Can Claim Home Renovation Tax Credit

However installing energy efficient equipment on your property may qualify you for a tax. Taxpayers must meet specific requirements to claim home expenses as a deduction.

Preparing House For Sale Tax Deduction How To Get Benefits In 2021 Tax Deductions Home Financing Real Estate Buying

Preparing House For Sale Tax Deduction How To Get Benefits In 2021 Tax Deductions Home Financing Real Estate Buying

The home office deduction Form 8829 is available to both homeowners and renters.

Can claim home renovation tax credit. When there is more than one qualifying individual for an eligible dwelling the total eligible expenses. You can also claim a tax. Home improvements on a personal residence are generally not tax deductible for federal income taxes.

Eligible expenses include the cost of labour and professional services building materials fixtures equipment rentals and permits. Although you cant deduct home improvements it is possible to depreciate them. There are certain expenses taxpayers can deduct.

These include both tax deductions and tax credits for renovations and improvements made to your home either at the time of purchase or after. Under this non-refundable tax credit Saskatchewan homeowners may save up to 2100 in provincial income tax by claiming a 105 per cent tax credit on up to 20000 of eligible home renovation expenses. A maximum of 10000 per year in eligible expenses can be claimed for a qualifying individual.

Renovation of a home is not generally an expense that can be deducted from your federal taxes but there are a number of ways that you can use home renovations and improvements to minimize your taxes. Seniors who qualify can claim up to 10000 worth of eligible home. How to Claim Home Improvement Tax Deductions It becomes clear it would be wise to maintain a record of everything you invest to update improve or maintain your property to claim a tax credit for home improvement once you sell.

Thanks to the American Recovery and Reinstatement Act you can get tax credits on 30 percent of the cost of all qualifying energy-efficient improvements to your home. You Qualify for the Home Office Deduction. Remember when you file your taxes online you dont need to know which schedules to fill out.

Individuals would be able to claim the credit for the expenses if the improvement was made to their principal residence or to a residence that they reasonably expect to become their principal residence within the 24 months after the end of 2021. They include mortgage interest insurance utilities repairs maintenance depreciation and rent. Answer No you cannot deduct the expense of home improvement using a home renovation tax credit.

However home improvement tax deductions are available for making your home more energy efficient or making use of renewable energy resources such as solar panels. New Brunswick Seniors 65 years or older in New Brunswick you could qualify for a tax credit to help with the cost of making their homes safer and more accessible. The New Brunswick Seniors Home Renovation Tax Credit is a refundable personal income tax credit for seniors and family members who live with them.

Home Accessibility Tax Credit For people that need to renovate their home to accommodate a person with disability or medical condition you will be offered some tax relief for the project typically up to 10000 per year In order to be eligible you need to be. In 2018 2019 and 2020 an individual may claim a credit for 1 10 percent of the cost of qualified energy efficiency improvements and 2 the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year subject to the overall credit limit of 500. This means that you deduct the cost over several years--anywhere from three to 275 years.

An individual who is eligible for the disability tax credit for the year. How to claim the HRI Tax Credit When can I claim Home Renovation Incentive HRI. To claim home accessibility expenses complete line 31285 for Home accessibility expenses on the Worksheet for the Return and report the amount from line 4 of your worksheet on line 31285 of your tax return.

You can claim for HRI from 1 January in the year after the qualifying work has been paid for. To qualify to depreciate home improvement costs you must use a portion of your home other than as a personal residence. The claim must be within 4 years after the year the qualifying work was paid for.

How To Deduct Donations Which Ones Qualify H R Block Business Tax Tax Write Offs Deduction

How To Deduct Donations Which Ones Qualify H R Block Business Tax Tax Write Offs Deduction

What Is The Energy Tax Credit For 2020 2021 How To Claim Qualify Tax Credits What Is Energy Energy

What Is The Energy Tax Credit For 2020 2021 How To Claim Qualify Tax Credits What Is Energy Energy

Invest In Education With A Heloc Citizens Bank Education Investing Secondary School

Invest In Education With A Heloc Citizens Bank Education Investing Secondary School

Tax Deductions On Rental Property Income In Canada Young And Thrifty Rental Property Tax Deductions Rental Property Management

Tax Deductions On Rental Property Income In Canada Young And Thrifty Rental Property Tax Deductions Rental Property Management

The Master List Of All Types Of Tax Deductions Infographic Income Tax Preparation Business Tax Deductions Tax Deductions

The Master List Of All Types Of Tax Deductions Infographic Income Tax Preparation Business Tax Deductions Tax Deductions

Mortgage Interest Deduction Or Standard Deduction Houselogic

Mortgage Interest Deduction Or Standard Deduction Houselogic

Are You Thinking About Renovating Your Kitchen Discover The Cost Of Your Kitchen Renova Kitchen Remodel Cost Estimator Kitchen Remodel Kitchen Renovation Cost

