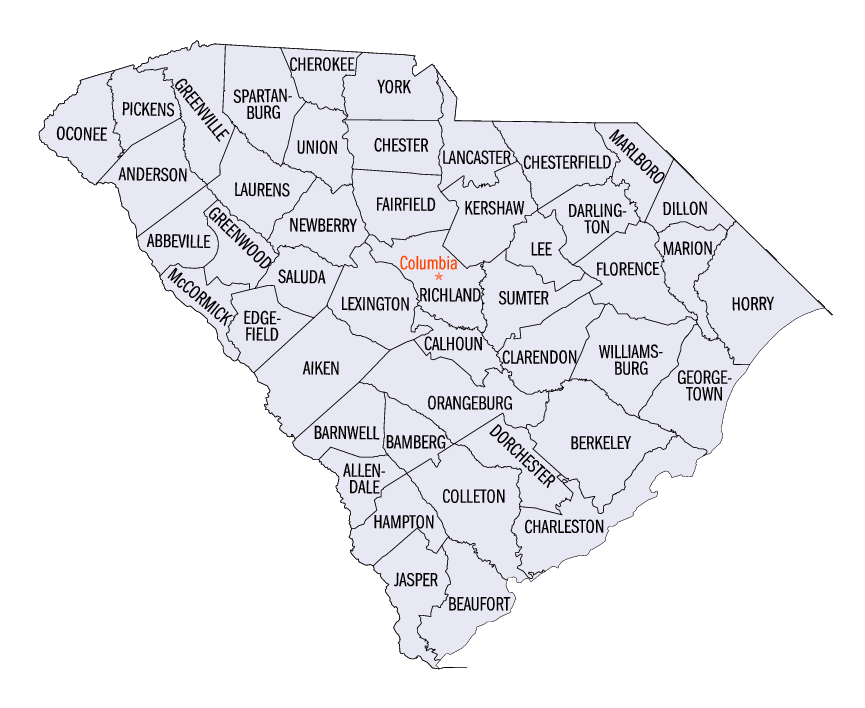

County Information South Carolina Association Of Counties

County Information South Carolina Association Of Counties

How Healthy Is York County South Carolina Us News Healthiest Communities

How Healthy Is York County South Carolina Us News Healthiest Communities

Maps Of Cherokee County South Carolina

Maps Of Cherokee County South Carolina

2021 Best Places To Live In York County Sc Niche

2021 Best Places To Live In York County Sc Niche

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home