Are You Thinking About Renovating Your Kitchen Discover The Cost Of Your Kitchen Renova Kitchen Remodel Cost Estimator Kitchen Remodel Kitchen Renovation Cost

Pros And Cons Of Remortgaging You Should Know Remortgage Calculator Ideas Of Selling Refinance Mortgage Mortgage Refinance Calculator Refinancing Mortgage

Pros And Cons Of Remortgaging You Should Know Remortgage Calculator Ideas Of Selling Refinance Mortgage Mortgage Refinance Calculator Refinancing Mortgage

Deductions Show Me The Money Accounting Humor Deduction

Deductions Show Me The Money Accounting Humor Deduction

What Expenses Can I Claim Free Printable Checklist Of 100 Tax Deductions All About Planners Receipt Organization Tax Printables Tax Deductions

What Expenses Can I Claim Free Printable Checklist Of 100 Tax Deductions All About Planners Receipt Organization Tax Printables Tax Deductions

Home Maintenance Plan How To Keep Your House In Top Shape In 2021 Home Maintenance Home Repairs Renovation Planner

Home Maintenance Plan How To Keep Your House In Top Shape In 2021 Home Maintenance Home Repairs Renovation Planner

How To Claim The 8000 Tax Credit First Time Home Buyer Home Decor Home Decor Catalogs Diy Home Decor

How To Claim The 8000 Tax Credit First Time Home Buyer Home Decor Home Decor Catalogs Diy Home Decor

How Do I Pay For Home Renovations Infographic Rwc Home Improvement Loans Home Equity Loan Remodeling Loans

How Do I Pay For Home Renovations Infographic Rwc Home Improvement Loans Home Equity Loan Remodeling Loans

Can I Claim The Home Office Tax Deduction For My Business Tax Deductions Tax Help Deduction

Can I Claim The Home Office Tax Deduction For My Business Tax Deductions Tax Help Deduction

Disability Tax Credit For Blindness Your Own Guide Tax Credits Disability Tax

Disability Tax Credit For Blindness Your Own Guide Tax Credits Disability Tax

What Home Improvements Are Tax Deductible 2020 2021

What Home Improvements Are Tax Deductible 2020 2021

Solar It S Called The Federal Solar Tax Credit And It Covers All Costs To Go Solar So You Never Have To Pay In 2021 Senior Discounts Funeral Costs Money Making Hacks

Solar It S Called The Federal Solar Tax Credit And It Covers All Costs To Go Solar So You Never Have To Pay In 2021 Senior Discounts Funeral Costs Money Making Hacks

List Of The Expenses You Can Claim As A Tax Deduction In Australia Is You Rent Out A Commercial Rental Property Commercial Rental Property Rental Property Investment Investment Property

List Of The Expenses You Can Claim As A Tax Deduction In Australia Is You Rent Out A Commercial Rental Property Commercial Rental Property Rental Property Investment Investment Property

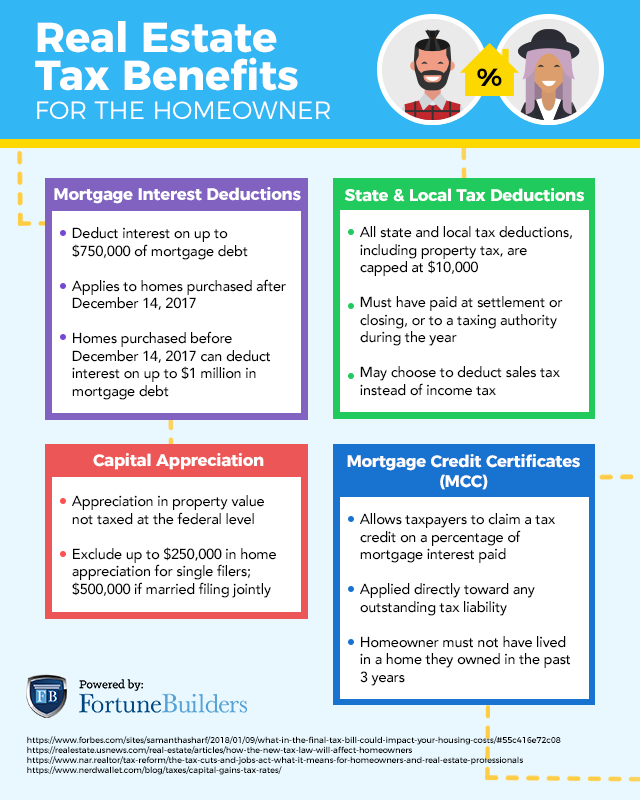

Property Tax Deduction Strategies An Investor S Guide Fortunebuilders

Property Tax Deduction Strategies An Investor S Guide Fortunebuilders

Labels: claim, credit, property, renovation

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home